CFOs Say Better Use Of Data Needed To Push Innovation, New Poll Reveals

StrategicCFO360 and Amazon Web Services

CFOs are critical advisors to the CEO and in today’s data-driven environment, finance chiefs need to hone their digital skills to keep pace with innovation. In a recent polling of 162 CFOs, conducted in partnership with Amazon Web Services, StrategicCFO360 found America’s finance gurus generally confident about the progress they’re making in that area—although most say they’re not yet where they’d like to be.

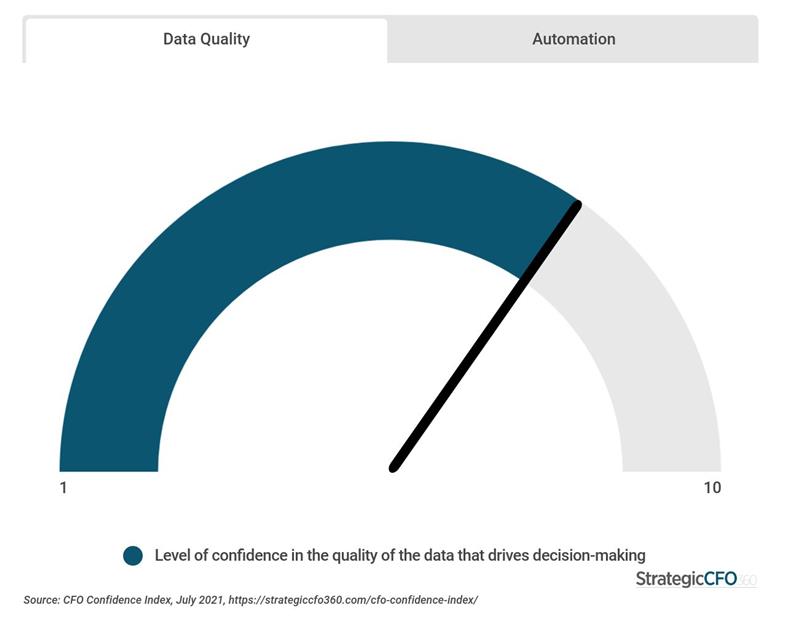

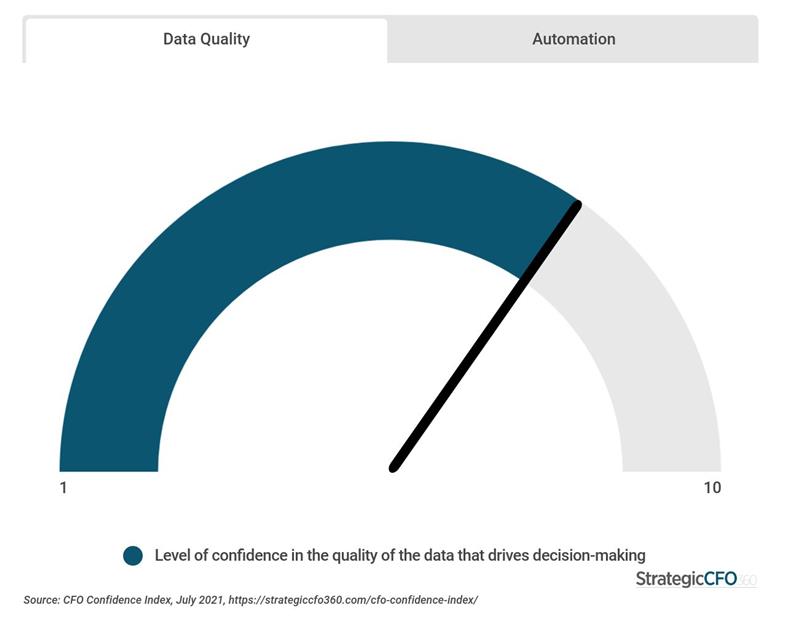

According to the survey, CFOs are confident in the quality of the data driving their decision-making—which they rate a 7.3 out of 10, on our 10-point scale—but many show concern over their company’s automation of the data collection, analysis and reporting process, rating it a 6.3 out of 10.

When asked to describe the sophistication of their data systems (what the company measures, who owns the data, who uses it, etc.), 32 percent of polled CFOs say they’re ahead of competitors—with 7 percent of those saying they have world-class systems—while 31 percent report lagging peers. The rest (37 percent) feel they are on par with their peers, although only 16 percent say that’s where they want to be.

It’s not surprising that the great majority (72 percent) aspire to be ahead of competitors with their data systems, and according to Mark Schwartz, AWS Enterprise Strategist, the key differentiator between those who will accomplish this goal and those who will remain behind is pure strategy.

“To be a leader, you have to be tenacious about getting to the truth,” he says. “Often, this means that you need to be agile enough to pivot when the data tells you you can jump on new opportunities or correct course.”

To do this, he says companies need a modern data strategy.

The catch? There’s no one size fits all. The ideal strategy is adapted to your business goals. Whatever that means for your business, he says there are key items to look for, including:

A CFO at a large industrial manufacturing company echoed many of his peers when he said: “We have invested significantly in technology (SAP Upgrades, software add-ons, etc.), but our efforts have been on transactional efficiency, not on data collection and analysis. It is a weakness in our company.”

He is not alone in that situation. Our research shows that three-quarters (74 percent) of companies, according to their CFOs, have not yet developed new business models based on the data collected from customers.

Those are missed opportunities, says Schwartz, who believes value for the company is created not by the data itself but by the processes used to analyze it.

“Businesses need to use data to support their agility and to respond quickly and flexibly to changing circumstances,” he says. “But agile processes are only one part of the story: The company’s data itself must also be agile. It must be accessible and meaningful. It’s this ability to use data flexibly—to make it available for new uses that we don’t know about in advance—that is the missing link in achieving enterprise agility. It’s what distinguishes the agile organization from one that has merely adopted the frameworks and trappings of agile models.”

Subscribe to our Weekly Newsletter

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.