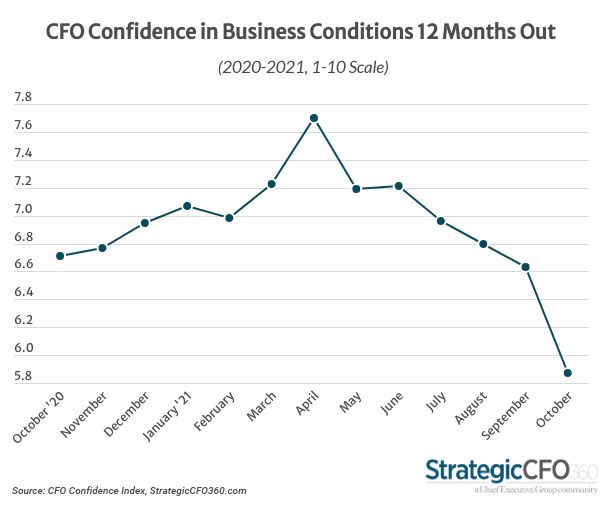

StrategicCFO360’s latest survey of confidence shows a significant drop in optimism among America’s finance chiefs. Our leading indicator, which forecasts business conditions a year out, is now down 11.5 percent since September, to 5.9 out of 10 on our 10-point scale, where 10 is “excellent.” CFOs’ assessment of current business conditions also fell considerably, down 7.3 percent to 6.1/10.

Those are the key findings from StrategicCFO360’s October reading of CFO confidence, conducted among 150 senior finance executives between October 18 and 21. While most members of the C-Suite reported waning confidence this month, CFOs’ optimism declined at a faster rate than the rest of their peers, including CEOs, whose optimism only slid 1.6 percent—and whose assessment of current conditions ticked up slightly when polled earlier this month.

Polled CFOs say their forecast is driven by labor shortages, supply chain disruptions and rising inflation that are now creating a roadblock to meeting growing demand. An increasing number of CFOs also voiced concerns over the current administration’s tax policies.

The proportion of CFOs who expect business conditions to improve over the next year has dropped to 33 percent in October—in line with CEOs. Instead, 45 percent forecast worsening conditions, the highest proportion on record.

Eric Price, CFO of Indiana-based retail trade company Shoe Sensation, rates current conditions a 4 out of 10—considered “weak” according to the scale points—and says he expects business conditions to continue deteriorating, to 2 out of 10 by this time in 2022 due to “continued disruption of the supply chain, higher interest rates, higher wages, too few workers, higher taxes and higher inflation,” he says. “I’ve noticed other businesses cutting back, which will lead to less consumer spending.”

His sentiment is echoed by many CFOs who list similar reasons for their declining ratings of the business environment. John Logan, CFO of an Oregon-based consumer goods company, says “supply chain delays and costs, including products, supplies and freight, are causing our projected costs to increase by almost 20%!” Like Price, he expects business conditions to decline from weak (4/10) today to poor (2/10) over the next 12 months.

Despite the growing number of forecasts calling for worsening conditions, many CFOs remain optimistic that the business landscape will have improved—or at least remain steady—by October 2022, although most share concerns over labor shortages and the state of the supply chain.

Joseph Kelley, COO & CFO at Phillips Lytle LLP, rates current conditions an 8 out of 10 (“very good”) and says he expects them to improve to a 9, with one caveat: “Our business was very good during the pandemic and has continued to grow. The one challenge will be the competition for talent,” he says.

“Strong consumer and business demand are partly causing the supply shortages, which will improve in time,” says the CFO of a tech company in New York. “But we are having trouble addressing difficulties in attracting and retaining talent.” He rates current conditions as “good,” or 6 out of 10, and expects them to improve to “very good”—8 out of 10—one year from now.

“Consumer demand is still strong,” echoes John Wille, CFO at Citizen Watch America, a wholesale/distribution company based in New York, who rates conditions as “good.” He nevertheless adds that because “supply chain disruption will impair the ability for business to improve far from where it is today,” he doesn’t expect much to change over the coming year.

Forecasting for the Year Ahead

The proportion of CFOs forecasting increases in profits and revenues over the next 12 months fell in October, by 28 and 15 percent respectively, to 47 and 66 percent—the lowest proportions on record.

The proportion planning to increase capital expenditures in the year ahead also declined, down seven percentage points to 51 percent—in line with CEOs. The same proportion (51 percent) expect to add to their headcount in the coming year, down 13 percent since September.

Our October reading shows that 20 percent more CFOs are now planning to increase debt, at 27 percent, while the proportion planning to increase cash is now down 24 percent month over month, to 36 percent.

Sector & Size View

CFO sentiment was down across most sectors in October, with the exception of energy, consumer manufacturing and tech CFOs, who forecasted improving conditions in 2022. Those in tech gained the most optimism (+5 percent) on the back of strong demand, sales pipelines and continued innovation.

At the other end of the scale, CFOs in healthcare and financial services lost the most confidence. Both sectors are down 25 percent, perhaps unsurprisingly considering the past 18 months.

Looking at confidence by company size (annual revenues), small company CFOs were the most optimistic this month, up 3 percent since September to 6.3 out of 10.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index