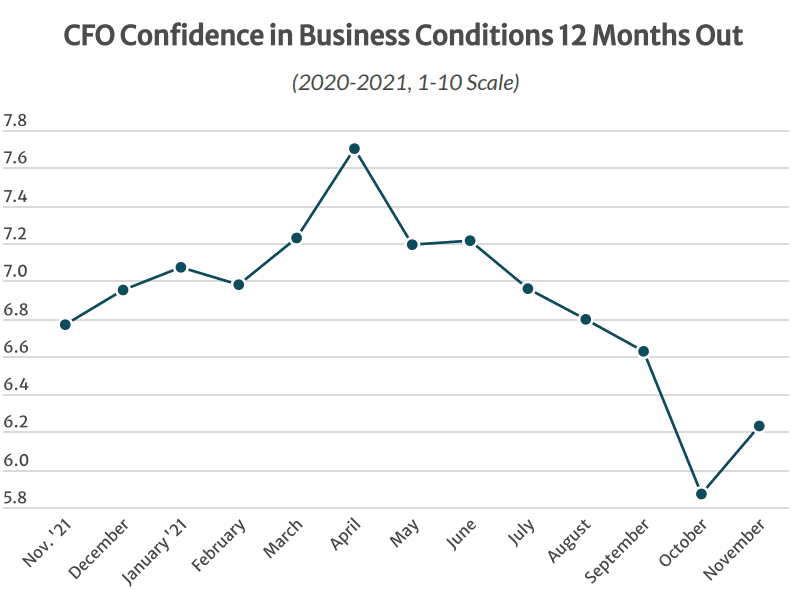

The outlook of U.S. finance chiefs for 2022 improved in November, as an increasing number of CFOs say they expect a resolution to supply chain issues and a better handle on the Covid pandemic. For those reasons, their forecast for business 12 months from now rose by 6 percent this month—the first significant uptick in CFO confidence recorded since our leading indicator reached a record high last April. That’s when vaccine rates skyrocketed and so did consumer demand for services. Nevertheless, at 6.2, our forward-looking Index remains well below its 2021 levels, as CFOs share concerns over inflationary headwinds, government policies, pricing and wages, among a host of other issues.

Those are the key findings from StrategicCFO360’s November reading of CFO confidence, conducted among 162 senior finance executives between November 9 and 11. Their rating for future business conditions is now a 6.2 out of 10 on our 10-point scale, similar to that of CEOs, who, when polled earlier this month, rated their outlook a 6.4 out of 10.s

CFOs’ rating of current conditions also increased this month, up 3 percent since October, to 6.3/10, as those polled say they are growing more agile at navigating the current environment despite the challenges and volatility.

Amid this environment, the proportion of CFOs forecasting business conditions will improve by this time next year jumped 9 percent in November, now at 36 percent, and has surpassed that of CEOs. In comparison, the proportion of CFOs forecasting conditions will deteriorate dropped from 45 percent last month to 37 percent this month.

Gary Zyla, CFO at investment advisor firm AssetMark Financial Holdings, believes that conditions will improve from an 8 out of 10 rating today to a 9 by this time next year. He is encouraged by low unemployment and infrastructure investment.

Nate Cohen, CFO at Cohen Architectural Woodworking, a family-owned architectural firm in St. James, Missouri, is encouraged by the overall performance of American businesses, which he says are creating better ways of doing business. “There are a lot of negative external pressures, but we’re making internal changes to better set up our organization for success,” he says. “I expect growth in our company and many—not because of what’s happening in the world around us, but what we’re doing to adapt and overcome.” He expects conditions to improve by 2 points to an 8 by November 2022.

Tyrone Adams, CFO at the Colorado Association of REALTORS, believes conditions will improve into “good” territory, giving them a 6/10 rating. “There will be more incentives for the labor force to return to work,” she says. “Sustainable companies and organizations will be more competitive with their work benefits and better work cultures to obtain the best employees.”

Yet, challenges remain.

“By the end of the next 12 months, I expect the supply chain and labor shortages, which have been driven by the back up in imports, will be resolved. The result I expect will be an inflationary environment and higher interest rates,” says Robert J Gold, EVP and CFO at civilian and military vehicle manufacturer AM General in South Bend, Indiana. Although he expects the supply chain to sort itself out, he believes business conditions will deteriorate to a 5/10, down from 8 today, due to the fiscal and monetary environment that lies ahead.

Hafiz Chandiwala, EVP/CAO of Coca-Cola Bottling Company United in Birmingham, Alabama, says despite the resiliency of his business, “We are currently experiencing labor shortages as well as commodity cost pressures.” For those reasons, he rates his outlook for the future bleaker than his sentiment of current business conditions, at 5/10 vs. 8/10.

Forecasting for the Year Ahead

The proportion of CFOs forecasting increases in profits over the next 12 months rose to 58 percent in November, up from 47 percent the month prior. The number of CFOs predicting increases in revenues also jumped, to 75 percent, up 13 percent since October.

The proportion of CFOs projecting increases in capital expenditures remains unchanged since October, hovering at 51 percent, while those predicting increases in their headcount grew by 21 percent, to 62 percent. All forecasts are below those of CEOs.

Sector & Size View

CFO sentiment is up across most sectors in November, with construction CFOs leading the way, with a 7.2-10 rating of future conditions, up 24 percent month-over-month, on the back of the recent infrastructure bill.

Energy/utility CFOs also gained confidence this month, up 14 percent, with the same rating as those in construction, for similar reasons.

Healthcare CFOs’ confidence dropped by 12 percent this month due to inflation, the labor shortage and the concept that vaccine mandates in many healthcare facilities are further limiting the supply of personnel.

CFOs in retail also reported a loss in confidence, down 16 percent in November, because of supply chain issues.

Looking at confidence by company size, CFOs in small companies are the only ones who lost confidence this month, due to tax and regulatory concerns.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance executives on their perspective on the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index