When we last checked in with CFOs on their 12-month forecast for business, in mid-January, less than a third said they anticipated conditions to improve over the next 12 months.

But in April, despite the recent bank run and increasing talk of a Fed-induced recession, nearly half of the 133 CFOs polled April 17-20 as part of StrategicCFO360’s CFO Confidence Index now say they expect improvements in the business landscape by this time next year

“I think while we will have a recession, it will be small in depth and breadth,” said one CFO summarizing general sentiment from our survey.

Overall, the proportion of CFOs who say they expect conditions to improve in the year ahead despite the risk of recession jumped 39 percent, to 44 percent, since our Q1 survey last January. Forty-two percent said they expect business conditions to be “very good” by April 2024—measured as a 7 or higher on our 10-point scale where 10 is Excellent and 1 is Poor.

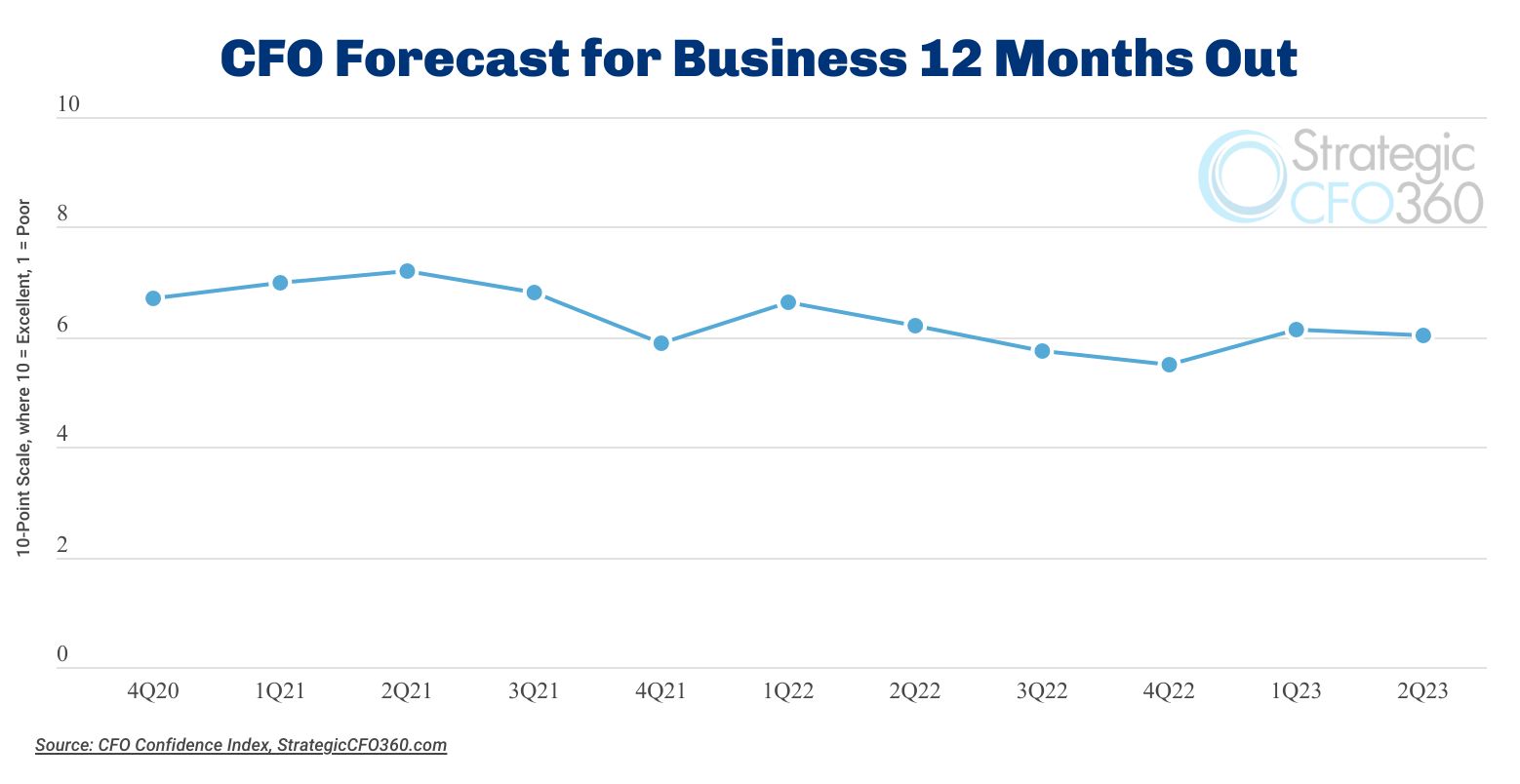

There is one caveat to this optimism: the quality of the conditions CFOs expect at this time next year dimmed slightly since Q1, from 6.1 out of 10 to 6.0 in April—a 1.8 percent drop—though still in “good” territory.

At 6.0, our forward-looking indicator remains above its second half 2022 trough but 3 percent lower than where it was at this time last year (6.2)—and 22 percent below its high of 7.7 in April 2021, when a post-Covid rebound and strong fundamentals had fueled hopes for a strong recovery.

CFOs also downgraded their rating of in Q2, by 2.5 percent, to 5.9 from 6.1 in Q1.

Both readings highlight renewed caution among CFOs that a recession remains in the cards for 2023. Analyzing sentiment from the April survey, we find 35 percent of CFOs who cited stubborn inflation as a primary reason for their rating, followed by the Fed’s strategy in combatting it (33 percent) and the ensuing risk of a recession (25 percent).

Many said they were anticipating the Fed to slow its rate hikes to avoid sending the U.S. economy into a recession, particularly as inflation numbers improve. But even with the potential for a recession, most CFOs said they don’t expect it to be long or painful.

“I expect the current inflationary conditions to improve,” said Michael T. Picard, CFO at SWBR Architects. “This will require some easing of interest rates by the Fed, or we will land flat.”

It is interesting to note that there continues to be a strong sector variant in these forecasts. For instance, CFOs in the wholesale distribution sector rated their outlook for business 24 percent lower than the overall average, at 4.6 out of 10. Meanwhile, healthcare and retail CFOs rated their outlook 23 percent higher than the average, at 7.4—the highest rating across the different industries represented.

The variation is less prevalent when looking at company size (by annual revenues), though the data shows larger companies forecasting gloomier conditions than their smaller counterparts, in general.

The Year Ahead

Against these forecasts, the proportion of CFOs expecting increased profitability by this time next year rose 17 percent, to 56 percent from 48 percent last quarter, while the proportion expecting revenues to grow declined 4 percent, to 66 percent from 69 percent in Q1. Instead, the number of those who expect revenues to remain flat YoY nearly doubled this quarter.

Overall, only 30 percent said they are planning to increase capex in the year ahead—down from 36 percent in Q1 and the lowest proportion since the Index’s inception in the fall of 2020. We did however observe an uptick in the proportion of CFOs projecting to increase hiring, up 9 percent to 53 percent and in line with the proportion of CHROs who said the same.

Looking at cash and debt, 35 percent said they expect to trim their cash position in the year ahead—vs. 32 percent in Q1—while the proportion of those who plan to increase it declined from 44 to 40 percent.

On the debt front, the numbers are relatively flat since Q1, with 21 percent who expect to increase their debt (unchanged from 21 percent in Q1), 57 percent who don’t anticipate changes (vs. 58 percent) and 22 percent who plan to reduce it (vs. 21 percent).

About the CFO Confidence Index

The CFO Confidence Index is a recurring flash poll of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index