It’s no secret that today’s business environment presents a slew of challenges. Inflation at levels not seen in decades, and the subsequent wage increases amid the Great Resignation and a global pandemic, have remained strong concerns for CFOs in recent months. Meanwhile, labor shortages and supply chain issues persist—and according to a plurality of CFOs, those challenges are likely to continue for at least another year.

In StrategicCFO360’s November CFO Confidence Index, our monthly flash poll of America’s finance chiefs on their outlook for business, CFOs shared their strategies to successfully navigating the near term.

Inflation Woes

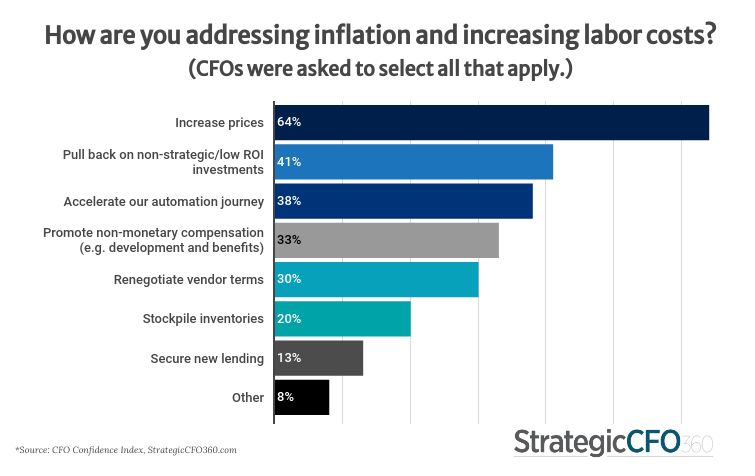

When it comes to helping their businesses deal with current inflationary pressures, 64 percent of CFOs say they’re increasing prices—by far the top strategy, well ahead of cost-cutting (41 percent), and perhaps unsurprisingly after having spent the better part of the past two years doing exactly that to keep their businesses afloat during shutdowns.

Other measures include accelerating the automation journey (38 percent), promoting non-monetary compensation (33 percent) and renegotiating vendor terms (30 percent).

Labor Shortages

Consistently for several months, across the C-Suite and into the boardroom, our research has shown that the lack of skilled talent is one of the top challenges facing corporate America today, and fully two-thirds of CFOs surveyed in November say they don’t expect labor shortages to subside for at least another year. None expect it to subside before the summer of 2022.

According to the data, the majority of CFOs have had to increase their personnel spending over the past year to help attract and retain talent—with nearly a quarter (23 percent) reporting increases of 5 to 10 percent of net total revenues.

The CFO of a mid-size wholesale distribution company says they had to “prune non-essential staff to offset the wage increases” of critical staff.

For one CFO in the nonprofit space, after having increased his personnel spend by more than 50 percent in the past year, the next step is turning to new pools of talent. “Stop chasing employees,” he says, “let some leave for higher wages and stop the upward-bidding war between companies.” Instead, he advises companies to hire more junior employees who are new to the industry, such as recent graduates.

Supply Delays

Another challenge topping CFOs’ agenda: disruptions in the supply chain. Nearly two-thirds of the CFOs we polled (63 percent) say they don’t expect supply issues to subside for at least another year—48 percent projecting 1 to 2 years, and 15 percent saying it will be more than 2 years. Nevertheless, 31 percent expect supply chains can get back to normal as early as summer of 2022—and a hopeful 2 percent say it could even be sooner.

The CFO at a nonprofit shares her strategy to weather the storm: “Up your customer service approach by letting your client base know why delays are happening; be honest to retain your customers.”

Receivables

While the majority report having experienced delays in their receivables in the past 12 months, industry plays a very important role, as one would expect. In the construction and healthcare services industry, 14 percent of CFOs report delays of more than 2 months, while fewer than 10 percent of nonprofit, tech and industrial manufacturing CFOs report similar delays.

What They Said…

Many respondents had thoughts on how to handle all these challenges. Following are a sampling.

“Prioritize projects and resources. Be increasingly selective.” – VP of Finance at a financial services firm in California.

“Secure materials orders well in advance of historic norms.” – CFO at a publicly traded upper mid-size consumer manufacturing company in Oregon.

“Drive org changes, job level responsibility changes and automation/software/business process improvement efforts to improve efficiency at key employee functions. This will help existing employees cope with ‘additional work’ caused by unfilled roles and higher turnover than in the past.” – CFO at a mid-size tech firm based in Washington state.

“Restructure compensation by using equity creatively.” – Chief financial and operating officer at a mid-size construction/engineering firm in Massachusetts.

“Increase focus on controlling direct costs, eliminating/removing process impediments and increase speed to market.” – CFO at a small nonprofit in Tennessee.

“Identify ways to automate processes in order to do more with less.” – CFO at a mid-size healthcare services firm in New York.

“Use of technology to offset rising costs. Improve vendor relationships. Develop internal apprenticeship and training programs.” – Chief finance and operating officer at a mid-size healthcare provider in Florida.

“Stay cost conscious, increase forecasting frequency, help improve internal efficiencies.” – CFO at a small advertising company in New York.

“Become more creative in benefit packages.” – CFO at a mid-size industrial manufacturing company in Illinois.

“Support development and retention programs, support acquisition of long lead items.” – CFO at an upper mid-size construction firm in California.

“We’re working to add language to contracts about material escalation. For labor shortages, we’re getting a current reality of where the local market is paying and will adjust to become competitive. We will increase pricing as much as the market allows and work with our current team on increasing their compensation while increasing some expectations from them.” – CFO at a mid-size industrial manufacturing company in Missouri.

“Streamline and digitalize processes, enhance collaboration in the entire value chain.” – CFO at a large ($1B+) industrial manufacturing company in Maine.

“Be ruthless in the prioritization of people and projects. Now is the time to determine what you really need and what you really need to pay for. Let less important things fall off the radar.” – CFO at an upper mid-size wholesale/distribution company in Illinois.

“Network for ideas others are using, constantly reassess everything the business is doing, provide meaningful metrics.” – CFO at a mid-size senior living company in Florida.

“Stay on top of KPIs to indicate areas that need attention.” – CFO at an upper mid-size consumer manufacturing company in California.

“Provide deeper insight into metrics that can lead to improved decision-making regarding cost control.” – CFO at an upper mid-size professional services firm in New York.

“Ensure predictability of results by locking in prices to delay future cost inflation while providing the business time to price permanent increases.” – CFO at an upper mid-size public consumer manufacturing industry.

To sign up for our CFO research panel and receive a digital copy of the full survey findings, please email [email protected].

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance executives on their perspective on the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index