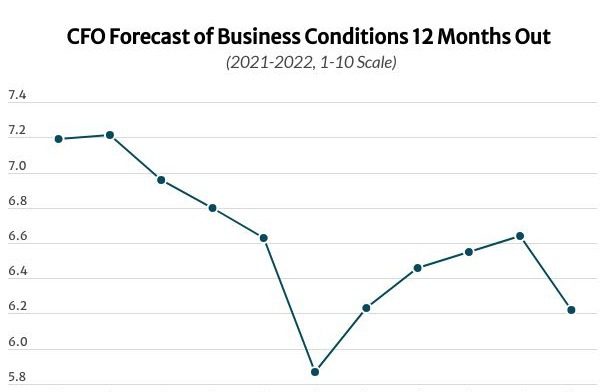

The May poll shows CFOs are now less confident than they were at the start of the year about what lies ahead for business in the short term. Inflation, market uncertainties and shortages of key goods are among their top concerns, the survey shows. Many say they expect geopolitical issues to cause a global economic slowdown, to which the U.S. is not immune. Despite the brunt of Covid-19 being seemingly behind us, unpredictability in the labor pool and supply chain is driving down their predictions for the future.

Those are the key findings from StrategicCFO360’s May reading of CFO confidence, conducted among 145 U.S. senior finance executives between May 9 and 19. Polled CFOs rate their 12-month outlook for business a 6.2 out of 10 on our 10-point scale where 10 is excellent and 1 is poor. This is a 6 percent drop since our last reading in February.

Despite the decline in optimism, this rating is 5 percent higher than that of CEOs, whose confidence in future business conditions has been on the decline for two consecutive months, reaching 5.9/10 in May, when polled by our sister publication, Chief Executive. CEOs’ rating is now at its lowest point in almost 6 years.

Looking at the current environment, however, CFO confidence rose by 5 percent this month, now at 6.7/10, from 6.4 when last polled in February. Surveyed CFOs say unfaltering demand and increasing normalcy in daily life are driving up their rating. In comparison, CEOs polled earlier in May rated current conditions 6.4/10—the lowest level since March 2021, before vaccines became widely available.

“Public-sector spending continues to be strong; household balance sheets remain strong as well,” said Dom Bernardo, CFO at CHA, Inc., a full-service engineering consulting and construction management firm. “The job market is still strong, public coffers are flushed with cash, and the infrastructure bill has yet to kick in.”

He is, however, not as positive on the coming months: “Looking forward, inflation could wipe out household positive cash positions…and higher interest rates will limit access to capital,” he said, forecasting conditions may deteriorate from what he rates as an 8/10 today to 5/10 by this time next year. “There is a general malaise impacting consumer confidence, continuing Covid, shortages of critical goods (e.g., baby formula), high gas prices, high home prices and apartments rent, etc.”

Many CFOs shared Bernardo’s concerns. The proportion of those who expect business conditions to improve nosedived this month, down 31 percent since February. Only 31 percent of polled CFOs now expect business conditions to improve over the next 12 months, compared to 45 percent in February. Instead, 48 percent say they expect business conditions to deteriorate over that same period.

Vandana Kapur, CFO at the Greater Indianapolis Chamber of Commerce, also expects conditions to worsen but not as drastically as others seem to predict. She doesn’t expect more than a one-point drop, from a 7/10 today to 6/10 one year from now. “Inflation and labor costs coupled with delays for supply chain will have a ripple effect that will cause capital expenditures to slow down,” she said, “however, the hunger for business growth is very strong, and consumer consumption is at an all-time high, so that may even out the effect of a recession.”

Some CFOs are net neutral, as they weigh both high demand and consumer spending but still acknowledge the numerous issues facing the business environment and overall economy.

“More or less business as usual. Dark clouds of inflation and supply chain issues exist—these must be navigated with care,” said Basil Marais, CFO at Applied Software Technology. He expects that conditions will remain stable at 6/10, or “Good” according to our 10-point scale.

Those CFOs who expect conditions to improve say they recognize today’s challenges but expect them to wane or be addressed efficiently.

“There will be improvement in supply chain bottlenecks and price stability will come,” said Perry Wiggins, CFO at APQC (American Productivity & Quality Center), who expects future conditions to jump to a perfect 10/10 by this time next year, from an 8/10 today.

Other CFOs forecasting an improvement in business conditions also say they expect that inflation will slow as supply chains smoothen. They expect the war in Ukraine to end, which, they say, would help improve the global economy.

Overall, CFOs’ forecasts are somewhat in line with other members of the C-Suite. For instance, 27 percent of CEOs said, when polled in early May, that they expect business conditions to improve in the year ahead, vs. 46 percent who expect them to deteriorate. CIOs, who were polled at the same time as CFOs in May, appear slightly more optimistic, with 39 percent expecting business conditions to improve over the coming months, vs. only 26 percent who expect them to deteriorate. CFOs are aligned with CHROs who were also polled in May, where 29 percent expect conditions to improve, the lowest of the C-suite.

Forecasting for the Year Ahead

Our C-Suite Confidence Index series, which covers CEOs, CFOs, CIOs, CHROs and Board Members, asks participants to forecast their company’s revenues and profits for the year ahead. In May, the proportion of CFOs forecasting increases in profits over the next 12 months remained unchanged since February, at 60 percent. The proportion forecasting increases in revenues, however, fell by 6 percent, to 75 percent.

Similarly, the proportion of CEOs predicting increases in revenues over the course of the next year declined this month—also down 6 percent, to 70 percent. Unlike CFOs, however, the proportion of CEOs predicting increases in profits has been declining for five consecutive month and is now at 58 percent.

As part of the Index, CFOs are also asked to share their plans for capital expenditures, cash and debt positions. In May, the proportion of CFOs planning increases in those three areas fell, after increases the previous quarter. Twenty-seven percent fewer CFOs now plan to increase their capital expenditures in the year ahead, down to 42 percent. This is much lower than the 52 percent of CEOs who said the same when polled two weeks earlier.

The proportions of CFOs planning to increase cash and debt are down 17 and 5 percent, respectively. Now, 50 percent of CFOs plan to increase cash, compared to 60 percent in February, while those planning to increase debt is now 27 percent.

As for hiring plans, 63 percent of CFOs say they intend to add to their headcount over the coming year, up 11 percent since February. In comparison, 57 percent of CEOs shared that view.

About the CFO Confidence Index

The CFO Confidence Index is a recurring flash poll of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index