Ram Charan has a thing or two over most of today’s business leaders, and among them is this: He was advising CFOs and CEOs the last time that the economy hit the wall, nearly 15 years ago, and most of the current crop of corporate chiefs weren’t in major decision-making positions at that point. They have no roadmap for facing what’s ahead.

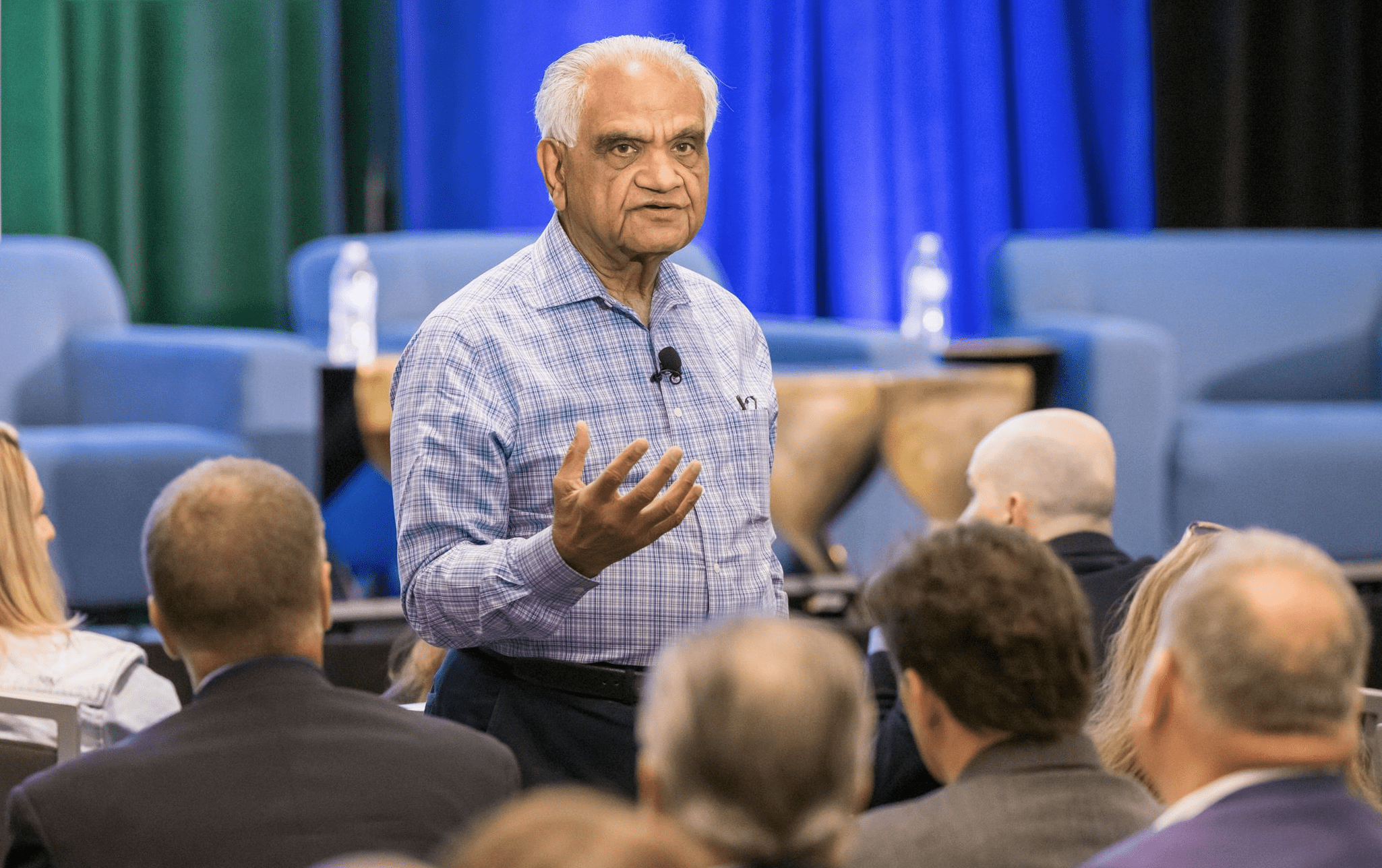

Relax—at least a little bit—was Charan’s message in a keynote at the CFO Leadership Council’s 12th Annual Leadership Conference. But it wasn’t an empty encouragement: Charan shared several specific strategic and tactical recommendations with the CFOs and other top finance executives who attended the annual gathering of Chief Executive Group’s CFO Leadership Council in Boston.

And Charan stressed why it is important for attendees to follow his advice in some form. “Each of you is a leader of your company,” he said. “Each of you is a leader in the finance function. And the finance function is crucial.”

Here’s the gist of Charan’s recommendations:

• Remember that cash is king. Manage your business “on the basis of cash, not on the basis of accounting,” Charan said, reminding his audience that Jeff Bezos built Amazon into a multi-billion-dollar company partly by putting cash on the throne of his operating philosophy.

“This is true not just during times of inflation, but all the time,” Charan said. “It’s always a good thing. And in the case of inflation, if you’re buying something for five dollars, its price now has increased, but it’s the same article. So for the price increase, you need more cash.”

• Beware cash traps. “Every single company has cash traps,” which Charan defined as places where cash is tied up but, if understood and accessed, can be loosened. Accounts receivable and inventories are the two areas of biggest concern.

“How many of you already are feeling that your customer isn’t paying you on time?” Charan asked. “That’s a cash trap. You have got to go after it, because if you continue to supply, and your payment used to be in 75 days — which is high, anyway — and [the customer] is stretching it to 180 days, you don’t have enough cash to do the future, and they’re using you to finance themselves.” He concluded: “Maybe you have to stop supplying some customers, or [at least] tell them you can’t afford 200 days” to payment.

In order to be more effective in this quest, Charan suggested, “Get your salespeople and accounting people with you and look at your customers. Who’s claiming they can’t pay. Some will be broke, but the rest do have cash. Are they giving you the priority? Go park yourself at their door. Show them how critical you are to them. It requires courage.”

Cash also tends to be tied up in inventories. “The psychology is, ‘I’d better order more because the price will increase,’” he said. “Get your purchasing person and your salespeople together to decide what is the right way to do this.”

• Make granular cash-flow forecasts. During tenuous times such as these, Charan suggested, “Make your cash-flow forecast month by month and week by week and, in some cases, day by day, and show it to all of your top team and to the second layer [of management] so they know what the data is, and what could be some problems, and they can tell you what they’re going to do.”

• Communicate—then communicate some more. Facing a difficult picture as may CFOs do these days, Charan said, it’s impossible to overcommunicate. “Pulling human beings together and getting them to see one another’s viewpoint is one of the most difficult things, but one of the most critical,” he said. “Whatever you are selling [while communicating], watch: Is the recipient getting it? There is no premium to conversation if the recipient doesn’t get it. Second: Does she agree, or not?

“Watch faces. Go slow, but connect. You are a leader of the company, in the center of information. Pull people together.”

Get people to discuss your forecasts. “Discussion deepens understanding,” he said. “Show the forecasts and say, ‘Here are our dilemmas: We’ve got a cash dilemma, or we’re not able to get price increases, or we’re not collecting receivables, or we’ve got too much inventory. Maybe manufacturing people aren’t obeying sales forecasts because they think they’re too optimistic.”

• Information must be inflation-adjusted. Finance chiefs must understand how much of price increases are simply making up for inflation. “Don’t say it’s ‘X’ number but inflation is involved in it,” Charan said. “Use your common sense.”

U.S. inflation is running at about 8%, but in Europe it’s about 9%. Many companies are increasing prices by multiples of those figures. “You’ve got to know that,” he said. He asked a leader of one company why it was increasing prices by 20%. “They said, ‘We’ll take it now and have a cushion.’ I said, ‘What about [dampening] volume?’ They said, ‘There may be some of that, but cash is more important.’ [And] maybe in six months they were going to do it again.”

• Find your pricing power. Most companies will increase prices three times or more this year, Charan said. In that environment, companies must “find your pricing power. If you are a chip supplier today, they’re willing to pay you any price. They may be dependent on you because you do your supply very reliably compared with the competition. Or, you may supply something that goes into a process they can’t change. That’s pricing power.”

• Do your research. Find out not just what your suppliers are doing with prices but what’s happening in the rest of your industry and the general economy, giving you a broad picture of the dynamics.

“Do Googling. Go to web sites. Look at companies’ announcements. That will give you early-warning signals. Then use your own common sense and say, ‘Who’s increasing prices though not in our industry?’ This phenomenon is across all industries. Therefore, you need to know.”

• Cull your lineups. Companies should be culling the long tails of their products, services and brands, and CFOs should be involved in those discussions. “CFOs have the data; you need to massage it, P&L and balance sheets, in ways that people can understand. Make it common-sensical.”

CFOs may want to guide their companies “to grow cash generation” instead of revenues per se. “That may mean fewer sales, cutting tails off — but they’re absorbing your cash. Take cash-absorbing products and services out.”

• Wield unit economics. It’s crucial to these discussions. “What is the unit price that can be easily understood? What is the gross margin on that? We’re not going to final costs — just gross margin, and gross margin that is inflation-adjusted. If that is shrinking, you’ve got a problem

“Even though you may not have high fixed costs that reduce the bottom line, if you don’t have gross margin, your bottom line is going to be affected. Look at fixed costs separately.”

• Be careful with capital. That’s especially true if you expect no growth for a while, Charan said. “Rethink your projects that use capital, such as building a plant.”

But capital allocations for digital transformation are the exception. “Don’t cut that,” Charan urged. “It isn’t inexpensive. But if you’re not connected to your customer digitally and aren’t using that data for decision-making, you’re falling behind.” And digital transformation need not be expensive or comprehensive to make it worthwhile to start.

• Don’t expect a reversal. Once inflation ratchets up prices, Charan said, “it never comes back down.” He expects inflation to rise by 18% to 22% overall during a three-year stretch. “Choose your own numbers, [but] look cumulatively and that will change your thinking in a very big way.