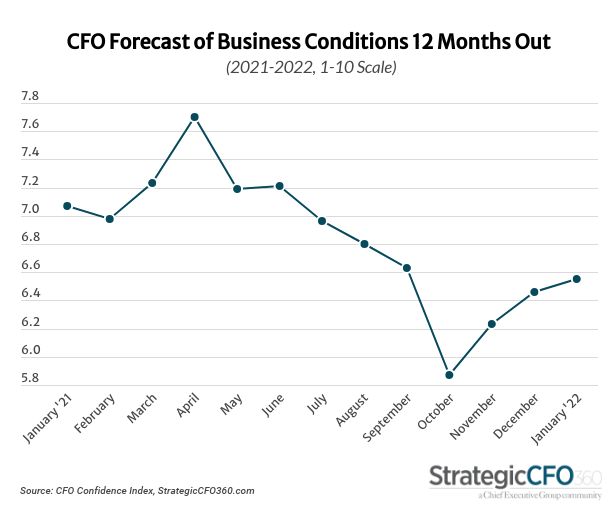

After months of significant growth in their rating, CFOs pulled back their confidence slightly on forecasts of a weaker economy due to historically high inflation rates. Increases in commodity prices, conflict in Europe, shaky politics and an unreliable labor pool are additional reasons that CFOs’ rating of future business conditions increased by only 1 percent this month after a 4 percent increase in December. However, they are still gaining hope, pointing to resolutions in the supply chain, high demand and an end to the pandemic.

Those are the key findings from StrategicCFO360’s January reading of CFO confidence, conducted among 197 senior finance executives between January 24 and 27. They now rate future business conditions as a 6.6 out of 10 on our 10-point scale, where 10 is excellent and 1 is poor. Their rating is below the 7 out of 10 given by CEOs, when polled by our sister publication, Chief Executive, earlier this month.

CFOs’ rating of current conditions remained unchanged this month, hovering at a 6.6 out of 10, matching the rating CFOs gave future conditions. Both ratings have improved since hitting a low in October.

The proportion of CFOs who expect business conditions to improve increased by 13 percent this month, from 31 percent in December to 35 percent now. And although the proportion of CFOs expecting conditions to deteriorate also increased, it did so by only 3 percent, now at 36 percent, still slightly overshadowing the optimistic of the bunch.

Mark Cvrkel, EVP, Treasurer and CFO at Kish Bank, is part of the slight plurality that expects conditions to worsen. He says, “I believe that the continued media focus on inflation and the recent volatility in the equity markets will cause consumer level of confidence to decline with an impact on the demand side. This however may eventually be a positive for the inflation outlook.”

Michael Meyer, Executive VP and CFO at BRC Rubber & Plastics, agrees with Cvrkel’s predictions echoing a sentiment many share: “I think the economy will suffer from the effects of inflation.” He too expects business conditions to worsen, rating future conditions as a 5, down from his current rating of 6.

David Mathis, President and CFO of MartinFed, a federal solutions company, believes that uncertainty, mainly caused by inflation but coupled with other factors, will cause conditions to deteriorate from a 6/10 to 5/10 twelve months from now. “Inflation is driving uncertainty,” he says. “We are a federal solutions company dealing with the budget cuts, major retirements, work from home and the lack of collaboration, and uncertainty.”

Many CFOs echo Mathis’ concerns about the unknown, pointing out that uncertainty, whether it be around Covid-19 variants, markets, Fed actions, labor availability and/or politics, is weighing heavily on their minds and is a main element driving their forecast. Larry Murff, CFO at SpinCar, a tech company, explains, “The unknown is too great. Shutdowns and taxes, coupled with the uncertain political environment create concern for me.” He is part of the 29 percent of CFOs who believe that conditions will remain unchanged over the course of the next year.

Alex Mobarak, VP of Finance at Cargas Systems, a software and professional services firm, also believes that conditions will remain unchanged. He rates both future and current conditions as an 8/10. He explains his forecast by saying, “Healthy customer demand, recurring subscription revenue growth, a strong cash position and less pandemic impact will boost our business even in the face of inflation.”

Many CFOs point to the lessening impacts of Covid-19 as a reason for optimism, even though there still is concern surrounding the economy and inflation. Dan Harris, CFO at SERHC, a healthcare company, is very confident in the future of business conditions, rating them a 9, up from the 4/10 which he rates current conditions. He says, “Covid-19 will slow down, giving the economy a chance to catch up.”

“The Covid-19 curve is flattening, there are increased vaccinations, talks of herd immunity, more pent-up demand waiting to come out, and supply chains getting restored,” says Venkat Balasubramanian, CFO at Creativeland Asia Limited, an advertising firm. He agrees with Harris, expecting conditions to improve as the pandemic wanes.

Forecasting for the Year Ahead

After closing out 2021 with high growth, the proportion of CFOs predicting increases in profits and revenues dropped this month. In January, 59 percent of CFOs predict that profits will increase (a drop of 3 percent since last month) and 74 percent expect revenues to increase (down 8 percent from 80 percent in December). Their predictions differ vastly from those of CEOs, of whom 88 percent forecasted increases in revenues at the beginning of the month, a 13 percent jump from December.

The proportion of CFOs planning increases in their number of employees also dropped this month, down 4 percent from December to 61 percent in January. The proportion planning to add to their capital expenditures remained the same, at 50 percent.

In January, 26 percent of CFOs are now planning to add to their debt. This is 30 percent higher than December, and also only one percentage point below the record high of 27 percent, reached in October of 2021. The proportion expecting to add to their cash also increased, up 4 percent and now at 49 percent.

Sector & Size View

Industry played a large role in CFO forecasts this month with ratings ranging from the low of 5.7, given by CFOs in consumer manufacturing, to a high of 7.4, given by those in the wholesale/distribution industry.

CFOs in tech gained the most ground this month, with their rating up 18 percent since last month, now at 7.3 on our 10-point scale. They are encouraged by the demand for goods and the waning impact of the pandemic.

The 12 percent drop in advertising CFOs’ rating of future conditions was the biggest of the bunch, with the rating now at 6.0, down from 6.8 in December. They are feeling the effects of inflation, wage growth, a tough hiring market and political gridlock, which all dampen their forecast for future conditions.

CFOs in industries such as manufacturing and distribution also point to the fact that their business is reliant upon the supply chain, and the lack of available materials is hindering their ability to grow. However, with predictions that the supply chain will level out as Covid-19 does, many expect growth in their business will follow. “We are distributors of home building/remodeling products. Our biggest challenge is supply. As product flow improves, so will the business,” says Chris Burns, CFO at E.B. Bradley Co., a wholesale/distribution company.

When it comes to company size, the most modest increase in confidence occurred in the rating of CFOs of companies with under $10 million in revenues, whose forecast improved by only 2 percent, compared to 5 percent within the other size ranges.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index