As a Covid-19 vaccine begins to roll out across the country, America’s CFOs are increasingly optimistic that business conditions will improve in 2021, with a growing number also forecasting increases in revenues and profits at their firms over the coming months.

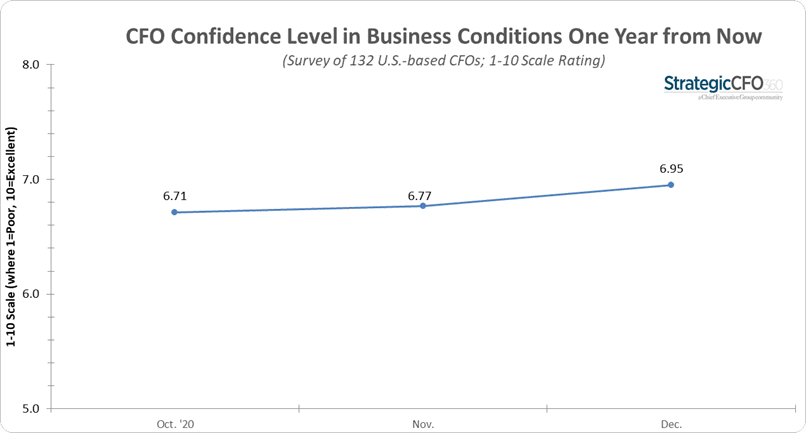

StrategicCFO360’s December reading of CFO confidence shows America’s finance chiefs rating the economy 12 months from now a 7.0 out of 10 on our 1-10 scale—3 percent higher than what it was in mid-November and 21 percent higher than their confidence in current conditions, which was 5.7/10, fairly unchanged from the month prior. Those numbers are in line with what we found in polling by our sister publication, Chief Executive, which found CEOs’ rating their outlook for next year at 6.9/10.

CFOs we polled said the availability of a vaccine and pent-up demand are the two main elements fueling their outlook. In addition, many of those polled said streamlined operations that have boosted their ability to adapt during the pandemic will lead to a strong recovery.

“As people have adapted and as vaccines are released for Covid, our economy will return to a pre-Covid state fairly rapidly,” said the CFO of a wholesale/distribution company, echoing the sentiment of many other respondents.

“Usually, business cycles coming out of a pandemic or recession have shown significant uptrend, and that’s the basis for the above forecast,” wrote the CFO of a large global professional services firm.

Still, some remain cautious in the deployment of new investments over the coming months, awaiting further clarity on the new administration’s policies, particularly with respect to tax and environmental regulations.

“I think if they change the tax structure and get rid of the 100% depreciation deduction that you will see a slowdown in capital expenditures, which in turn affects jobs and the supply chain,” said the CFO of a large international IT organization, who nevertheless expects business conditions to improve by the end of 2021.

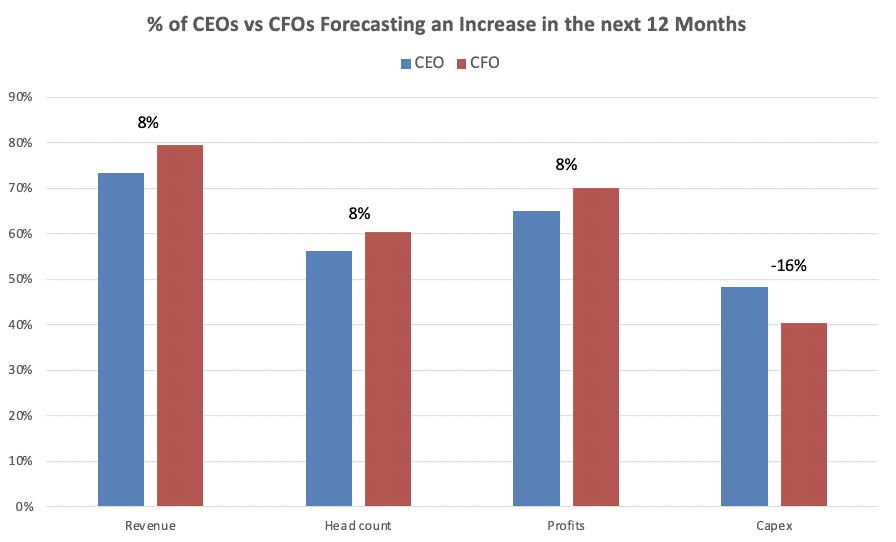

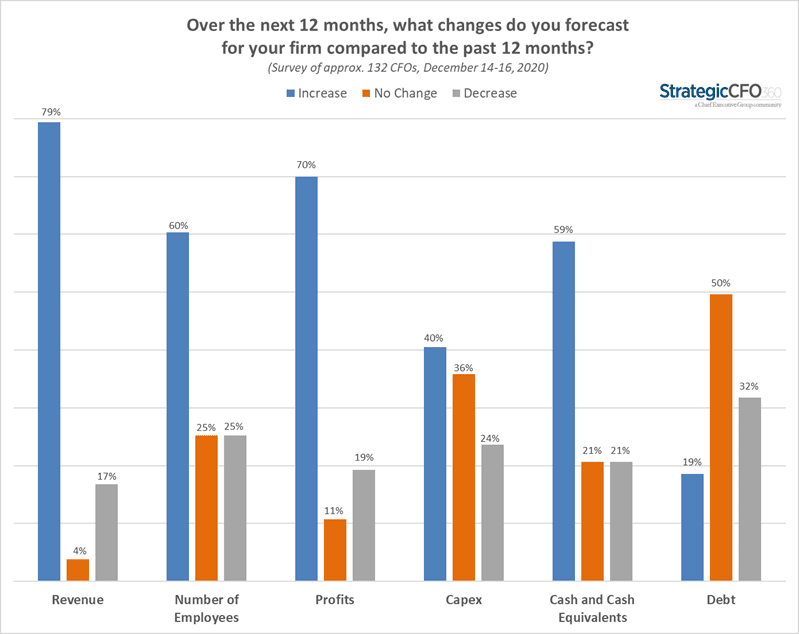

For the first time since we began fielding the CFO Confidence Index in October, a greater proportion of CFOs are planning to decrease capex over the next 12 months—at 24 percent compared to 15 percent the month prior. Of those expecting to cut expenditures, 52 percent said it would be by more than 20 percent. In comparison, 48 percent of CEOs project an increase in capital expenditures over the next 12 months—17 percent more than CFOs.

Forecasting for the Year Ahead

Our December reading of confidence shows CFOs are increasingly optimistic about their company’s revenue growth and profitability, with forecasts revealing a promising trend: 79 percent of senior finance executives say they anticipate revenues to be up by this time next year (+7 percent since our November survey), and 70 percent are also expecting increases in profits (+6 percent from prior month). To account for that growth, 60 percent say they plan to add to their headcount (+7 percent MoM).

In contrast, CFOs’ forecasts across those three variables are 7.5 percent higher than that of CEOs.

Alternatively, a growing proportion of CFOs say they are planning to increase cash and reduce debt, up 9 percent and down 10 percent from last month, respectively.

Sector View

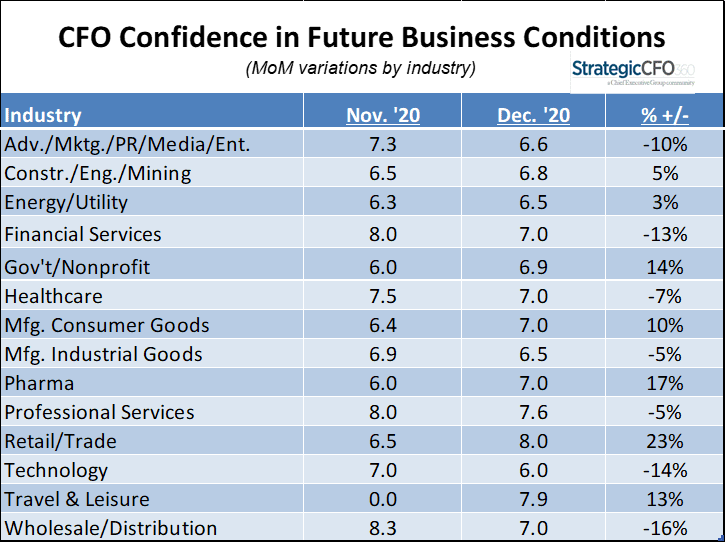

Covid-19 has affected all sectors in different ways and to varying degrees, and CFOs’ expectations of how quickly the pandemic will be resolved and businesses will return to pre-crisis levels differ greatly depending on the industry they’re in. Similarly, CFOs are divided on the impact of the incoming administration’s agenda on their companies, as some fear regulations that can inhibit their growth while others welcome policies that will open up opportunities for their sector.

That range of perspectives is clearly highlighted by our December Index, with CFOs in the Wholesale/Distribution, Technology and Financial Services anticipating a decline in business conditions by this time next year, and CFOs in Retail/Trade, Pharma and Travel & Leisure expecting things to get better with the deployment of a vaccine.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly pulse survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index