In the wake of the U.S. election, American CFOs remain optimistic about the state of the economy in 2021 though they say much depends—as you’d expect—on the progress of the Covid pandemic. The findings also revealed greater confidence among CFOs than CEOs who we recently polled about the future of the economy a year from now, as well as the finances of the businesses they lead.

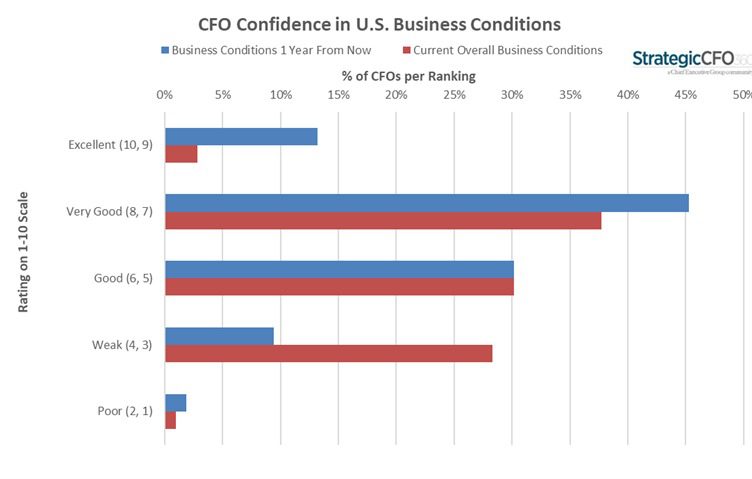

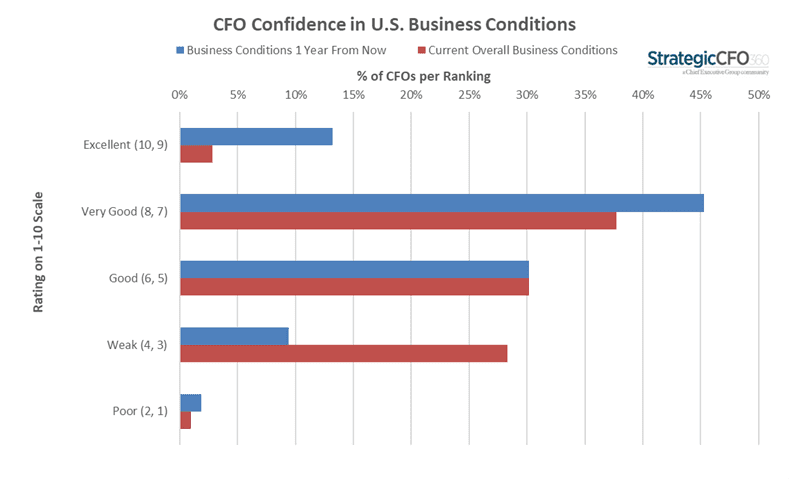

StrategicCFO360’s November reading of CFO confidence shows America’s finance chiefs remain hopeful business conditions in the U.S. are on track to improve over the coming months. Those polled expect the economy 12 months from now to rate a 6.8 out of 10—what we consider “very good”— on our 1-10 scale. That is 17 percent higher than their confidence in current conditions (5.8/10).

Contrast that with CEOs, who ranked business conditions 12 months out at 6.4 out of 10 in our most recent polling, down 6.4 percent this month from October. This is among the largest single-month declines of the past 5 years for the CEO Confidence Index, and the largest in 2020. The last time the Index declined by a similar margin in a single month was in December 2018, when CEOs feared the consequences of an intensifying trade war with China and the subsequent cooling of the economy. It had then dropped by 7.3 percent.

But while CEOs’ confidence in the future of the economy fell sharply in November on fears of increased taxes, regulations and renewed Covid lockdowns under President Joe Biden, the CFOs we polled said sustained growth in demand over the past few months and the likelihood of an effective and widely available vaccine becoming available in the near term are impetus for their cautious optimism.

Exchanger industries’ Mark el Baroudi says while the recent vaccine announcements bode well for demand in 2021, he is concerned about the long-term effect of the pandemic. “What we will likely find on the other side of this pandemic is an economy that is far more deeply scarred than we perhaps understand it to be today,” he said, adding that the stock market is also more likely to suffer a material correction. “The probability of a sufficiently ‘robust’ stimulus bill to bridge these two economic realities in a world in which the senate remains controlled by Republicans is increasingly unlikely.”

“There will be pent-up demand when we finally break out of the pandemic, but it will take time for American consumers who lost jobs and income to plug back in,” said the CFO of a global commercial construction/engineering company. “A second significant downturn within 2 decades could cause real long-term hesitancy to spend.”

“Covid still needs to be resolved; [the] president-elect and his party are not pro-business, but the economy is resilient and already showing signs of getting back to pre-Covid bullishness,” said the CFO of a small industrial manufacturing company in the Southeast. “That all washes out to lead me to conclude that it will be about the same a year from now as it is now.”

“There is uncertainty in the market right now with a new president and Covid, but in general we continue to operate in a market that is strong and has opportunities to increase revenues,” said the CFO of a large retail company in the Midwest.

Several of his peers echoed the idea that planning through political uncertainty is always very challenging, although some said it isn’t so much about who wins the election but the policies that get implemented.

“Who is in the White House does not matter,” said Frank Sonderer, CFO and CIO of RB Royal Industries, a “design-ufacturer” in Fond du Lac, Wisconsin. “What tax laws and environmental regulations Congress pass matters.”

“[I’m] more concerned about political unrest from propaganda wars than what party is actually in charge of the three branches,” said the CFO of a global tech company on the matter.

For Gary Pederson, corporate controller at global pre-fab home manufacturer Lindal Cedar Homes, however, “It is only the uncertainty of the election that impacted our business,” he said, adding that he expects there will be another round of stimulus that will help activity rebound significantly. “We expect to have a good year in 2021.”

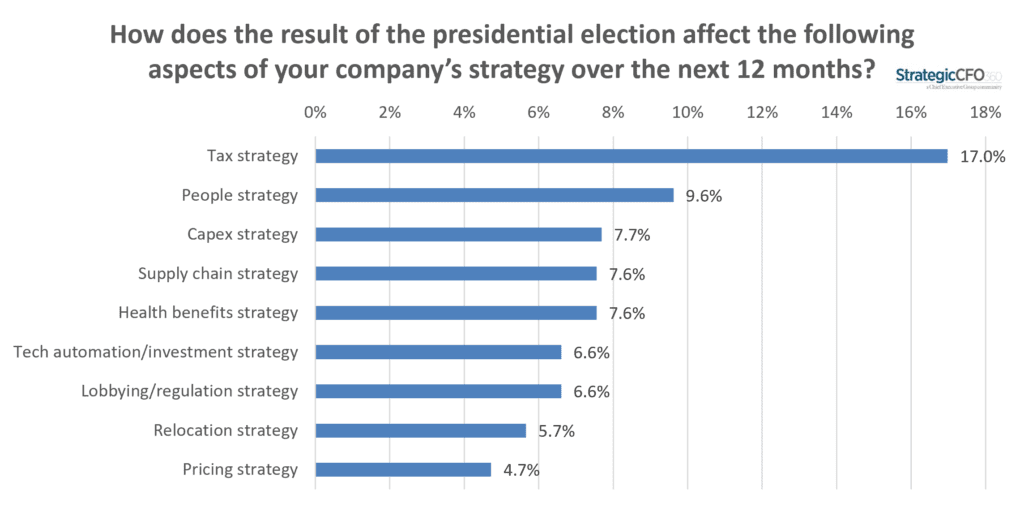

When asked about the impact they expect government to have on the different aspects of their strategy in 2021, CFOs overwhelmingly said their tax strategy would likely be most impacted—far ahead of any other aspects.

Forecasting for the Year Ahead

The CFOs participating in our poll agree, there remain several unknowns on the horizon, with many saying until there is more clarity as to the trajectory of the recovery and the policies a new administration could bring, they will proceed with caution before deploying excess capital into the business.

Forty percent said they are not planning on making any changes to their investment strategy over the next 12 months, and an increasing proportion said they are planning to increase cash and reduce debt, when compared to the prior month.

“We will continue to search for opportunities while minding expenses as tightly to revenues as possible,” said a CFO in the education sector, resounding the overall sentiment of the poll participants.

Looking at CFOs’ forecast for revenues, profits and hiring over the next 12 months, we found a greater number are anticipating increases across all three facets: 74 percent anticipate growing revenues (up 7 percent since our October survey), 66 percent are expecting increases in profits (up 13 percent from prior month), and 56 percent are forecasting increases in headcount (up 15 percent MoM).

These numbers are much higher than those reported by CEOs. In comparison, 64 percent of CEOs project growing revenues over the coming months, 54 percent expect increases in profits, and 47 percent forecast adding to their headcount by this time next year.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly pulse survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index