After a near 7 percent drop in May brought on by inflation fears, CFO optimism clawed back 1.4 percent of the losses in June, on the back of strong domestic demand, the lifting of restrictions across industries and low interest rates. While other members of the C-Suite—and particularly CEOs—increasingly expect conditions to deteriorate over the coming months, three-quarters of CFOs polled continue to believe conditions will either improve or remain stable.

Those are the key findings from StrategicCFO360’s June reading of CFO confidence, conducted among 170 senior finance executives between June 21 and 24. America’s finance chiefs rated their confidence in the business environment 12 months from now a 7.3 out of 10, according to our 10-point scale—5 percent higher than the 6.9 out of 10 rating CEOs gave, when polled by our sister publication, Chief Executive, earlier this month.

These results find CFOs much more confident than CEOs; only 36 percent of CEOs are predicting conditions will improve by June 2022—and the same proportion of board members agreed with CEOs, when polled by our sister publication, Corporate Board Member, earlier this month. Despite CFOs’ enthusiasm, CHROs remain the most confident members of the C-Suite polled, with 49 percent predicting that conditions will continue to improve over the next 12 months.

CFOs also showed increased confidence in the current business environment this month, rating it a 7/10, up 6 percent since May. These findings show CFOs expect conditions to improve by 4 percent by this time next year. They report that consumer demand, the lifting of restrictions and the Fed’s decision to keep rates unchanged are supporting business growth.

Anwar Chaudhry, CFO of Destination Canada, a mid-size nonprofit company, rates current business conditions a 4/10 but forecasts they will improve to an 8/10 because “restrictions around border opening are reducing, travel and general trade are opening up.”

Another CFO of a mid-size healthcare company, who expects conditions to improve from 5/10 to 8/10 over the next 12 months, says, “The lessoning of Covid-19 impact on employers, allowing for the return of employees to their places of employment, will improve the environment. Improvements in the company’s products that were delayed by the pandemic will also have an impact.”

And while nearly half (46 percent) of CFOs surveyed believe that conditions will improve over the next year, that number represents a 16 percent drop from the month prior, when 55 percent predicted conditions would improve over the same period, indicating a potential shift in perspectives as things evolve. According to the poll, 30 percent now believe things are more likely to stay the same—up 36 percent month-over-month.

Of those expecting conditions to worsen, our surveys find 40 percent of directors, compared to 24 percent of CFOs and 33 percent of CEOs.

They all point to similar concerns over the trajectory of the economy: lack of skilled labor, supply chain issues, inflationary pressures and Washington’s business policies, which they forecast will lead to deteriorating conditions in the U.S. However, the more optimistic CFOs and CHROs point to a more normal recovery and further investments in labor and capital.

“We are dealing with what I call ‘fake Inflation,’ which basically amounts to price gouging post Covid-19,” says Brian Patterson, CFO of Robar, a mid-size construction company. “Recoveries of firms’ losses during the pandemic are being reflected in current prices, and they should and will normalize.”

“Higher interest rates and continuing issues with supply chains will tamp down additional economic growth. Offsetting that will be strong demand for housing and consumer goods,” says the CFO of a mid-size non-profit.

Forecasting for the Year Ahead

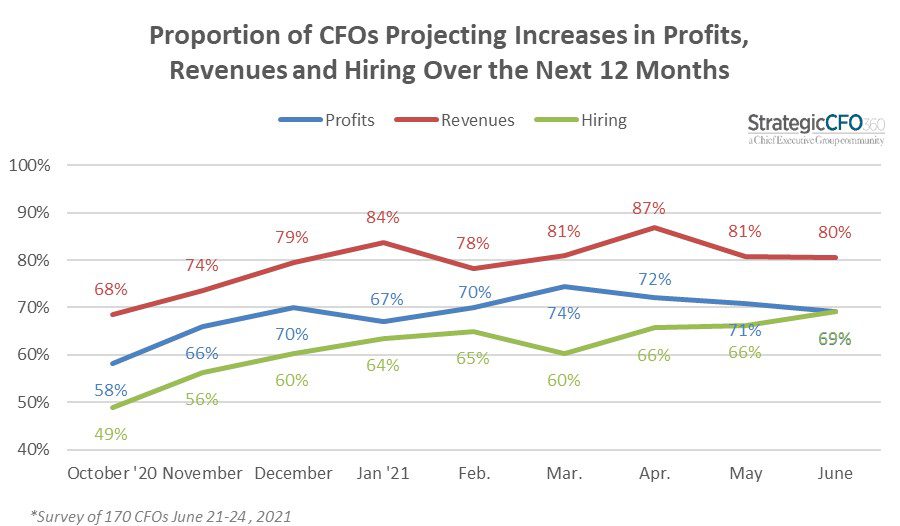

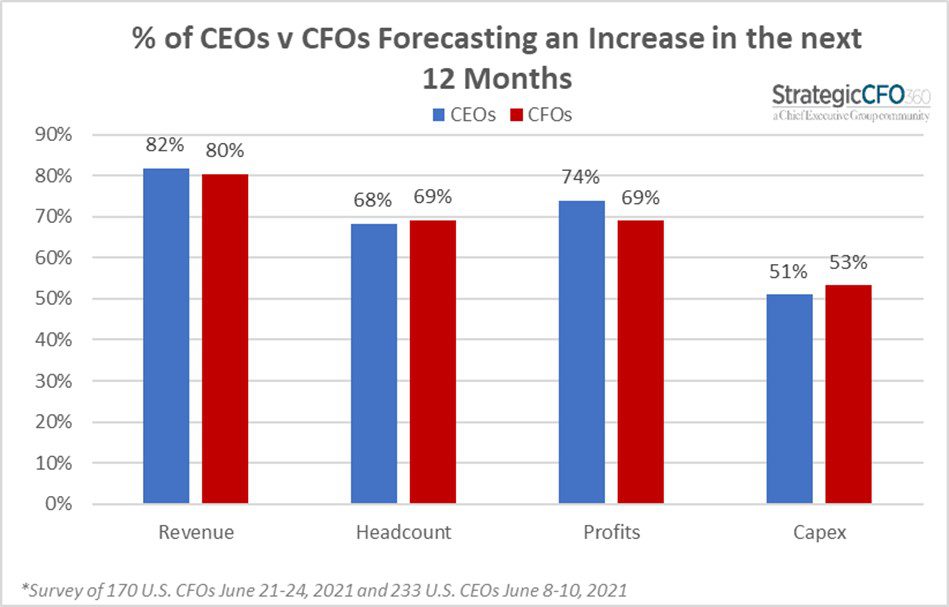

CFOs’ projections for increases in revenues and profits remained fairly steady in June: 80 percent of CFOs are forecasting increases in revenues and 69 percent expect an increase in profits—compared to 81 and 71 in May.

The proportion of CFOs forecasting increases in capital expenditures rose by 6 percent this month to 53 percent, after a 15 percent drop in May. It has now surpassed the proportion of CEOs expecting to increase capex, at 51 percent.

With immense growth across many sectors that were put on pause due to the pandemic, vaccine acceptance across the U.S. and unprecedented consumer spending, more CFOs plan to increase capital expenditures, despite their concerns over inflation.

A CFO from a mid-size financial services company based in Virginia plans to increase capital expenditures up to 10 percent. He says, “the availability of low-cost capital will result in increased investments in operations and resources, there’s lower unemployment and a more normalized return-to-work environment.”

Sector, Size & State

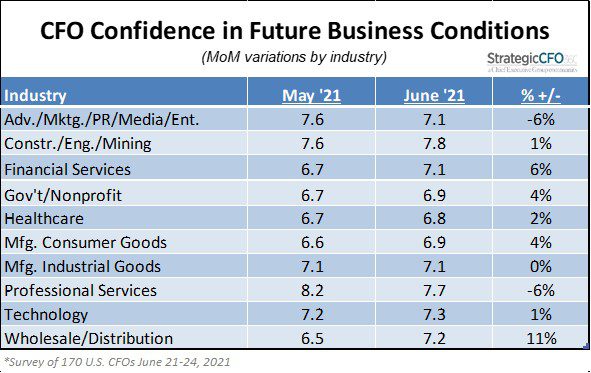

CFO confidence in future business conditions is up across almost all sectors, with the exception of advertising and professional services, where CFO confidence declined by 6 percent due to concerns over inflation, higher interest rates and increasing taxes.

The largest increase in confidence was among wholesale/distribution CFOs (+11 percent), which they attribute to the lifting of Covid restrictions and more people returning to work.

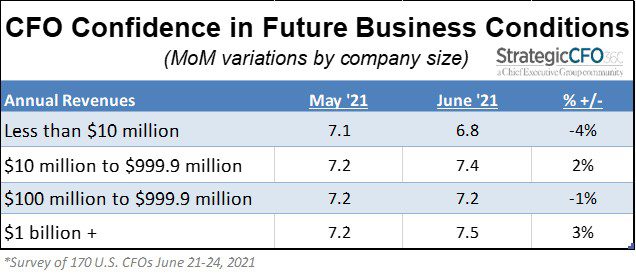

When looking at confidence by company size (by annual revenues), smaller company CFOs (less than $10 million) are the only ones whose outlook dimmed in June (-4 percent). They say the current administration’s policies are restricting small business growth.

“Proposed tax policy and continued spending habits will have an adverse impact on the entire U.S. economy,” says the CFO of a small financial company.

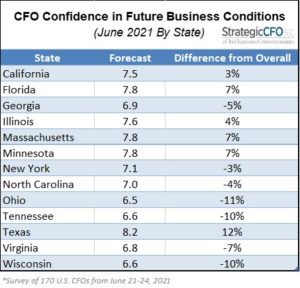

The most optimistic CFOs are in Texas, with a rating of future conditions at 8.2/10, 12 percent higher than the overall rating of 7.3.

“There is significant cash, at the consumer, corporate and investor side, sitting on the sideline waiting to be deployed. This should drive the economy for the next year,” says the CFO of a mid-size manufacturing company based in Texas.

CFOs in Ohio and Wisconsin rate their outlook the lowest, 10 percent below the overall rating of CFOs, on concerns over Democratic policies contracting business activity and continued supply change shortages making it difficult to catch up with demand both now and in the future.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index