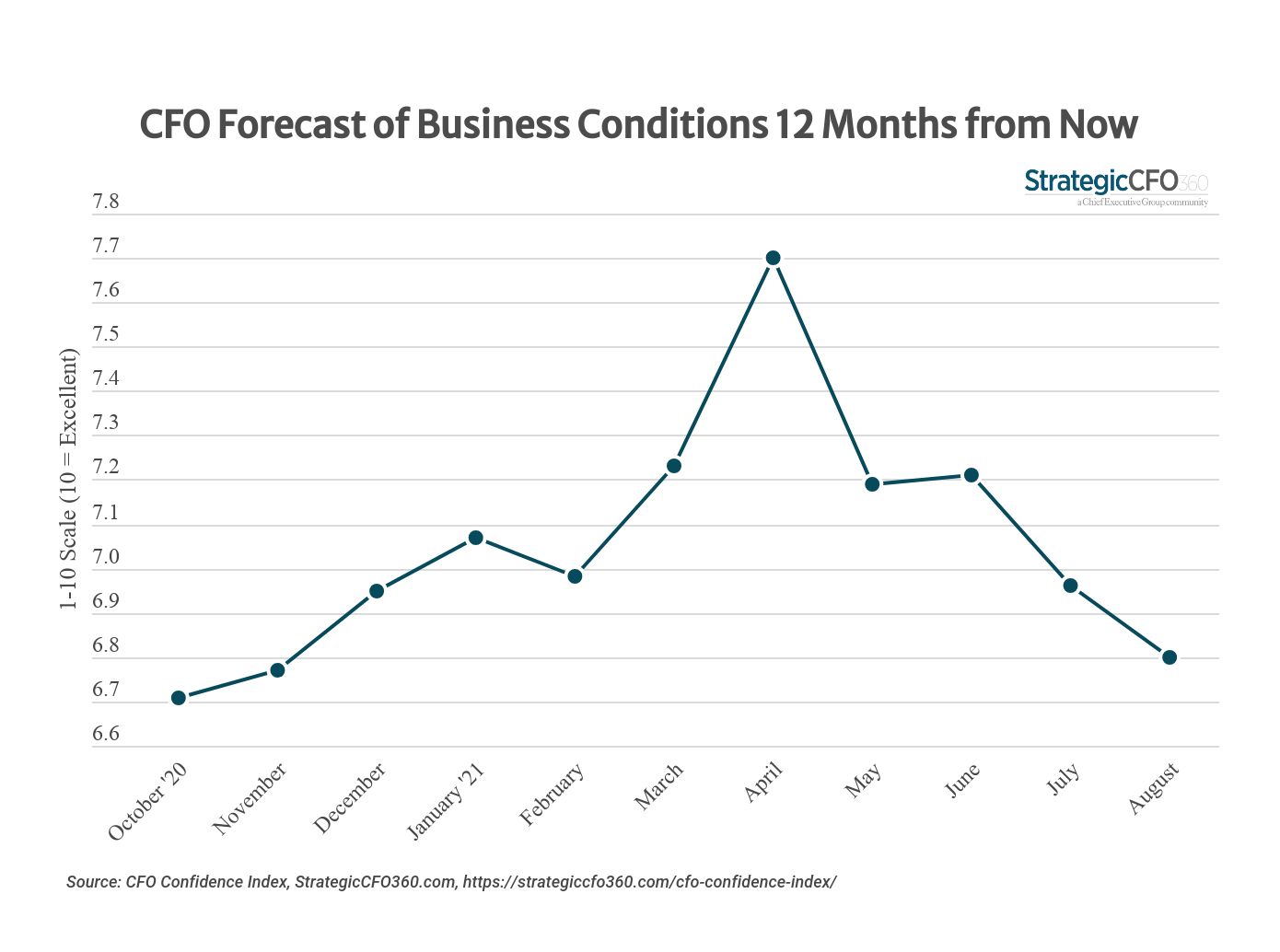

CFOs’ outlook for business over the next 12 months declined for the third consecutive month in August, shedding another 2 percent down to 6.8 out of 10 on our 10-point scale. That’s the lowest the CFO Confidence Index has been since November 2020, when volatility spiked due to uncertainty surrounding Covid vaccines and the U.S. presidential election. The leading indicator is now down 12 percent from its April high.

CFOs’ assessment of current conditions is also down, to 6.65/10 from 6.72 in July. Covid variants, supply chain issues, labor shortages and inflationary pressures are all cited as reasons for the declining confidence.

Those are the key findings from StrategicCFO360’s August reading of CFO confidence, conducted among 142 senior finance executives between August 23-26. America’s finance chiefs’ assessment of business conditions is now in line with that of CEOs, who also rated their outlook for business a 6.8 out of 10 when polled earlier this month.

CFOs are slightly more hopeful than CEOs, however, with 43 percent expecting conditions to have improved by this time next year. Only 34 percent of CEOs feel the same. The most optimistic of the C-Suite? CIOs, with 59 percent who forecasted improvements in the business environment over the next 12 months.

Vandana Kapur, CFO at the Indiana Chamber of Commerce, explains her optimism: “Consumers have purchasing power with the infusion of cash. [They’ve] been couped up at home due to the pandemic so they’re looking for an outlet. This leads to companies increasing pricing to meet demand and thus causing the outlook to be positive,” she says, giving future business conditions a rating of 9 out of 10.

Heather Morrison, finance director at Raleigh, NC-based Media Two Interactive, says she also expects conditions to improve—to a 7/10 by August 2022—but “turnaround will be slow and complicated by the ongoing health crisis,” she says, adding that the main challenge at this time is the labor market, finding “both available and willing talent.”

She is far from alone in that view. Many CFOs participating in our poll cited lack of skilled workers as one of the main challenges to their organization’s growth. Overall, 61 percent say they plan to add to their workforce over the coming year—although whether they will be able to find the talent they need remains uncertain, they say.

Issues with supply chains are also a concern for several CFOs, who say it is causing sales to slow.

“Clients are eager to spend capital to get large projects moving, however supply issues will likely check some of the demand, at least in the first half of 2022,” said a healthcare CFO at a midsize organization.

“Disposable income will support consumer spend while supply chain issues will create volatility and suboptimize total performance,” echoed the CFO of a large manufacturer in the Midwest.

CFOs across nearly all sectors said supply chain disruptions are impacting their outlook to varying degrees. When asked to rate the extent of the challenges these disruptions are posing for the business, CFOs gave them a 7 out of 10, with 24 percent saying they had invested much greater resources (50 percent+) in increasing resilience in their supply chain and reducing their exposure to this risk so far this year.

“We increased our inventories earlier this year when supply issues first started,” said the CFO of a medical device manufacturer on the issue.

Forecasting for the Year Ahead

The proportion of CFOs forecasting increases in revenues and profits fell in August, down 11 and 14 percent to 75 and 65 percent respectively, from 84 and 75 percent the month prior. These numbers are the lowest they’ve been all year—and since November 2020.

The proportion of CFOs forecasting increases in capital expenditures also decreased this month, down 10 percentage points to 51 percent from 61 percent in July.

One area where CFOs are planning for an increase is among employee ranks: 61 percent say they expect to increase hiring over the coming year, compared to 59 percent in July.

Sector & Size View

StrategicCFO360’s August reading of CFO confidence shows wide variations depending on sector. Financial Services CFOs, for instance, reported a 22 percent increase in optimism on the belief that current issues facing business will normalize over the short term, while their healthcare peers experienced a 26 percent decline, which they attribute to high levels of uncertainty on many fronts—but mainly with respect to Covid.

Real estate CFOs also reported a significant increase in their assessment of future conditions this month, +20 percent since July to 7.2 out of 10. They say they believe that by this time next year, “Covid will be gone.”

The lowest rating received this month (5.4/10) comes from pharma CFOs, who say inflation is a top concern along with labor shortages.

When looking at forecasts by company size (by annual revenues), sentiment is fairly flat across all groups this month, with larger company CFOs reporting greater confidence in future business conditions. They note, among other things, the stabilization of supply chain disruptions and a return to employment once government support programs expire as the main reasons for their optimism in the business environment one year from now.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index