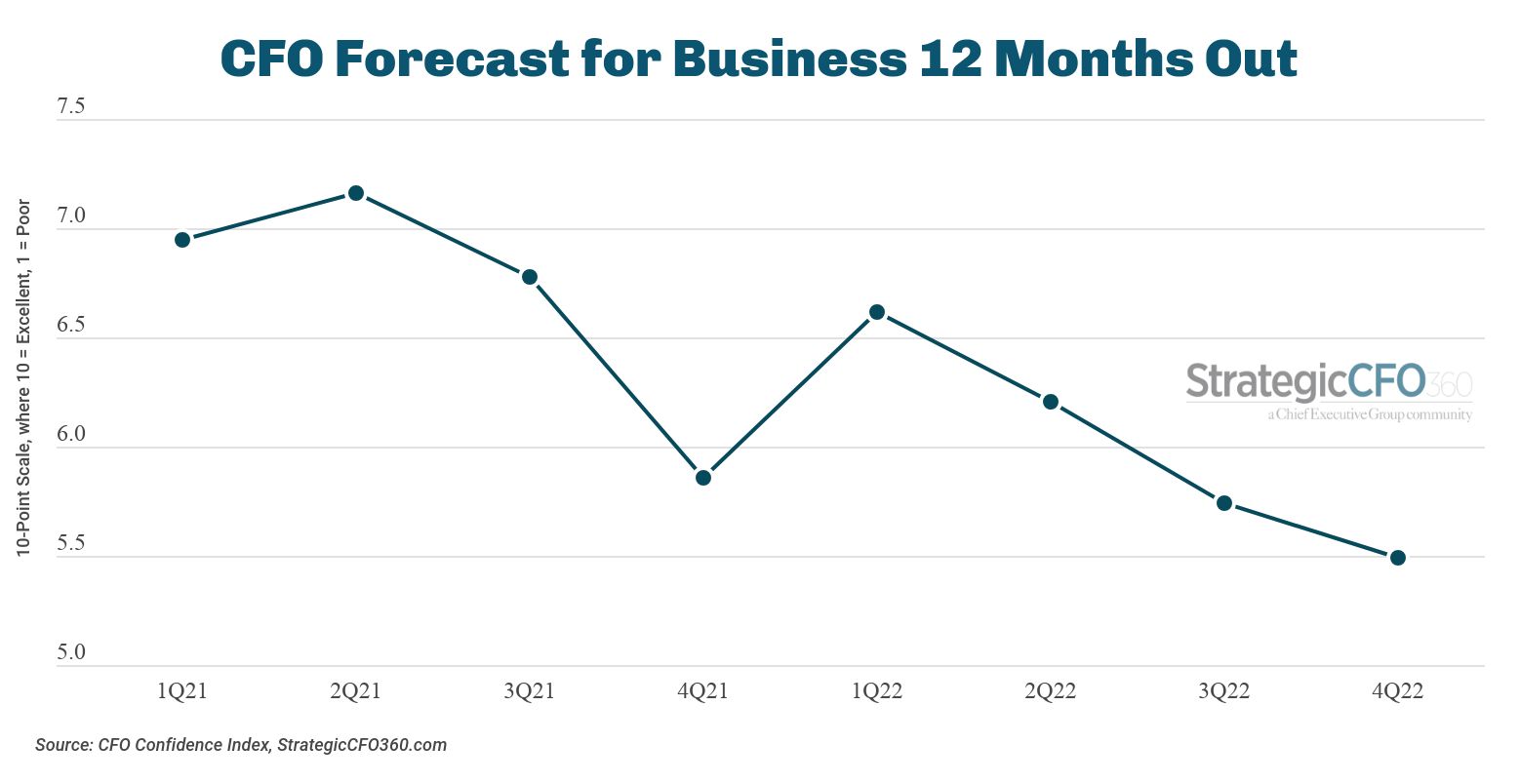

StrategicCFO360’s Q4 CFO Confidence Index reading shows optimism in business conditions 12 months from now fell another 4 percent since our Q3 poll in August, to 5.5, as measured on a 10-point scale where 10 is Excellent and 1 is Poor.

That drop adds to the already declining index, which lost 8 percent in August and 6 percent in May, thus cumulating to an overall 17 percent decline since the beginning of the year.

CFOs’ rating of current business conditions also declined, though to a much smaller extent, to 5.8, from 5.9 when last polled in August. Both indexes are now down double digits since the beginning of the year and at the lowest levels recorded since we began polling CFOs on these issues amid Covid in 2020.

CFOs polled October 10-13 say persistent inflation and the Fed’s tightening policy are increasing the chances of a recession in the near term. While many expect it to be slight and short-lived, they are also seeing subtle shifts in demand that indicate we may not have reached a bottom just yet.

Supply of material and labor, along with geopolitical conflicts, are also fueling caution among those surveyed. “Hopefully it will be under control in 12 months,” said one of the 113 qualified respondents.

Consensus At the Top

Back in August, CFOs had bucked the growing trend of CEOs and board members who believed the Fed may be on the verge of pivoting due to key inflation reports that, at the time, showed some easing. While CEOs and board members’ forecast for the next 12 months had jumped on renewed optimism (climbing 14 and 8 percent, respectively), CFOs’ forecast had gone the opposite way, dropping nearly 8 percent, as many said they believed inflation still remained too high for the Fed to change course on raising rates in September—and they were right.

Now, once again in October, many CFOs maintain the idea that things are likely to get worse before they get better. Overall, 45 percent say they expect conditions to be worse by this time next year—up 5 percentage points since August.

“Aggressive interest rate hikes by the Federal Reserve will lead to future economic weakness while the current inflationary environment is driving cost pressures—a toxic cocktail, indeed,” said Ted Darling, CFO of Maine-based multiplatform branding agency Ethos Marketing.

CEOs and board members have since also revised their forecasts, mostly back to pre-August-bump levels.

Over the past few months, one of the big drivers of optimism in the C-Suite—and, ironically, also the impetus for the Fed’s hawkish policy—has been persistent demand. Despite the long list of challenges businesses have faced in the past year, CFOs, CEOs and board members have reported continued strong demand and healthy pipelines.

While some say they are starting to see subtle signs that this is abating, 41 percent of CFOs say demand for their products and services is actually up compared to the beginning of the year—and 46 percent expect it to be even higher by this time next year.

Planning for the Year Ahead

With so much uncertainty, two-thirds of CFOs say they are focusing, for now, on cost containment to mitigate the downside of inflation and a possible recession.

“Manage debt closely, have liquidity lined up. Don’t overpay for people, assets or debt,” advised Ali Firoozi, CFO of consulting firm The PAC Group.

“You need to get ahead of the liquidity squeeze that will happen in the next 12-18 months,” echoed a CFO at a large publicly traded telecommunications firm.

“Be sure to include worst-case interest rate scenarios in your forecasting model(s), such as 2 percent higher than current rates,” said the CFO of a tech consultancy.

The picture doesn’t look buoyant, but it helps explain why only 32 percent now project to increase capex in the year ahead—down from 37 percent in August and from 57 percent at the beginning of the year. Rather, 47 percent say they’re staying the course and not making any changes to their expenditures for the time being.

The data shows a similar trend in hiring: 42 percent forecast adding to their workforce in 2023, down from 48 percent in August and from 61 percent in Q1—with 37 percent saying they are keeping the status quo instead.

And perhaps one of the biggest change this month’s data shows: the proportion of CFOs forecasting increases in profits and revenues is down significantly—to 46 and 62 percent respectively, from 63 and 74 percent in Q3.

Some CFOs participating in the survey this month said upward wage inflation is one of the main factors affecting their bottom-line forecast, as they doubt prices can continue increasing at the same pace to allow them to remain competitive.

“Staffing concerns and cost of pay [have] an impact to our bottom line,” said the CFO of a large nonprofit in the healthcare sector, who expects both profits and revenues to be down in 12 months.

There are, of course, other factors in the equation. Higher borrowing rates, the war in Ukraine, burdensome regulations and a strong dollar are among some of those cited by to explain their downward forecast.

“The value of commodities is having a hard time staying pace with increase cost of inputs,” said Kevin Harrison, CFO at Arizona-based Rousseau Farming Company.

About the CFO Confidence Index

The CFO Confidence Index is a recurring flash poll of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index