Today, CFOs have a critical role in enhancing the effectiveness of their companies’ strategic product management process. In our turbulent competitive world, in which whole industries can be bankrupted in a matter of months, this is a key differentiator between success and failure.

In the past Age of Mass Markets, which extended for most of the prior century, markets were relatively homogeneous, and both prices and cost serve were quite stable. In this period, product management was very tactical and operational, rather than strategic.

In the prior mass market era, product managers focused on what was called the Four Ps: product, price, place and promotion. Product differentiation was minimal, prices were relatively stable, product location (distribution) was typically as wide as possible, and product promotions were mostly broad and untargeted.

In this prior era, the core objective was to maximize revenues, as this brought economies of scale and lower costs—while lower costs, in turn, brought more revenues. For years, this virtuous cycle was the underlying profit engine of most companies. The Four Ps were well-suited for tuning a company to meet this objective.

Today’s Age of Diverse Markets has changed all this. Markets are increasingly heterogeneous and highly segmented, with both prices and cost to serve varying widely.

Amazon and the other digital giants are vacuuming up market share of small customers with arm’s length services in an information-rich environment. This digital giant encroachment is forcing incumbent companies to develop more-differentiated, higher-touch product-service packages that are both high-profit and defensible. This rapidly emerging high-end market is very fragmented, as customers seek customized product-service packages that increasingly address their unique and rapidly evolving needs.

What’s missing today is a Fifth P: profitability. Today, strategic product management, which positions a company into a unique, defensible, high-profit competitive position, makes all the difference between sustained success and rapid failure. The CFO has to be a central partner in this process, answering questions like:

- What is the most feasible competitive positioning that will produce sustained high profits and will be defensible against powerful competitors?

- Which products do we need to carry for our highest-profit customers, and how can we manage the customer/product curation process?

- How can we optimize the profitability of each customer’s product mix?

Competitive positioning

The CFO has an immensely important role to play in competitive positioning. Throughout this process, CFOs need to have a broad view of the positioning development process.

The primary objective of strategic product management is to position a company as central to its key customers’ future success. This requires investment criteria that are common in the incredibly successful digital innovation sector. Companies like Amazon, Microsoft and Apple will tolerate modest market failures if they enable the company to learn enough to develop the next generation of hugely profitable products like the iPhone.

In contrast, in the early days of telecommunications deregulation, one major company had a set of investment criteria that were extremely problematic. While every capital budgeting process requires calculations that show that the return on investments are adequate, the critical question is: what counts as returns?

This company provided telecommunications services to one of the nation’s largest, most sophisticated cities. Strong competitors were targeting the company’s Profit Peak accounts. The company’s financial managers decreed that investments in new facilities that prevented the erosion of revenues could not count in the return on investment calculations, because they could not be measured. Consequently, the company lost major sectors of its business.

In this way, the CFO’s capital budgeting process provides the financial infrastructure that can either accelerate strategic positioning progress, or act as a sea-anchor on profitable growth.

CFOs are critical in a second major aspect of competitive positioning. Once a CFO puts an appropriate capital budgeting process in place, the next step is to develop products that meet—or lead—the evolving needs of the target defensible high-profit customers. (After all, if you meet a customer’s needs you are a good supplier—but if you create products that meet critical customer needs that the customer did not even see yet, you are a strategic partner.)

The starting point in this process is for CFOs to develop a full, granular understanding of their respective company’s profit landscape. Enterprise Profit Management (EPM), which creates a full, all-in P&L for every transaction (every invoice line) provides this information in a few weeks. In our experience, this is the profit segmentation that almost always emerges:

- Profit Peak customers—typically about 20% of the customers generate 150% of a company’s profits;

- Profit Drain customers—typically about 30% of the customers erode about 50% of these profits; and

- Profit Desert customers—typically the remainder of the customers produce minimal profit but consume about 50% of a company’s resources.

We have seen this profit segmentation in all aspects (e.g., products, suppliers) of almost every company.

Effective CFOs develop and provide this essential information, which includes not only an identification of the Profit Peak customers, but also a detailed customer-by-customer profile of their product purchases. This laser-sharp customer targeting enables the strategic product managers to focus on the evolving product needs of this prime profit-generating segment—working directly with these customers to identify and meet their emerging product needs.

This focused strategic product development process creates decisive first-mover competitive advantages where they count the most, which would not have been possible had the process been targeting all customers, or all large customers. This precise targeting process, in turn, provides ample justification for the investment to discover and develop new products to meet these key customers’ emerging needs.

Customer/product curation

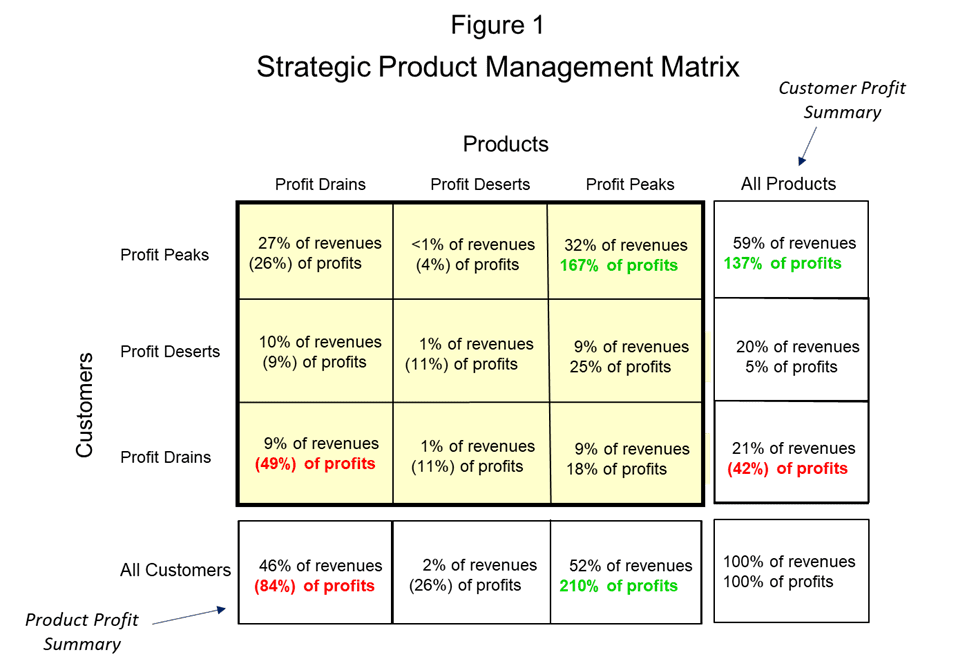

In a recent StrategicCFO360 article, we featured a profit early warning matrix in which the vertical axis showed customer profit segments, and the horizontal axis showed product profit segments. The nodes of the matrix showed the relevant performance statistics for each customer/product segment. The overall customer profit summary is shown in the column on the right side, while the overall product profit summary is shown in the row on the bottom.

Figure 1 shows this matrix, renamed here as the Strategic Product Management Matrix. It shows, for example, that when Profit Peak customers purchase Profit Peak products, they provide 32% of the company’s revenue, but 167% of its profit. In contrast, when the Profit Drain customers purchase Profit Drain products, they provide a mere 9% of the company’s revenue, but erode a whopping 49% of its profits. (Each matrix node can easily show the profitability of individual products purchased by specific customers.)

This CFO-developed matrix is critical for strategic product managers. It shows which products are critical for their target Profit Peak customers and which products each Profit Peak customer is purchasing. These products are clearly critical candidates for further development.

It also shows which Profit Drain products are primarily purchased by Profit Drain customers, and which of the numerous Profit Desert products are primarily purchased by the numerous Profit Desert customers. In most companies, these categories constitute the bulk of the product management costs, and they are potential candidates for elimination.

The Enterprise Profit Management profit landscape is typically produced every month, as the company’s financials are produced. This enables strategic product managers to discern just-emerging trends, and to track their progress in producing and selling products that their key customers want and need, while fueling this product development and sales process with funds harvested by eliminating the inventory of unproductive products.

This process enables CFOs to focus their investments on strategic products that position the company to achieve sustained, defensible profit growth, without the need for additional outside capital.

Manage customer product mix

The EPM profit information also shows strategic product managers the best practice product mix of their most profitable customers (controlling for customer industry, size and other factors). Because this profitability information can be produced for every customer—or, better, for every Profit Peak customer—the relevant account managers can develop game plans to rapidly improve the product mix profitability for their respective customers.

This process is the critical link between strategic product management objectives and actual customer purchases. It provides the day-to-day profit engine that produces a company’s sustainable profit growth.

Critical CFO role

CFOs are essential in every stage of strategic product management—from developing sound capital budgeting processes that fuel growth in a fiscally disciplined manner, to identifying the company’s Profit Peak customers and profiling their purchases, to enabling their product management counterparts to curate their customer/product matrix, to providing best practice product mix opportunities to every sales rep for each customer.

In this way, astute, proactive CFOs can shape and fuel a strategic product management process that propels their companies to a leading position in today’s turbulent ever-changing business world.