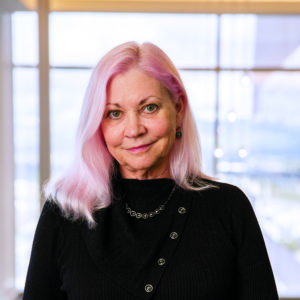

A computer programmer by training, Therese Tucker broke the tech sector’s gender barrier when she tapped her retirement savings to launch BlackLine in 2001. Fourteen years later, readying the finance and accounting automation software provider’s IPO, she looked for a CFO to partner with her in capitalizing on BlackLine’s early-mover status.

“I wanted a true strategic partner, someone who would bring reality to bear on the management team,” says Tucker, who stepped down as CEO on January 1, 2021.

She found the right fit in Mark Partin, who joined BlackLine in 2014, following four previous CFO stints beginning in 1997. “Therese didn’t want a CFO who would always say yes or always say no; she wanted a strategic partner who understood the business to identify and measure the risks of doing this or that,” says Partin. “She also wanted a CFO who had sales and marketing savvy beyond the financial chops to assist our growth strategy—because that’s a CEO’s primary focus. I had to care about what she cares about. We’ve been great partners.”

When seas are churning and the outlook is as clear as mud, CEOs need a strategic partner to guide the corporate ship to the destination. In a growing number of companies, this partner is the CFO. No other senior executive combines the skillsets needed to transform vision and strategy into actions and results.

“A strategic CFO can play a crucial role in a CEO’s ability to make more informed, insightful and assured decisions, particularly at times of great economic uncertainty,” says Sanjay Sehgal, partner and advisory head of markets at KPMG. “During the pandemic, CEOs who shared a strategic partnership with the CFO had someone they trusted to identify, interpret and monitor key business drivers, helping them to more fully grasp the situation and execute on strategy.”

To pull the pin on these near-term and mid-term decisions during the pandemic, strategic CFOs stress tested current plans against present reality, clarifying where to reposition capital from underperforming assets to cash-generating opportunities. In determining where to unlock capital, they drew from two singular talents—an ability to interpret the financial data and a profound knowledge of the business.

In turn, this gave them the pluck to advise the CEO on which direction the company needed to go and how it will get there. “In an environment where so many companies are fighting for survival, the CFO has been the only one in a position to help the CEO figure out what is doable and not doable and the degrees of freedom within these extremes,” says Tim Koller, a partner in McKinsey & Company’s strategy and corporate finance practice.

Benjamin Finzi, managing director and co-leader of Deloitte’s Chief Executive program, calls this type of CEO-CFO relationship a “dynamic duo—a partnership in the truest sense of that word.”

Chief Executive reached out to four dynamic duos to inquire how these senior leaders forged an alliance to profitably challenge the past year’s multifaceted crises. As Koller puts it, “This is not a matter of two executives sharing the limelight, but rather what happens behind the scenes between them to move the organization forward with greater certainty of success.”

When the Road Washes Out

Like other CEOs, when the pandemic struck in early 2020, Alan Trefler was astonished at the corporate carnage. “Although the impact on technology companies was comparatively softer than on other industry sectors, many tech firms were implementing hiring freezes and laying off people,” says Trefler, CEO at public company Pegasystems, a provider of cloud business process and customer management software solutions.

“Overnight, we had to respond to incredibly fast-moving events in an extremely uncertain environment ahead,” Trefler says. “In March and April, nobody knew where we were headed. I was extremely anxious. Ken was instrumental in helping me find the way.”

“Ken” is Ken Stillwell, Pegasystems’ CFO. “Part of my role is to help Alan either come up with ideas or get behind his ideas during times of immense pressures,” Stillwell says. “Other CEOs were making decisions I felt were very short-term focused. Alan was inclined to believe there were opportunities for us to take market share. But he wanted my input, given the capital risks this strategy entailed.”

To carve market inroads, Pegasystems needed an intact workforce, contrary to the decisions by some technology CEOs to reduce labor expenses and terminate jobs. “The uncertainties were so overwhelming that the most sensible thing would be to preserve cash, furloughing the staff,” Trefler concedes.

Stillwell, however, was reading the numbers on a daily basis and had other suggestions. “I applied the ‘Rule of 40’ to strike a balance between rapid growth and increased profitability, which typically are at odds with each other,” he says. “It suggested we had an opportunity to grow, supporting Alan’s inclinations that this was a rare opportunity to seize market momentum.”

The Rule of 40 is a high-level, objective gauge of performance used in the SaaS (Software-as-a-Service) sector. The analysis suggests that at scale, a company’s revenue growth rate plus profitability margins should equal or exceed 40 percent.

“As competitors lost customers and terminated jobs, we kept everyone here employed,” Trefler says. “They helped us build our customer base, generating a 20 percent growth increase in annual contract value—three quarters in a row. Looking back, Ken diligently worked through the challenges and the possibilities, assuring me the strategy was sound.”

Seeing Beyond the Visible

Now Optics, one of the fastest-growing retail optical chains in the U.S., closed 70 of its 181 company-owned and franchise stores in April. Although local governments deemed Now Optics an essential business, many customers stayed home, fearful of the Covid-19 contagion risk. The company was prepared for this possibility. Two months earlier, Now Optics’ CEO Daniel Stanton and CFO Bill Aurilio drafted a road map to navigate what they expected to be an arduous journey ahead.

“Bill has always been an operations-focused finance and accounting professional with a very analytic point of view,” says Stanton. “Complicated decisions needed to be made, and he was right by my side helping me make them.”

Aurilio was appointed CFO at Now Optics in 2011, although he and Stanton previously worked together at another retail optical chain in 2003, three years before Stanton founded Now Optics. The company grew slowly from a handful of stores owned by a family office to a large and innovative industry competitor. Two years ago, Now Optics unveiled the industry’s first proprietary telehealth software solution, giving customers the option to receive a remote eye examination provided by an off-premises optometrist.

Like other telehealth offerings at the time, remote exams made up a small proportion of overall eyeglass prescriptions. The pandemic spurred an extraordinary uptick, giving Aurilio the data needed to design a store-level earnings model addressing each store’s revenue challenges.

“Obviously, if your revenue faucet is about to shut off, your immediate concern is cash to run the business,” Aurilio says. “We needed to create a vision of earnings in a very short period. I went into cash-planning mode, working through the various ways to preserve cash and find opportunities to raise money, if necessary.”

These deliberations guided Stanton in the company’s store-closing strategy. “Bill’s analysis suggested we needed to close the 70 stores that didn’t have the telehealth option, furloughing these employees for the time being to preserve cash,” Stanton says. “He then redirected the capital towards advertising the telehealth opportunity in the stores that had remote exams.”

The strategy paid off. Many competing optical chains without the telehealth opportunity experienced a sharp decline in customers and were forced to close during the early months of the pandemic. In these market regions, Now Optics stores remained open.

“Customers felt comfortable coming in for an exam and leaving with a new pair of eyeglasses,” says Aurilio. “Comparable year-over-year sales growth in the stores with the telehealth option shot up 50 percent in May and June, giving us the confidence to allocate capital towards adding another 40 store locations with the telehealth feature in 2021.”

“You don’t survive a pandemic without a strategic CFO to analyze and interpret the financial data for you,” says Stanton. “Bill put the spotlight on where we could generate revenue and enabled the operations team to perform as lean as possible, optimizing our profits.”

Pulling the Pieces Together

There are two different types of CFOs, says John Driscoll, CEO of CareCentrix, a leading provider of home nursing care to more than 26 million people at 8,000 post-acute care settings nationally. “Some CFOs are good at understanding the business and others excel at managing finance,” he says. “I’m fortunate to have a CFO that pulls together both skill sets.”

The combination of talents has proven crucial at CareCentrix. In 2017, Driscoll sought to transform the business from a transaction payment model based on the cost of each patient’s care to a riskier subscription-based, recurring revenue payment model, in which aggregate care costs could exceed total monthly revenue. The task of analyzing the risk-reward ratio fell to CFO Steve Horowitz.

“I needed Steve to balance the positive cash flow of a recurring revenue model with the execution and talent risks,” Driscoll says. “Fortunately, he has both the financial and operational chops to figure out how we could go from a per transaction pay spread to a monthly member spend and budget. It was super important we get this right. Not every stakeholder agreed with the strategy, given the risk of getting it wrong.”

“The risk with subscription-like contracts is less income upfront due to competitive pricing,” Horowitz says. “You’re betting on sales to grow over time. What John had in mind, however, was to push the organization to provide better health care, as opposed to improving a particular metric by three or five percent. He wanted the business to be the best it could be. Operationally, it was a great strategy, one that would enhance our brand reputation.”

“Steve got the fact that we couldn’t stay in the safety zone we’d been stuck in for 23 years,” says Driscoll. “We had to break the habit of transactions. A SaaS-like model puts the focus on the customer experience. The more customers like what they receive, the greater their retention.”

The decision turned out to be extremely fortuitous. According to the Subscription Economy Index, revenues for subscription businesses increased during the first half of 2020 at a 12 percent clip, compared with a 10 percent decline in sales for S&P 500 companies overall. “There’s no question what we did is not for the faint of heart, but it fundamentally improved our strategic position in the marketplace and our profitability,” Horowitz says.

Like a quarterback with a stalwart receiver, Driscoll chalks up the success to Horowitz running the ball through the goalposts. “I couldn’t have executed on the strategy without a CFO who not only interpreted the numbers but also understood the business.”

Capitalizing on Finance Transformation

At BlackLine, the close partnership between Tucker and Partin has helped the company regularly exceed analyst growth estimates, contributing to a more than four-fold rise in its stock price. Closeness, however does not imply a lack of intellectual tension between the partners.

“Mark has never been and will never be a ‘yes man,’” Tucker says. “There were times when he annoyed the daylights out of me, frustrating and angering me, as I’m sure I did with him. Just the other day, he described himself as ‘the thorn in my side.’ But the good thing about conflict is that it’s constructive—you arrive at a better place because of the dialogue. We absolutely trust and respect each other’s areas of expertise, which are different.”

Asked for an example of where Partin made a difference, Tucker points to the road map he drafted to guide BlackLine through the pandemic. “Mark put together three scenario plans,” she says. “The one we chose called for us to continue to invest in R&D and our planned initiatives, at a time when other tech providers were cutting back. He saw an opportunity for us to capitalize on ‘finance transformation’ as a mission critical goal for CFOs.”

Partin explains, “Many CFOs were struggling to close the books on an entirely remote and virtual basis using manual accounting processes. Consequently, they also struggled to put together a forecast. It was an opportune time for us to say, `we can help.’”

Help was sorely needed. More than 50 percent of companies in the S&P 500 either withdrew or reduced their earnings guidance at mid-year. Those able to provide an outlook cobbled together several forecasts, each one postulating a different long-term recovery scenario.

To seize the opportunity, Partin allocated capital augmenting the sales and marketing organizations instead of pulling back to preserve cash. He earmarked additional funding to R&D to expand BlackLine’s product line and enhance existing product features. He also invested capital in adjacent software plays, acquiring Rimilia, a leader in accounts receivable automation solutions, in October.

These calculated gambles paid off. BlackLine’s third-quarter revenues increased 21 percent compared to third quarter 2019 figures, a sizable leap for a company not considered by local governments as an essential business. “The roadmap Mark drafted at the outset of the pandemic fell right into place during the crisis,” Tucker says. “Our demand environment continued to steadily improve.”

More than a Partnership

Each of these CEO-CFO pairs have one other thing going for them besides complementary skillsets—friendship. “A personal connection is extremely important in my work with John,” says Horowitz, who has partnered with Driscoll for more than 14 years at two health care companies. “To build trust in a person’s values, you need to talk about more than just business.”

Stanton says he and Aurilio “like to create an environment that is collaborative and fun as we come up with strategies to improve the business. We’re not always in agreement, but that’s a good thing. It helps that Bill is charismatic and very likable.”

Hearing this, Aurilio laughed. “Dan is not the type of CEO that’s afraid to hear disagreement,” the CFO says. “He always welcomes disagreement because the evolution of thought comes from constructive debate.”

Pegasystems’ CEO and CFO text and phone each other continually throughout the day. “We enjoy a very informal relationship,” Trefler says. “We don’t wait for the next meeting. It’s always, ‘You got a minute?’”

Tucker’s and Partin’s closeness led the two of them in late-August to successfully climb to the summit of California’s Mount Whitney, elevation 14,505 feet. Three other people, including Partin’s teenage daughter, joined them.

“We trained for weeks,” says Tucker. “I’m not an athlete, but Mark is in ridiculous shape. He wore shorts and Tevas—no hiking shoes! I’m huffing and puffing, but I did it. We did it!” Few words better describe the essence of a strategic partnership.