Certain functions in your business are more important than others. And much like these functions, some people on the executive team are more important than others. Their compensation should, therefore, reflect the value of their work and how their work can fuel growth for the business.

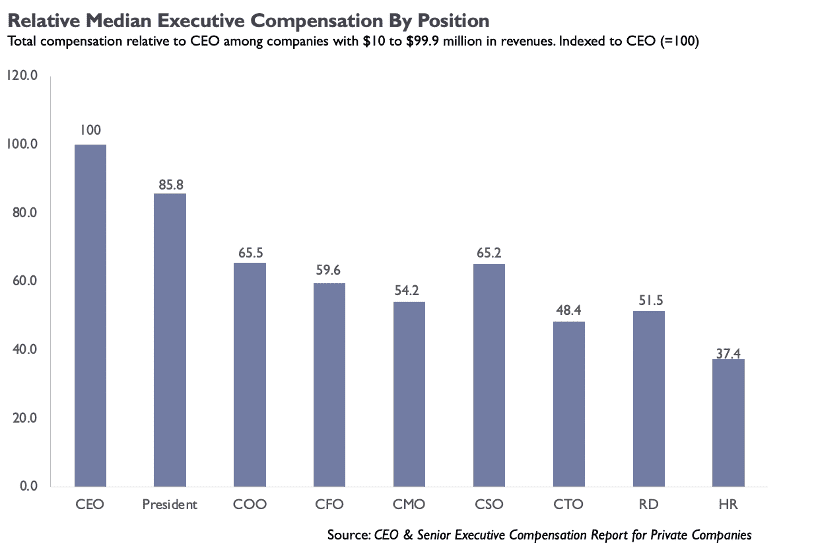

That may sound like common sense, but based on Chief Executive’s annual CEO and Senior Executive Compensation research, far too many companies prioritize “fairness” and average out executive compensation across their entire team. The data, indeed, shows that while CEOs and presidents lead the C-Suite as far as compensation goes, remuneration remains fairly similar across most senior executive titles.

Yet, in pursuit of “fairness,” many companies lose the ability to pay and retain the key superstars that they need to fuel growth.

Yet, in pursuit of “fairness,” many companies lose the ability to pay and retain the key superstars that they need to fuel growth.

Instead, research from our sister publication, Chief Executive, has found that the best strategy is a mix of talent levels and compensation across the team, one that pays more for what’s more valuable. A superstar top-quartile executive (paid a superstar top quartile executive salary) is not going to be warranted or affordable for most companies. Smart companies will differentiate having a great vs. a good person in certain functions—and will pay them accordingly.

No fixed rule applies across the board—every company needs their own formula. For instance, if the business is a mature private equity-backed manufacturing company that’s growing at a decent rate with strong cash flow, the CFO may be one of the most important executives. The CFO has to deal with bank covenants, make sure they don’t trigger any of the loan covenants and work on cost control initiatives. The significance of that role should warrant a “superstar” CFO and commensurate top quartile compensation.

Compare the mature manufacturing company to an early-stage biotech company, where the head of research and development may be one of the most critical positions to have a superstar vs a good or a very good performer. The VP of sales and marketing in this early stage or pre-revenue company? Maybe not as important.

There’s no perfect science for this talent-compensation formula, but it will take some focus. Companies need to consider:

- What stage of growth your company is in (e.g., early stage and not yet profitable vs. mature)

- Your industry and business model

- Compensation benchmarks for your industry and specific roles

- Your ownership model (e.g. Venture Capital vs. Private Equity or Family Owned)

- Your overall balance sheet

Once that is assessed, leaders can figure out who on the senior team should be given a superstar salary and who just needs to be a good performer. Once there, they can better understand how to divvy up the executive compensation pie by further benchmarking what rivals are willing to pay. This can also lead to potential opportunities to recruit superstar executives to fill specific needs.

For additional information and in-depth benchmarks by sector, size, ownership type, growth rate, region and profitability, Chief Executive’s 2020-21 CEO & Senior Executive Compensation Report for Private Companies offers more than 140,000 data points collected from 1,780 companies in April through July of 2020 about their 2019 fiscal year compensation levels and practices, as well as their current and expected compensation levels for senior executives for the remainder of 2020. This kind of data can go a long way in helping you better figure out where you stand and make the right moves in doling out executive compensation.