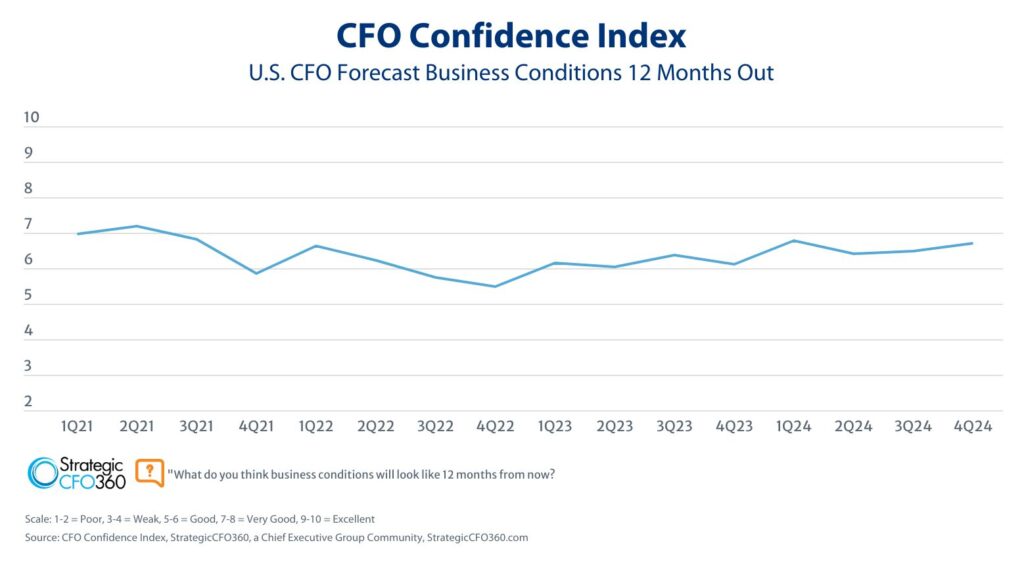

Like other CFOs surprised at the strength of the U.S. economy and bullish prospects ahead, Mike Smith is eyeing a host of capital spending opportunities this year and next, among them M&A transactions, data and analytics tools, and initiatives to attract top talent.

“Coming into the back end of 2021 and into 2022, we’ve got strong financial results and some pretty sizable dry powder to invest in continuing growth,” said Smith, CFO at public company Voya Financial, a New York-based financial, retirement, investment and insurance company with $7.6 billion in 2020 revenues. “Many economists seem to agree the good times have some staying power and we want to take advantage while we can.”

With “good times,” Smith is referencing the extraordinarily robust U.S. economy, one year after it experienced the sharpest contraction since the end of World War II. Putting aside (for the moment) deepening worries over the Delta variant, sluggish vaccination rates, a protracted supply chain debacle and rising prices—the Consumer Price Index shot up 5.4 percent between July 2020 and July 2021—Smith is spot on when he says many economists project economic growth. StrategicCFO360 interviewed five economists, each one expressing upbeat conditions through 2022.

The economists have a surplus of evidence to back up their rosy projections. Between April and June, the U.S. economy grew 6.5 percent, an economic output surpassing pre-pandemic GDP. Nearly a million (943,000) jobs were added to the economy in July, much more than analysts expected, marking a stunning reversal of where employment stood the previous July. Unemployment consequently fell to 5.4 percent, while the number of job openings (this is really big news) catapulted to a new record—9.2 million.

Add it all up and the U.S. economy right now can’t be beat. “2021 is looking incredibly strong and next year looks the same way,” said Beth Ann Bovino, Chief U.S. Economist at Standard & Poor’s Rating Services. “We have GDP for this year at 6.7, which would be a 37-year high. After something like that, you’d think a pullback would be likely next year, but we don’t expect it. There’s huge demand for talent with job openings at record highs.”

With many public companies enjoying record stock prices, dry powder piling up at private equity firms and irresistibly low interest rates compelling a debt-fueled borrowing boom, capital is copious for strategic CFOs to spend widely and wisely. CFO Mark Partin at BlackLine, for instance, is eyeing product adjacencies enhancing the accounting automation company’s platform solutions. April Downing, CFO at customer engagement company Khoros, is looking to increase talent rolls by 20 percent. And CFO Johnathan Taylor’s growth trajectory at HR outsourcing services provider LandrumHR will be fueled, in part, by acquisitions. “I’m in the middle of conversations with three candidates right now,” Taylor said.

The positive economic news and forecasts are catalyzing CFOs to reinvent their businesses while they can, putting aside last year’s economic miseries to seize opportunities in an historic turnaround, one that could last several years. “In a market like the one we’re in now, you either take advantage of the opportunities or you don’t,” said Ken Stillwell, CFO at public company Pega. “You win or you lose. We see now as a time to differentiate and be a winner.”

A Rising Tide

To be fair, each of the five economists we interviewed did not sweep the key economic risks consuming media and business attention under the rug. The Delta variant (and other emerging coronavirus variants), the surprising hordes of unvaccinated Americans and on-again, off-again, inflation fears—are potential party poopers.

Following a surge of optimism in early July, a survey of CEOs by Chief Executive in early August suggests their outlook about the economy has retreated to pre-vaccine levels, with the same proportion of respondents (34 percent) stating the economy will either improve or remain the same. Fewer Chief Executives forecasted increases in profits and revenues through the end of the year, but still, those numbers are higher than they were in January.

The big reason for the sudden malaise is the continuing spread of the Delta variant. The economists we interviewed downplayed the economic risks—to a certain extent. “We’re in what I’d call the ‘indefinite zone’ of the variant, but we’re already seeing cities and states require masks indoors to reduce the risk of spreading,” said Ernie Goss, professor of economics and director of the Institute for Economic Inquiry at Creighton University.

“While there will continue to be anti-vaxxers, the momentum is toward them having to wear masks along with those of us who are vaccinated,” Goss said. “This suggests that governments have no intention of shutting down businesses again. From an economic standpoint, the Delta variant is manageable and temporary.”

If it turns out otherwise, David A. Levy, chairman of the Jerome Levy Forecasting Center, said, “The economy could get into trouble. In July, the number of Delta cases in the U.S. quintupled and if it does that again this month, that puts a lot of people out of work. We’d need more stimulus money to keep the economy growing. And if more infectious and deadly variants transpire, obviously that’s really worrisome.”

Future-Proof Your Organization

The best way to boost your organization’s competitiveness tomorrow is by upskilling your employees today. And the process doesn’t have to be daunting. Here’s how PwC did it—and you can too.

Inflation, on the other hand, although elevated, is expected to moderate. The Consumer Price Index increased 0.5 percent in July from June, a slower rate than the 0.9 percent increase in June from May, although still above the 0.2 percent rate average from 2000 to 2019. “We’re in the camp that inflation is just a transitory thing that will filter out of the system,” said Bovino, pointing to a combination of temporary factors that lifted prices. “Demand surged because it was V-day (for vaccinations); people wanted to celebrate and spend money but supply chains couldn’t keep up,” she said. “Manufacturing slowed and prices ticked up. It’s not like they’ll stabilize next month—that will take some time—but this is not a 1970s or 1980s story of runaway inflation.”

Others echoed the same refrain. “Fears of runaway inflation have been exaggerated,” said PhD economist Robert Hartwig, a professor of finance and director of the Risk and Uncertainty Management Center at the University of South Carolina. “Any ‘uptick,’ to borrow the words of Federal Reserve Chair (Jerome) Powell, are `transitory’ and will `wane.’ Although prices have risen, they will revert to the mean of consistent annual 2 percent increases.”

Cristian deRitis, Deputy Chief Economist at Moody Analytics, also sees inflation as a momentary blip. “As supply chain problems iron out, the current price increase pressures will moderate,” he explained. “It’s harder, of course, to rein in recent wage and salary increases compensating for higher prices. Once they go up, the harder (it is) to pull them back. But look at it this way—companies are paying people more but they’re also investing in automation to increase productivity, which balances out and should put a curb on inflation.”

Higher and Higher

Like S&P, Moody Analytics projects 6.7 percent GDP growth this year, slipping a notch to 5 percent in 2022. “That’s still more than double the historical average of 2.3 percent GDP growth in our baseline,” deRitis said. “All that pent up demand among consumers and businesses buying from other businesses is letting loose. Frankly, were it not for ongoing supply chain issues, our GDP growth forecast would be 7 percent (for 2021).”

Such stratospheric heights would have been unimaginable last summer. Yet, Hartwig said the economy is enjoying a “rare Goldilocks moment,” the term used to describe an ideal state of near-full employment, economic stability and steady growth—“neither too hot nor too cold but just right,” to borrow a line from the popular children’s story. “Virtually all the conditions are lining up for many U.S. businesses to enjoy growing sales and profits and for many people to realize growing income, with relatively modest inflation,” he said.

Levy expects the U.S. economy to outperform the rest of the world over the next several years, “in some cases way more,” he said, “because we’ve had a much bigger federal stimulus and a big lead in vaccinations.” He added that strong forces are coalescing to bring manufacturing back to U.S. shores. “Companies left to leverage cheap labor abroad, but with widescale automation, the labor arbitrage is less. We’ve also learned from the pandemic that the cost of carrying goods in inventory is a much better option that the risk of losing sales because of global supply chain disruptions.”

It’s reasonable to conclude that the economic climate is vibrant and even a bit tranquil. “Are there risks? Sure,” said Hartwig, “but demand is exploding in the aftermath of the pandemic on a global basis. Using inexpensive debt and equity capital and combinations thereof, CFOs can be expected to sharply increase their capital expenditures, making multi-decade investments in productivity enhancements, M&A activity, cutting edge technologies and talent through the remainder of the decade.”

Money, Money, Money

CFOs are doing just that. At BlackLine, a developer of cloud-based software and services designed to automate and control the entire financial close process, CFO Partin is investing in the development of product adjacencies organically and through M&A. In 2020, the public company acquired Rimilia, a provider of accounts receivable AI tools, a competency BlackLine lacked at the time.

“The management of a company’s capital structure is in sharp focus right now,” Partin said. “Accounts receivable impacts key financial statements—the balance sheet, income statement and the statement of cash flows. Controllers want to become more forward-thinking about the company’s future revenue streams and investment returns. AR automation is very high on the agenda for controllers to drive value, making AI tools that shorten the time to this value a valuable product adjacency for us to have.”

Through this year and into next year, Partin is eyeing other product opportunities to advance BlackLine’s platform functionality for its more than 3,600 customers worldwide. “We’re committed to investing capital in bringing end-to-end optimization and automation to other areas that touch the controller,” he said.

Taylor, CFO at privately held LandrumHR, which tallies corporate clients in 16 states and revenues of $700 million annually, plans to invest capital in acquisitions to enhance the HR outsourcing firm’s capabilities and talent. “We did some deals in 2019 and were ready to pull the plug on another one when Covid hit,” Taylor said. “Because of the unknowns at the time, we backed out. Now with more certainty in the economy, we’re plotting acquisitions in our growth plan, with three targets under review.”

M&A also is on tap at Khoros, a customer engagement software company with more than 2,000 global customers, including one-third of the Fortune 100. “The market we’re in is growing like crazy and we are very well positioned to invest,” said CFO Downing, who joined Khoros in early 2021.

This year, Khoros made two acquisitions predicated on the interests and needs of its customer base—Topbox, an omnichannel customer experience analytics platform, and Flow.ai, a conversational AI and machine learning platform. The deals also bring with them solid talent prospects. Nevertheless, Downing also is investing capital in new hires. “Even though we’re considered a top place to work, talent is just extremely hard to come by right now,” she said.

The company’s “remote-first” approach to work should make this task easier, she said, elaborating that Khoros has been more flexible than other tech companies when it comes to where and when people work. This attractive work culture also allows for reductions in office space, “our second biggest operating expense,” said Downing. “We’ve got 11 offices globally, including North American facilities, and have no plans to open additional offices. We can shift this capital to accelerating product innovations and employee opportunities for advancement, upward mobility and education.”

Strategic growth objectives also involve people at Pega, a provider of business process management and other technology tools. “Our biggest opportunity to accelerate our growth is talent acquisition,” said Stillwell. “We’re continuing to build the kind of company people want to work at, investing in their career development and in a more inclusive culture. We want people to be energized by the opportunity to work here.”

At Voya Financial, CFO Smith is doing all the above, investing in M&A opportunities, technology enhancements, and talent-focused initiatives. As the retirement planning space consolidates, Smith is eyeing acquisitions of companies with different pieces and parts that augment Voya’s offerings, he said. “We’re a top five player, but there are strategic opportunities for us to buy competitors that may have a technology or people with unique technological capabilities that we lack,” he said. “The (deal) multiples are significant, but so are the opportunities.”

He offered a similar opinion about talent. Whereas 20 percent of Voya’s employees worked remotely from their homes on a fulltime basis pre-pandemic, 35 percent now do the same. For the remainder of the firm’s more than 5,500 employees, the current plan is “to be fairly flexible” when people choose to come into the office, he said. “Workforce planning will be driven by each team’s needs. This `hybrid-first’ work environment will help us capture top talent.”

The CFO said he plans to increase investments in technology, chiefly data and analytics tools and digital and mobile enhancements to Voya’s platform, with the aim of assisting client decisions on different employee benefits like retirement solutions and healthcare plans. “I see digital transformation as ongoing,” Smith said. “Technological capabilities are a battle well fought but never won, requiring ongoing investment.”

Fortunately, there’s ample capital on hand to make them. When Voya went public in 2013, its market cap was $7 billion; today, it’s around $8.5 billion. One other way the CFO is spending capital? “We repurchased around $800 million of our stock this year and continue to see this as a tool helping our shareholders get value for their shares,” he said. “When you’ve got extra capital, that’s a pretty good use of it.”