From employee safety to work-from-home pivots, Covid-19 has transformed huge swaths of the way American business does business. But it has also vastly increased the personal involvement of chief executives in decision-making—especially when it comes to controlling the purse strings.

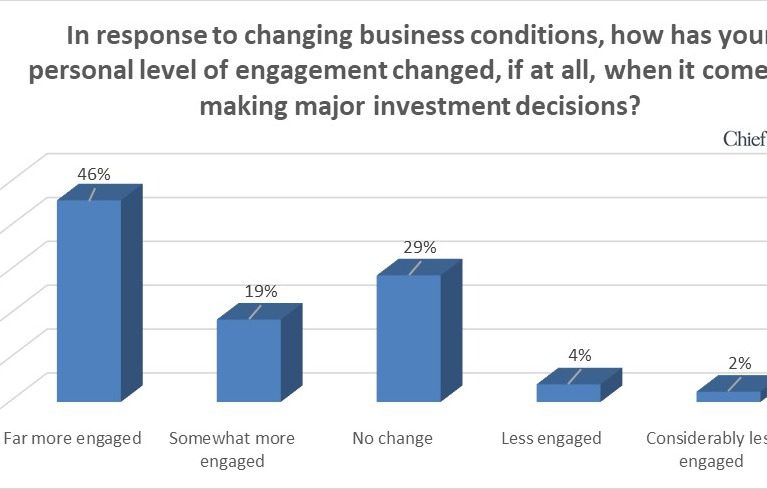

In May, we asked 300+ CEOs how the virus changed their behavior when it came to company spending decisions. Two-thirds (65 percent) say that changing business conditions have prompted them to be more personally engaged than ever when it comes to making major investment decisions—nearly half of which (46 percent) say they are “far more” engaged than before.

It appears that the larger the company, the more involved the CEO: 88 percent of CEOs at companies with more than $1 billion in annual revenues say they are more involved in major investment decisions than they were before—63 percent of whom qualify their involvement as “far more” than in previous years. When comparing all size groups, they are by far the most involved.

More than four out of five CEOs say that business chiefs should be involved in all meaningful investment decisions.

Half of those polled also say they believe their degree of involvement has changed because investments today carry greater risk (financial, customer relationships, reputation, etc.). What’s more, for larger companies ($1 billion +), there’s also greater scrutiny about investments from board members and other stakeholders, according to 67 percent of polled CEOs within that peer group.

“Our organization has gotten flatter, requiring me to be more involved in various decisions; but that has paid big dividends,” says Scott H. Rasplicka, CEO of Memphis-based construction company Delta Metals.

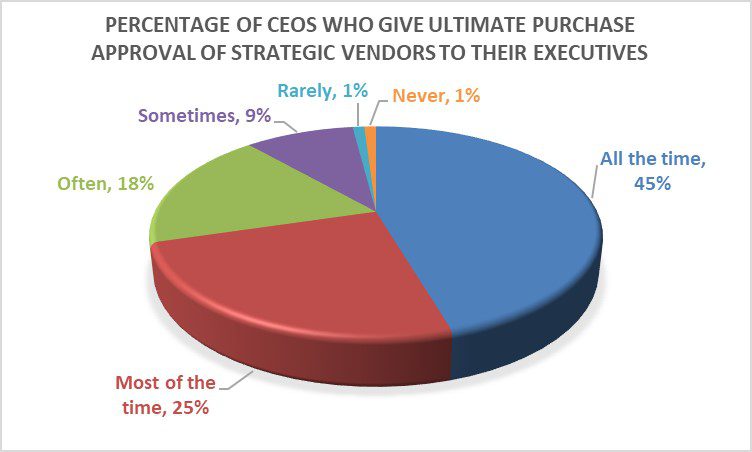

Still, some 70 percent of CEOs say that while their executives have the mandate to interact with the key strategic vendors that impact their respective areas, they nevertheless come to them for the ultimate purchase approval for major investments.

“The buck truly stops with CEOs, so choose to get involved in strategic decisions early,” advises Tom Kulikowski, president and CEO of Penco Products, a midsize industrial manufacturer in the southeast.

Joe Mirachi, president and CEO of Launch Federal Credit Union, agrees and recommends optimizing the CEO’s time by being selective about the vendors he/she interacts with. “Pick the handful of key vendors and strategic partners to be closely engaged with by meeting their CEO or senior management. Dedicate the relationship with the others to the business units,” he says.

Where is the most CEO attention focused? Among those we polled, they are more involved in IT, finance-related investments and facilities/site locations than other areas.

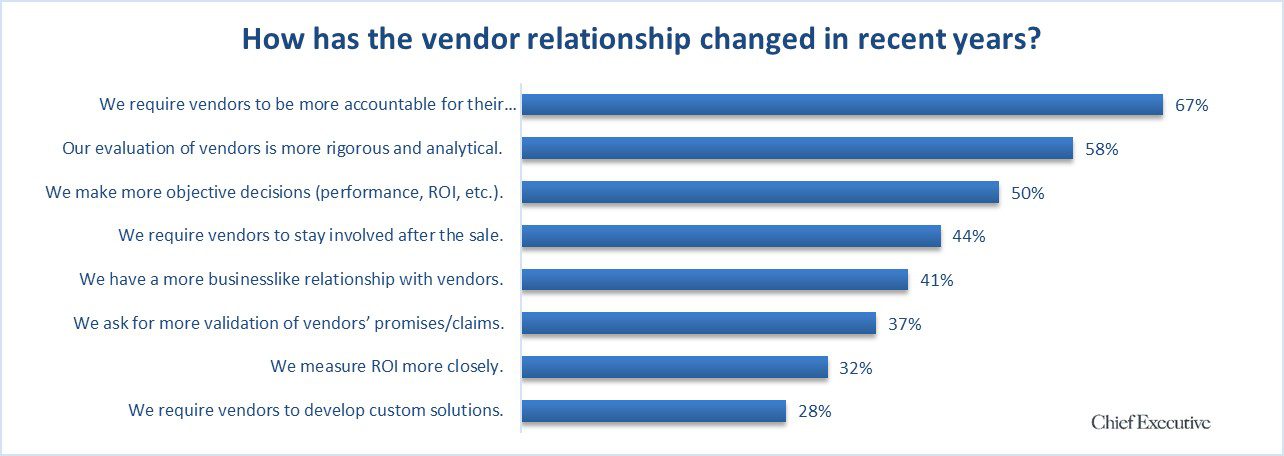

And when making a final decision, CEOs say they are looking increasingly at accountability. More than 3 out of 5 CEOs polled say they require vendors to be more accountable for their performance and promises, and 58 percent say their evaluation of vendors has become more rigorous and analytical.

As a result, 84 percent say they are willing to consider higher priced vendors if they can demonstrate a greater ROI.