After months of unbridled optimism, America’s CEOs are signaling a bit of caution in their forecast for the year ahead. According to Chief Executive’s latest poll of 231 U.S. CEOs, fielded from March 2-4, business leaders are reporting growing concerns over the potential for rising inflation in the economy and possible damage to business from the Biden administration’s policies—a concern their CFO peers also shared with our sister publication, StrategicCFO360, last month.

At 7.1 out of 10 on our 10-point scale, CEO confidence in business conditions 12 months from now remained robust—at the highest level since September 2018—but it was also was unchanged since last month. Similarly, confidence in the current environment is also essentially flat, at 6.3 out of 10, up only one percent month over month.

In each case, March was the first month since November where our confidence measure had not gained ground—and only the 3rd month in the last 10 where it did not increase month over month.

Tim Zimmerman, president and CEO of Wisconsin-based Mitchell Metal Products, says he doesn’t believe business conditions will improve over the coming months, rating them a 6 out of 10. He says his forecast is based on his anticipation of changes in corporate tax policies and regulations, as well as the “large amount of pent-up inflation in the domestic manufacturing sector of which many do not seem aware,” he says.

The CEO of a large global IT service management company agrees that although pent up demand and the customer response to Covid are positive elements in the forecast, “corporate tax changes with new leadership in DC, supply chain constraints, rising costs of raw materials and shipping, [and the] threat of inflation” need to be weighed in the balance.

For Victor Gioiosa, president and CEO of ARC Federal Credit Union, this means we’re looking at a downward trend. He says, “the effects of the pandemic on the economy after the pent-up demand is satisfied and the effects of increased taxation and regulations along with rising interest rates due to inflation,” will cause business conditions to have deteriorated by this time next year, rating them a 4 out of 10—or “weak” on our scale.

For many other CEOs polled, however, the bigger question is the state of the supply chain.

Craig Young, president and chairman of Young Truck Sales, a mid-size transportation company based in Ohio, says there is “high demand in our industry, but supply problems can undermine any potential improvement,” he says. For that reason, his outlook for business by this time next year is only slightly more confident than his view of current conditions, at 8 and 7 out of 10, respectively.

“Demand is strong,” says the president of an industrial manufacturing company in California, but the “issue is supply chain/logistics,” he says, echoing other CEOs in that space. “Energy markets are rebounding, we are taking actions to vastly improve our business.”

Despite the uncertainty, the majority of CEOs we polled expect business conditions will have improved by this time next year, thanks to pent-up demand and political stability that will facilitate decision-making.

“Covid will be controlled,” says Andrew Ly, CEO of Sugar Bowl Bakery, who rates current conditions an 8 out of 10 and future conditions even better at 9 out of ten. “There will be stimulus and infrastructure spending, a huge circulation of money. The economy can’t get worse but get better. More people will be back to work,” he says, explaining his forecast.

“Returning to more normal activities, both business and personal, should continue to allow the economy to open up, especially in the hard-hit food service and entertainment sectors,” says Jim Vandergrift, president of R&M Materials Handling in Springfield, Ohio. He forecasts business conditions to improve from “good” to “very good” over the next year.

Scott Glaze, CEO of Fort Wayne Metals, agrees: “We are seeing many indications of growth from our customers, both in currents products and in new product development,” he says, rating conditions by March 2022 to be a perfect 10 out of 10.

The Year Ahead

In another strong sign of confidence, the proportion of CEOs expecting increases in profits, revenue, headcount and capital expenditures is up across the board this month, when compared to the month prior. The proportion of CEOs forecasting a year-over-year increase in profits and revenues is up 3 and 4 percent, respectively.

Similarly, the proportion of CEOs expecting an increase in hiring has jumped 8 percent this month, to 64 percent, and the highest increase we’ve seen in more than 2 and a half years.

A greater proportion of CEOs also report planning to increase capital expenditures this year—12 percent more than last month and the largest proportion since the spring of 2019.

Sector & Size View

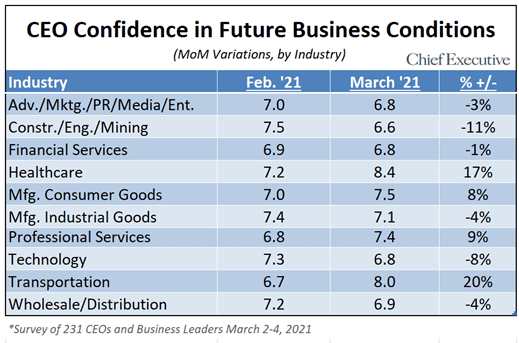

When looking at the data by industry, its worth noting that CEOs from six industries are reporting declines in their optimism when compared to last month, but their forecast is counterbalanced by the buoyancy of Transportation CEOs (+20 percent), Health Care CEOs (+17 percent) and their peers in the Professional Services and Consumer Manufacturing sectors (+9 and +8 percent, respectively)—mainly, they say, due to demand.

Meanwhile, CEOs from the Construction (-11 percent) and Technology (-8 percent) sectors reported the largest declines in confidence.

Meanwhile, CEOs from the Construction (-11 percent) and Technology (-8 percent) sectors reported the largest declines in confidence.

John Filion, president of Wallboard Supply Co., which supplies the construction industry, says, “Price and availability of materials are driving my forecast. Price is climbing faster than the ability to raise prices on a distributor level.”

On a year-over-year basis, most forecasts range from good to very good, with our highest rating being 8.4 in Health Care. Jorge Amaro, CEO of Healthcare A3i Inc. explains his “very good” forecast of future business conditions (8/10) by citing: “Stabilization of U.S. foreign affairs, loan rates staying low, introduction of new energy markets, stronger ACA leading to lower healthcare cost trend,” he says.

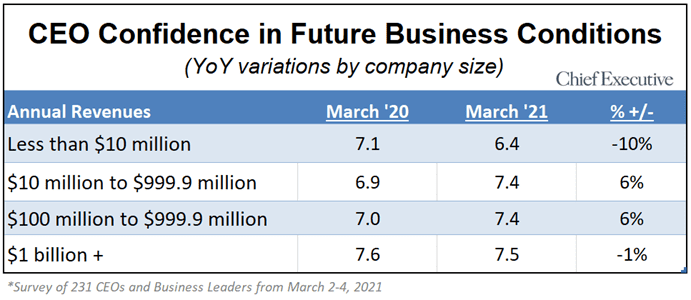

When looking at forecasts by size, small company CEO confidence has taken a hit this month, down 6 percent—opposite the trend among their large-company counterparts. The president of a small energy company shares: “This administration is killing small business and the energy industry. We will be back to foreign dependency,” he says, rating his view of future conditions a 3 out of 10 and echoing many other small company CEOs polled this month.

Looking at the data year over year, small company CEOs also show a decline in confidence in the future compared to other cohorts.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/