The impact of the Covid-19 pandemic on global deal making in the first six months of 2020 was significant but not unexpected, yet regional differences in deal performance and volume revealed by M&A data from Willis Towers Watson have been more dramatic.

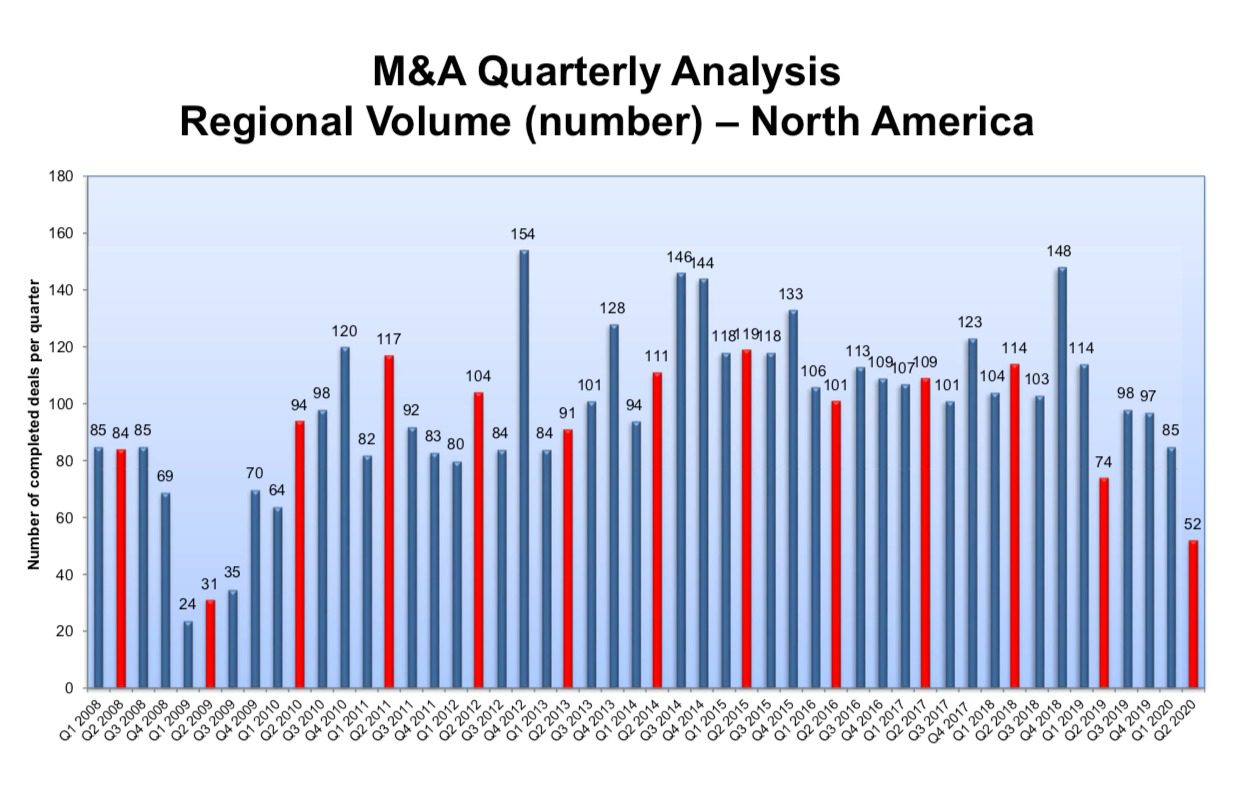

Based on share price performance, the latest results from Willis Towers Watson’s Quarterly Deal Performance Monitor (QDPM), run in partnership with Cass Business School, show North America experienced the sharpest fall in M&A performance by some margin. Acquirers underperformed their regional index by –7.2 percentage points with just 137 deals completed in the first half of 2020 (compared with 188 in the first half of 2019). This is the lowest number of North American deals for a six-month period since 2009.

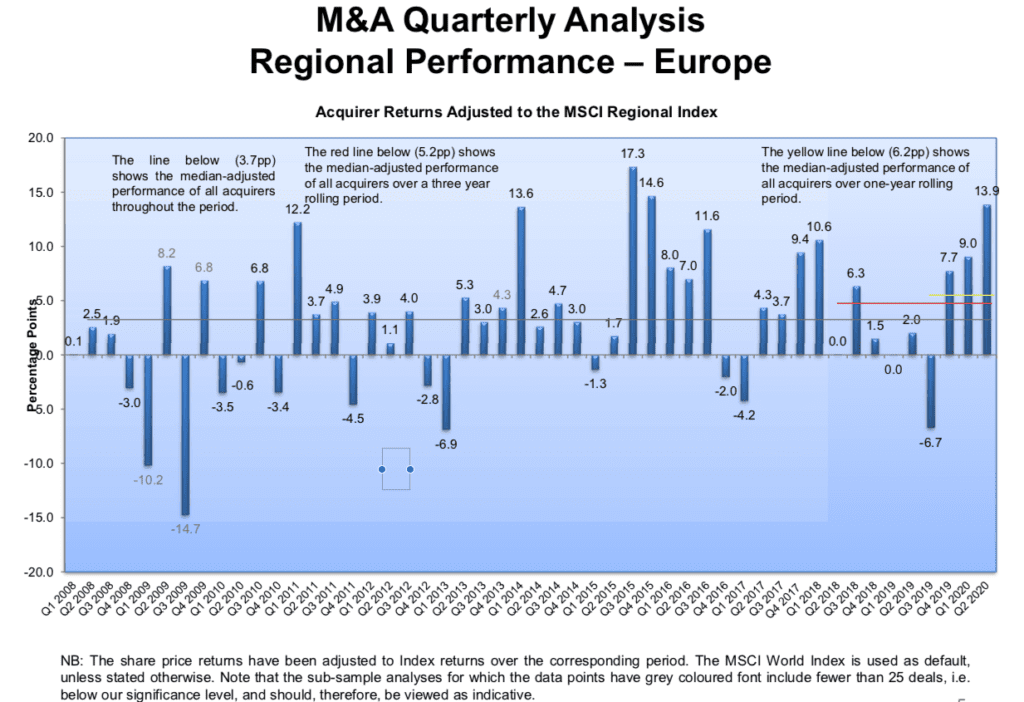

In contrast, European buyers performed +10.2 percentage points above their regional index in the first half of 2020 based on an actual increase in deals completed (80 deals compared with 68 deals in the first half of 2019). This is also the first time in two years that Europe has recorded three consecutive quarters of positive performance. Meanwhile, U.K. acquirers performed +16.9 percentage points above the index with 15 deals in the first half of this year.

In contrast, European buyers performed +10.2 percentage points above their regional index in the first half of 2020 based on an actual increase in deals completed (80 deals compared with 68 deals in the first half of 2019). This is also the first time in two years that Europe has recorded three consecutive quarters of positive performance. Meanwhile, U.K. acquirers performed +16.9 percentage points above the index with 15 deals in the first half of this year.

Asia Pacific deal makers also fared better compared with their regional index in the first half of 2020, albeit with a more modest positive performance of +3.1 percentage points and based on a slight dip in volume (82 deals compared with 95 completed in the first half of 2019). Perhaps more significantly, the region’s outperformance in the past three months improved substantially at +8.0 percentage points based on 41 deals closed, the region’s first significant positive quarterly performance since late 2016.

Asia Pacific deal makers also fared better compared with their regional index in the first half of 2020, albeit with a more modest positive performance of +3.1 percentage points and based on a slight dip in volume (82 deals compared with 95 completed in the first half of 2019). Perhaps more significantly, the region’s outperformance in the past three months improved substantially at +8.0 percentage points based on 41 deals closed, the region’s first significant positive quarterly performance since late 2016.

“Global M&A activity tumbled to its lowest level in more than a decade in the wake of the Covid-19 outbreak, with most of this decline driven by North America. Economic uncertainty caused by the pandemic seems to have had a far greater negative impact on the ability of U.S. companies to initiate and successfully complete M&A negotiations,” said David Hunt, senior director, Human Capital and Benefits, M&A.

“Global M&A activity tumbled to its lowest level in more than a decade in the wake of the Covid-19 outbreak, with most of this decline driven by North America. Economic uncertainty caused by the pandemic seems to have had a far greater negative impact on the ability of U.S. companies to initiate and successfully complete M&A negotiations,” said David Hunt, senior director, Human Capital and Benefits, M&A.

Additional findings from the QDPM data include:

• Deals are taking longer: The average time to close a deal in the first six months of 2020 increased by 8% compared with the same period in 2019 (from 144 days to 156). This trend is likely to endure, says Willis Towers Watson, with M&A deals continuing to be delayed or cancelled as companies try to wait out the worst of the downturn.

• Mega deals still in play: Six mega deals (valued at $10 billion-plus) closed in the first half of 2020 compared with five deals in the same period in 2019.

• Industry winners: Acquirers in the energy and power (+8.2 percentage points), healthcare (+3.4 percentage points) and materials (+9.8 percentage points) sectors all outperformed their respective indices in the first half of 2020.

• Industry losers: High technology (–15.4 percentage points) acquirers have been hit hardest during the Covid-19 outbreak.

• Domestic versus international: Cross-border and cross-regional deals both outperformed their indices in the first half of 2020 by +0.3 percentage points and +6.2 percentage points respectively, while domestic deals struggled with an underperformance of –2.6 percentage points.

“Before the severe disruption of Covid-19, deal makers already faced uncertainty, including trade disputes, the threat of global recession, the rise of shareholder activism and a U.S. presidential election on the horizon, making the deal performance and volume in some markets even more impressive,” said Hunt. “While it’s not possible to forecast the pandemic’s long-term impact on M&A, more turbulence seems inevitable.

“What previous crises do tell us is there will be opportunities to make deals, underpinned by vast amounts of capital still waiting to be deployed. Activity, partly driven by distressed M&A and non-core divestitures at bargain prices, will become more selective, deals will take longer, and acquirers will need to be prepared for the duration and depth of their due diligence to increase, even as Covid-19 subsides,” concluded Hunt.