When information systems leaders have a mutually beneficial relationship with their organization’s finance leaders, everyone wins—including the company.

So says Rich Temple, vice president and CIO at Deborah Heart and Lung Center in Browns Mills, New Jersey. Temple spoke with StrategicCFO360 about how CIOs and CFOS can best work together, why collaboration is critical to routing out inefficiencies and when it’s better for a CIO to report to the CFO than the CEO.

Can you discuss why it’s important for CFOs and CIOs to collaborate within an organization?

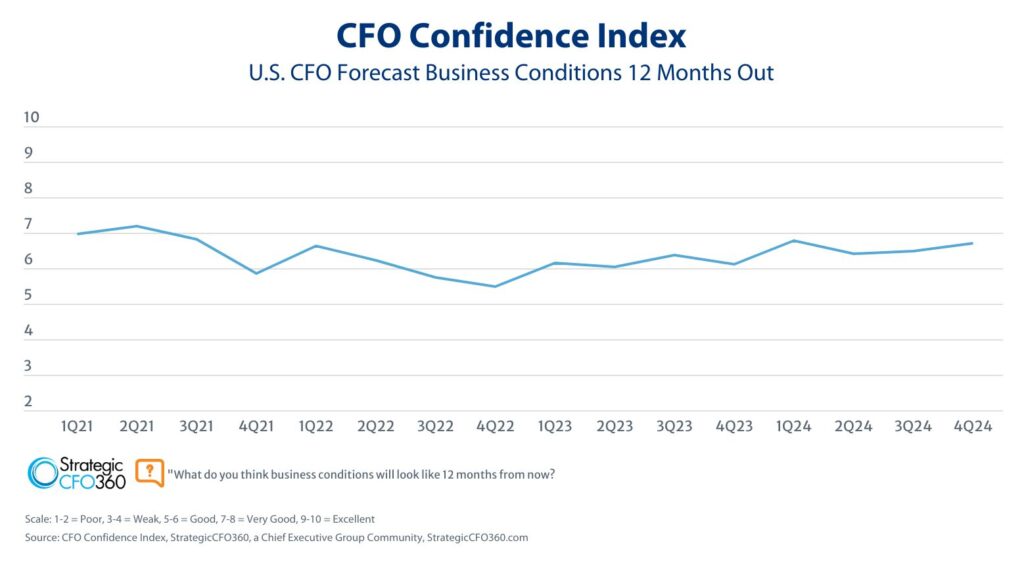

Often, the finance department views the information systems department as an organizational expense that lacks tangible or visible benefits to justify the high cost. With inflation and decreased budgets more prominent now than ever across industries, companies—including health systems—need a solution to this disconnect in order for organizations to progress or even stay afloat in an uncertain economic environment.

Finance and IS collaboration is essential due to the structure and benefits that both teams provide to the rest of the organization. Strong communication between the two results in a mutually beneficial relationship, where funds can be allocated with more informed decision-making and the right technology can be put in place to help the finance department make those decisions. Both teams must advocate for each other since they have more effect on organizational outcomes than most other individual departments.

The IS team has to support other departments by implementing the right technology for their specific needs. Specifically, when it comes to finance, IS must equip teams with the essential tools to identify areas for savings and margin improvements, along with proper training to ensure those assets are utilized correctly and maximizing potential.

Additionally, integrating new technologies requires extensive backend work from the IS team that no one else directly sees, so the finance team must support their efforts in order to stay up to date with security, regulations and competitors, among other areas where technology is utilized.

Another benefit of close collaboration is that during the IS department’s due diligence in researching for a new project that may be requested by our medical team, we gain incredible technical knowledge that we can synthesize into an understandable framework for the finance team. It saves time having one department learn and understand what a user is asking for. We figure out how to make it happen and then ask finance to pay for it. That knowledge sharing saves considerable organizational time.

What happens when there is a disconnect between the two teams?

Various issues can arise when the finance and IS teams do not communicate and collaborate. Other departments do not always have visibility into the work that these teams do, but without them organizations would be facing multiple inefficiencies and gaps in their operations.

For example, the IS team can support the finance department by helping them implement tools that provide data and analysis around spending, budgeting and allocations. When finance has insight into this information from across the organization, they can identify ways to save and redirect funds to the departments or initiatives that need them most.

Once a strong working relationship is formed between the finance and IS teams, conversations surrounding budget allocation and high-level priorities will become easier. For example, the teams can align on technology investments that can benefit the entire organization by increasing efficiency and security or can determine whether they need to reconsider their staffing or supply needs based on available finances. Rather than working in parallel, cross-team collaboration can solve inefficiencies and problems that will result in a better experience for everyone involved.

Can you tell us about how technology can be implemented to better inform decision-making? How does it benefit the organization as a whole?

Previously, in many situations, one would find the finance and IS teams working in silos, which sometimes prevented finance departments from getting access to the technology and information they needed. Organizations are now finding, though, that working together and bringing new technologies in can improve operations. Technology has allowed many processes to be automated, with information to drive our decision-making now readily available to help streamline processes like forecasting.

For example, my IS team at Deborah Heart and Lung Center recognized the finance department’s need for a solution to help them, so we worked closely with them to implement technology to best suit the unique requirements for financial performance analytics. We now partner with Strata Decision Technology, which provides access to key data throughout the organization.

What is your advice for other CIOs looking to better collaborate across teams and with other C-Suite members?

A good place to start is streamlining review cycles. For instance, I used to report to the CEO, but after some internal organizational changes were made, I began reporting to the CFO and the organization began to realize immediate benefits from having us directly collaborate.

Through this change, workflows were optimized and we have been able to significantly streamline operations. This change improved cross-team communication and allowed for a better approval process for the entire organization’s IS needs. We now have more transparency across teams along with improved communication so that everyone can understand the risks and possible outcomes of the decisions we make.

It’s also important to note that implementing new technology to create change is a step in the right direction, but utilizing it and clearly understanding the tools it can provide is essential to drive the greatest improvements within the organization.

Leadership must also encourage teams to collaborate and implement specific processes to ensure that the communication does happen, or else the siloed system will persist.

One example of these processes could include delegating a group of individuals led by executive leadership and spanning across departments to ensure that new financial performance initiatives are seen through and goals are met. Including people in higher-level conversation to then oversee what is actually happening on the floor will lead to the most accurate route for identifying areas for cost improvement—saving the organization money and identifying areas of cost reduction in a continuous and accountable way.

Without the executive team in support of a cross-team initiative, the needle will only move so far. This kind of communication will not only help individual teams run smoother, but with the essential nature of both the finance and IS team and the power they hold over organizational operations, they have the opportunity to provide strategic optimization in many untapped areas.