Supply chains—a concept consumers barely considered prior to Covid-19 and the events of 2020-2021—are now a daily priority that fills headlines for organizations and consumers alike.

For organizations, it’s fair to say the Environmental, Social and Governance (ESG) aspects of supply chain, in particular, have become central to decision-making overall.

Likewise, the increasingly closer examination of corporate practices has inevitably extended to companies’ supply chains. The ripple effects of whether a company can deliver lumber or microchips, for example, could be a fraction of the economic damage they’d face if the process of obtaining and delivering these commodities were later determined to have violated a regulation or been improperly sourced.

Even more challenging is the fact that the environmental and social footprint of a business extends far beyond its own walls. For most products, according to McKinsey, 80% to 90% of their greenhouse-gas emissions are “Scope 3”: indirect emissions that occur not within the company itself, but across its outsourced value chain in situations such as embedded emissions in purchased goods and services, employee travel and commuting, and the use and end-of-life treatment of sold products. Yet the economic and reputational damage of any misstep lands in the organization’s lap just the same.

Best practice priorities in 2022

Thankfully, ESG is high on the priority list of regulators and investors, and their demand for ESG data continues to grow. For example, The U.S. Trade Facilitation and Trade Enforcement Act addresses unfair labor practices across global supply chains by barring the import of forced-labor-linked goods into the U.S. In Europe, the EU Directive 2014/95 requires disclosures on human rights issues in the supply chain. Similarly, Australia’s Modern Slavery Act 2018 requires companies to report on modern slavery risks in operations and supply chains.

Consumers vastly prefer products that are ethically and sustainably sourced, with 73% saying they care about traceability and sustainability and 71% willing to pay a premium to ensure it, according to an IBM consumer preference study.

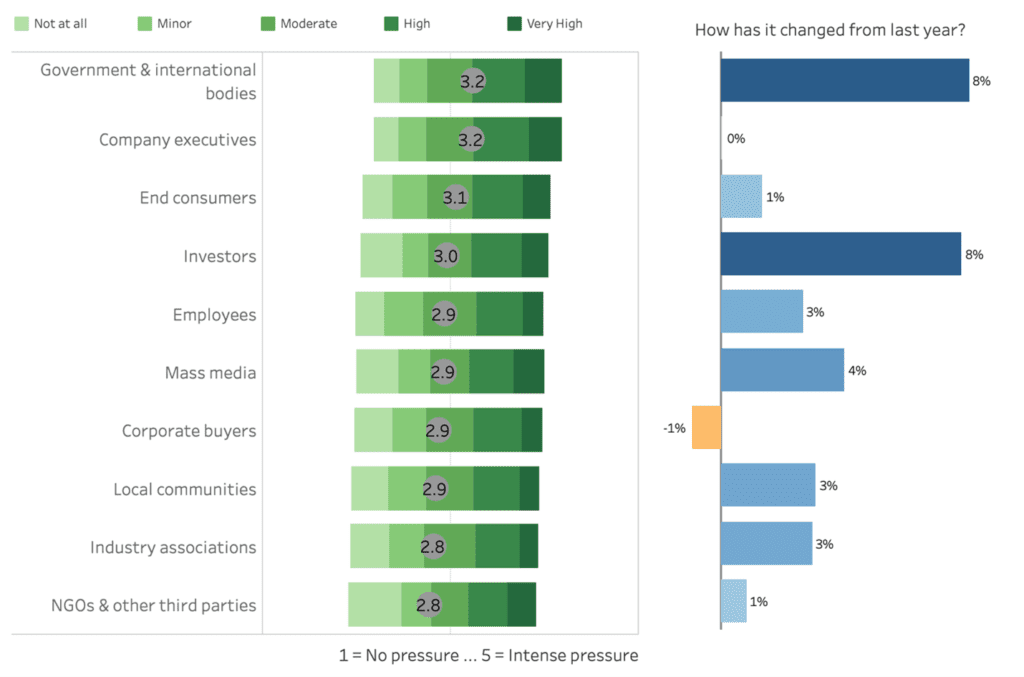

According to the State of Supply Chain Sustainability 2021 report from the MIT Center for Transportation and Logistics, the increased emphasis on supply chain sustainability since the beginning of Covid-19 is profound. In data drawn from 2,400 supply chain professionals based primarily in North America and Europe, a full 36% of respondents stated that their organizations’ commitments to supply chain sustainability have increased since the pandemic began. The report also notes the level of pressure on firms to increase supply chain sustainability is remarkably high and comes from many sources, as outlined in the following table:

Sources of Pressure to Increase Supply Chain Sustainability (Source: MIT Center for Transportation and Logistics, State of Supply Chain Sustainability 2021)

However, actual implementations are in nascent phases

As a global provider of cloud-based supply chain risk management, my organization (Avetta) conducted a recent study of 45 companies in a variety of industries, including facilities management, chemicals, construction, utilities, telecommunications, transport, manufacturing, and food and beverages. While they understand the importance of various ESG issues, some are understood extremely well: 79 percent consider employee health and wellness are “very important” (though we’d far prefer this to be 100 percent). But when the questioning turns into an understanding of the way these issues extend to the supply chain, the correlation is murky. For example, a priority of diversity and inclusion that might be considered “very important” as an organization may translate into the supply chain issues as only “slightly important” or even “not important.”

This indicates the understanding of the need for the integration of supply chain priorities into companies’ priorities as an organization has barely begun and, in some cases, the correlation is not yet understood (alarming in that as much as 90% of the company’s operation may actually be taking place within the supply chain instead of the parent organization).

The integration of supply chain into the corporate policies and procedures is in the early stages, but encouragingly, 24 percent report direct plans to make supply chain a part of their ESG programs. For those beginning integration, here are the steps they are taking:

- Setting internal targets that will inform our ESG supply chain integration (10 responses)

- Adjusting sourcing and procurement policies to align with the organization’s ESG policy (8 responses)

- Engaging with suppliers on improving ESG performance (14 responses)

- Joining industry/sector networks to support and develop supplier education and best practices programs (9 responses)

Most encouraging is that organizations are addressing and reporting on ESG issues according to metric-driven industry frameworks, with the UN Sustainable Development Goals topping the list, along with reporting through frameworks such as the Paris Agreement and Science-Based Targets that may be more prevalent in Europe and other non-U.S. locales.

The future is increasingly bright

Companies are launching incentives to improve ESG performance and are using ESG metrics as a factor in contracts and renumeration. In all, we see strong momentum in 2022 toward models that incentivize management to prioritize long-term improvement of supply chain sustainability over short-term profit maximization. And it is safe to say that regardless of region or political affiliations, this is a prioritization upon which all sides can agree.