America’s finance chiefs are increasingly optimistic in their outlook for the economy—and the finances of their own firms—over the next twelve months, predicting a strong rebound from the recession triggered by the Covid-19 pandemic.

But those hopes hinge on a number of factors that may or may not play out as hoped.

Those are the key findings from StrategicCFO360.com’s inaugural StrategicCFO Confidence Index survey of 317 CFOs, conducted October 19-20. The new monthly poll measures CFOs’ outlook for business conditions in the U.S., as well as their forecast for their company’s growth amid those conditions. StrategicCFO360 is the latest leadership community developed by Chief Executive Group, longtime publishers of Chief Executive magazine and the well-known CEO Confidence Index, the largest monthly poll of chief executives in America.

Leadership, Not Numbers. Sign up for the New, Weekly StrategicCFO Newsletter >

CFOs said their optimism was mainly driven by growing demand and consumer spending. Many say they are experiencing backlogs of orders and customers returning with pent-up demand. But while participants rated current business conditions at 5.8 out of 10, those polled said they expected conditions 12 months from now would be far better—6.7 out of 10.

Those findings were in line with expectations from CEOs we polled in early October, who also rated their outlook on the current economy at 5.8 and expected conditions a year from now to rate 6.9 on our 1-10 scale.

“We currently have more business than we can accommodate,” says John MacDonald, CFO of VNA Community Healthcare, a home healthcare agency based in Guilford, CT.

“While Covid may still impact life, shopping brings a sense of normalcy,” says Jeff Jones, CFO of western and casual footwear company Twisted X. “Less travel, less eating out and more money to spend at retail.”

Nevertheless, CFOs say this positive forecast is predicated on a full recovery from Covid-19, with a vaccine or effective treatment made available in early 2021 to allow for all sectors to return to full operations—particularly with respect to the hospitality, travel and entertainment industries.

Tim Sether CFO EVP of OIA Global, a global logistics, packaging and material sourcing provider headquartered in Portland, Oregon, says his “very good” 8 out 10 rating of the economy 12 months from now is based on “recovery for businesses most impacted by Covid-19 and confidence that many businesses will have adapted to the ‘new’ normal and the digital e-commerce reality that has been accelerated in the pandemic,” he says.

Recovery across hard-hit sectors is something Kevin Lavan, CFO of Autoclear LLC, a provider of security x-ray machines to America’s parks and attractions, is also hoping for: “For my business, schools and government buildings are our primary customers. We will need things to fully return to normal for our business prospects to be good,” he says, rating his outlook for fall 2021 a more modest 5 out of 10.

“We are in the live events business. When we consider the logistics associated with actually distributing a vaccine (which seems likely in Q1), we do not expect people to actually be congregating in groups until (at the earliest) the end of next year,” says Karen Stern, CFO at The T1 Agency, an integrated-experience agency based in Toronto, Canada.

The amount of uncertainty—beyond Covid—from election results and future financial stimulus/aid programs to unemployment rates and changing consumer behaviors is contributing to cautious corporate behavior.

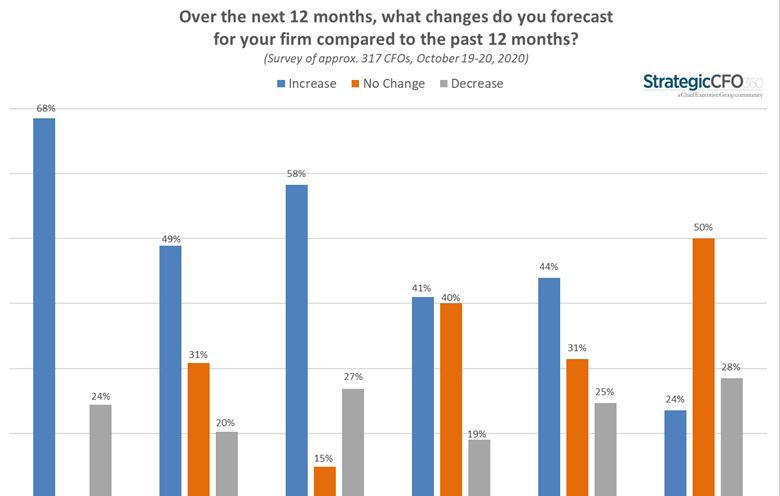

While 68% of those polled forecast growth in revenues and 58% expect the same for their profits over the next 12 months, nearly half expect to increase cash and cash equivalents over that same period, and 40% say they are not planning to increase their capital expenditures.

“With interest rates so low, it is difficult to know where to invest one’s excess cash in the short term, other than at the FRB,” said the CFO of a mid-sized financial services company in the Southwest, who predicts loan losses will begin to peak in the fourth quarter of 2020 through the first quarter of 2021. “Higher terms/maturities do not justify the nominal yields one receives, which in turn creates interest rate risk.”

Of those planning to increase or shift their investments, however, CFOs say their focus is likely to be toward digitization and Cloud initiatives (53%), followed by cybersecurity (47%) and financial automation (40%).

Sector/Size

When looking at confidence levels by industry, Travel & Leisure and Energy CFOs have the lowest levels of confidence in the current environment—rating it 3.5 and 3.8 out of 10, respectively, considered “weak” on our 1-10 scale.

But Travel & Leisure CFOs expect recovery in their sector by fall 2021, rating their confidence in next year’s economy at 6.6/10, which is 89% higher than their take on the current situation. “Time to recapture lost revenue and get back to the business levels. Consumer habits have change,” explains the finance director of an upper-middle-market company in the industry.

At the other end of the spectrum are Transportation CFOs, whose outlook for conditions 12 years from now are 12% lower than their confidence in the current economy. “Prolonged stress on the restaurant, travel, hospitality, commercial real estate and energy sectors leading to increased bankruptcies and unemployment,” one CFO in the sector told StrategicCFO360. “Ultimately, this is likely to be a drag on demand across sectors that will take some time to rebound from once a full reopen is in place.”

When looking at the results from a company size perspective (by annual revenues), smaller companies are showing more optimism about the business environment 12 months from now than their larger counterparts—as well as the largest boost in confidence across all size groups (+19%).

“Customers are pushing orders out, whether due to Covid-19 or cash flow is unknown. We are starting to see a little improvement and are hopeful this will continue into next year,” explains the CFO of a small company in the industrial manufacturing space.

“Covid is a blip,” says another industrial manufacturer CFO participating in our poll. “Once it’s resolved, the V-shape dip will be complete, and we’ll be back to a roaring economy, assuming there aren’t significant changes politically that would hinder business growth.”

About the CFO Confidence Index

The CFO Confidence Index is a new monthly pulse survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index