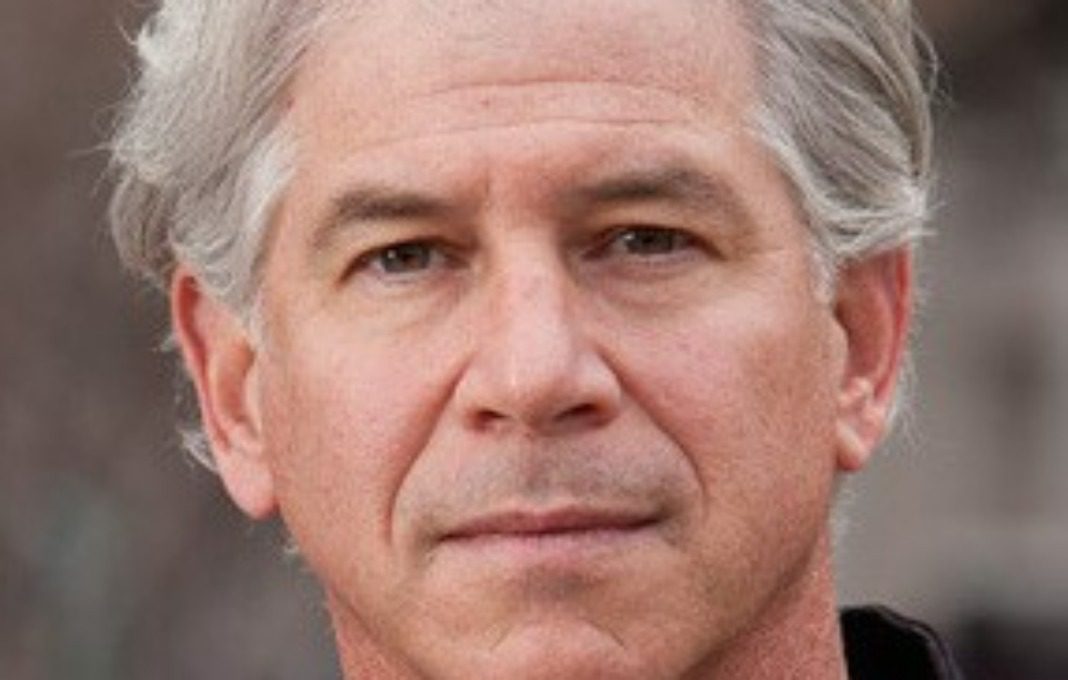

Editor’s Note: Last week we brought you Part I of StrategicCFO360 reporter Russ Banham’s recent interviews with Andrew Fastow, the chief financial officer at Enron during its 2001 collapse. Fastow is known, of course, for putting together the cutting-edge asset securitizations, special purpose entities and balance sheet debt instruments that catapulted Enron’s fortunes—and ultimately felled the company. He was charged with 78 counts of fraud and served a six-year prison sentence. (For more from Fastow, check out the CFO Leadership Conference: East in Boston June 6-8, where he will keynote.)

Here the discussion continues about ethics and finance, comparisons between Enron and FTX—and just how CFOs can get into trouble. “Almost no one wants to break the law,” he says. The conversation that follows has been edited for clarity and conciseness.

Did ethics ever figure into your reasoning at Enron?

The relevant word is “risk,” not ethics. When I’m invited to do talks at companies [during] what they almost always call their Ethics and Compliance Week, I start out asking the attendees, “What is compliance?” Everyone replies that it’s following the rules. Seems straightforward. I agree. Then I ask, “What is ethics?” And invariably the answer is doing the right thing. “What is the right thing?” I ask. I’ll throw out some issues and they can’t agree. And invariably because they can’t agree, they come back to following the rules.

Ethics just becomes another word for compliance, then. I get that, but it’s a very dour view of human behavior, as it suggests the only way to limit the possibility of accounting fraud is to tighten the rules so tautly, there are no loopholes whatsoever. Since people can’t be trusted not to exploit the gray areas, and partnering organizations will look the other way if you do it successfully, regulators are the only line of defense. Have we reached this point where everyone is assumed to be dishonest unless proven otherwise?

No. I was a poor CFO; the vast majority are good CFOs. But there is nothing wrong with management trying to find every advantage, including in financial reporting. CFOs get into trouble because they fail to properly identify, price and manage the risks associated with creative accounting solutions. Almost no one wants to break the law. Yes, there are the Bernie Madoffs out there, but that is very rare.

Interesting that you mention a failure to manage risks, since FTX’s Sam Bankman-Fried said pretty much the same thing to George Stephanopoulos at ABC News: “I wasn’t even trying, like, I wasn’t spending any time or effort trying to manage risk on FTX.” In other words, he didn’t set out to commit fraud, he made managerial errors. Do you believe him?

I don’t know. Maybe it was a big scheme right from the beginning. I’m not sure. We don’t yet know if he followed all applicable rules. But it’s clear that when things go wrong, clever solutions look more criminal than creative.

In the enormous coverage of the FTX implosion, the media often points to similarities with the Enron debacle. Former Treasury Secretary Larry Summers even weighed in on Bloomberg News, stating that the FTX implosion bore “whiffs” of fraud similar to Enron’s collapse. What do you think?

There are some similarities and some very stark distinctions. On the distinction side, it’s not clear from any of the reporting that Bankman-Fried had bona fide attorneys and accountants reviewing and approving what he is alleged to have done. We did. Then again, we were a public company and FTX wasn’t.

True, but FTX’s 2020 and 2021 financial statements were, in fact, audited.

By two different audit firms, which should have been a red flag. Nevertheless, it appears that he was so disorganized and understaffed on the compliance side, I’m skeptical he had appropriate reviews and approvals for what he was doing. That strikes me as the biggest distinction and maybe his Achilles heel.

And the similarities?

One similarity that’s very stark is he had a conflict of interest with Alameda Research, and I had a conflict of interest with LJM [a special purpose entity fashioned by Fastow in 1999 to create a hedge so Enron would not have to report a decline in asset values]. Conflicts of interest are not illegal, per se. But you are required to have them approved by an independent board, and you are required to disclose them to investors. Again, it is not clear from public information whether these steps were taken. In either case, if you put that in front of a jury, it looks really bad.

Is that what happened in Enron’s case?

LJM was fully disclosed in excruciating detail in a footnote called “related party transactions.” In FTX’s case, I’m not sure if it was disclosed. If there were communications or presentations showing it was disclosed, then it’s another matter. In either case, if you put a conflict of interest of this magnitude in front of a jury of incredibly well-educated people with years of business experience, they are still likely to just assume it is illegal.

Aside from the conflicts of interest, any other similarities come to mind?

Both companies seem to have mispriced their asset values for reporting purposes. Now no one accused me of mispricing asset values, but it turned out that the traders at Enron were massively mispricing asset values, to the tune of $5 billion. For highly illiquid assets like FTX was trading, and in many cases the Enron guys were trading, there is no market value. This brings up a rhetorical question: What do the accounting rules say about valuing such assets? The non-accounting way to describe this is, “however they want.” They make up the value and report it.

You’ve spent a lot of time thinking about your actions at Enron, dissecting why you did this or that. I want to return to the subject of gray areas, since that is where the trouble seems to originate. Is there some personal advice you can pass on to CFOs to discern when they might be entering dangerous territory?

One thing I’ve come to realize is that when our brains are in the gray area, looking to exploit weaknesses in the rules to get a desired but misleading result, it tends to be very bad at identifying and pricing risk. You’re not as good as you think when making accounting decisions or engaging in certain types of structured transactions to manage the financial statement.

And that, in turn, increases the risk of getting caught?

Yes. The problem isn’t necessarily doing these things—they’re quite ubiquitous—the problem is they make your company more fragile.

Why then dabble in creative solutions to begin with?

Let me ask you a question: If CFOs were just glorified accountants, if all they were supposed to do is count the money, why do they get paid so much? Why pay them $5 million a year? Because the function is looked upon to make the numbers match what people expect. That’s a lot of pressure. When CFOs fulfill these expectations, people applaud them. It feels good to make people happy. And you want to make them happy again, so you become less objective.