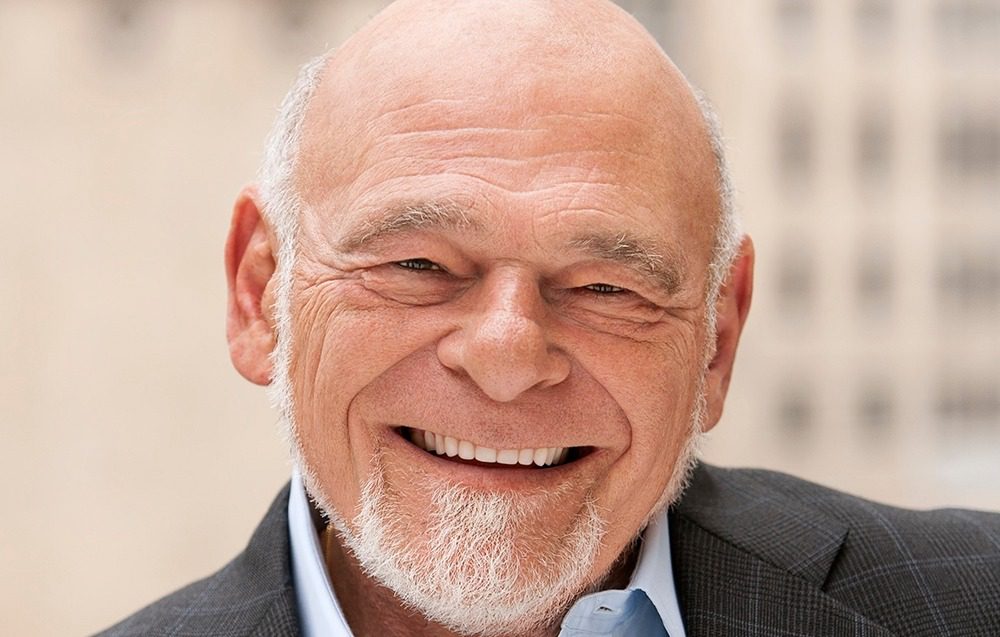

Sam Zell is something of a business oracle, so when the billionaire real-estate investor speaks, people tend to listen. They don’t always agree, but Zell always knows he’s been heard.

Sam Zell is something of a business oracle, so when the billionaire real-estate investor speaks, people tend to listen. They don’t always agree, but Zell always knows he’s been heard.

And lately, the chairman of Chicago-based Equity Group Investments has been one of the biggest exponents of the viewpoint that urban centers of business aren’t going to disappear post-Covid. Downtowns from Manhattan to Chicago’s Loop to San Francisco’s Financial District have been rocked by the pandemic and the scattering of people to remote work, for sure. But Zell’s repeatedly articulated opinion is that workers and residents will stream back into core cities as soon as they can.

“All of the conversation about a geographic re-set in terms of suburbs versus central business districts [CBDs] is highly over-speculated,” Zell recently told Chief Executive. “It’s kind of ridiculous.” He added, “As an urbanist and as an investor in CBDs, I think the attraction of CBDs and the 24×7 city isn’t going to change.”

Zell founded Equity Group Investments more than a half-century ago, was a pioneer in Real Estate Investment Trusts, and now heads Equity Group and two other REITs. Along the way, he has invested in many troubled real-estate assets as well as in other rocky companies, often turning them around, leading industry consolidations, and bringing companies to the public markets. Currently, his investments are in logistics, healthcare, manufacturing, energy and real estate.

So while Zell is transparent about his huge stake in the continuation of CBDs, he also makes a passionate case for them.

“Office buildings were created to encourage ideation and mutual stimulation to allow people to manage businesses with lots of people by assembling them close at hand,” Zell said. “I have many employees where, since COVID began, there’s less connectedness, though we all have Zoom. I’ve been a big encourager of people coming back to the office. Yes, some companies will have a smaller office footprint, but office space isn’t obsolete.”

Zell conceded that “the issue in Chicago,” New York and other cities “is going to be oversupply. That’s already becoming over-obvious. This will lead to the vacation” of major business addresses “but not abdication of office usage.”

The demographics of city denizens will change, Zell said. “The people who represent the core” of this group “have been coming and living in the city. Let’s say they’re 25 to 39 years old, because of the deferment of marriage and family formation. But they don’t have the same kind of connection to the city that previous generations had.”

Just several years ago, Zell was much more bullish about the future of the city, as he commented to the media about how young Americans were shunning the suburbs in favor of city life in what he told CNBC was a “re-urbanization of America.” “You’re drawing all the young people in America to these 24×7 cities,” he told the network in October, 2013.

One market clearly being boosted by Covid, Zell added, is industrial-distribution real estate. “We’ve seen tremendous growth in that,” he said, “and it’s probably the only area except single-family houses where we’ve seen more activity this year than last. And while NIMBY [not in my backyard] applies to mobile-home parks and high-density housing it doesn’t really apply to distribution, because that means jobs. Therefore the ease of creation of industrial and distribution properties is easy relative to other forms of real estate.”