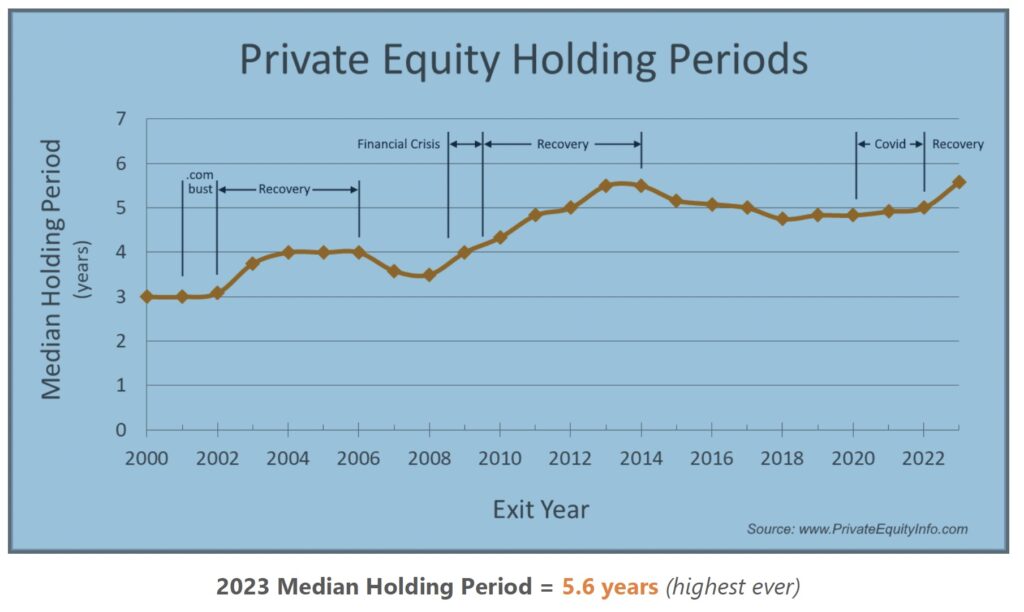

The median holding period for PE-backed portfolio companies is now 5.6 years, the highest value since we started tracking this metric in 2000.

Trends in portfolio holding periods across 23 years and three major economic downturns provide valuable insights for the M&A industry.

• Macroeconomic shocks create a three-phase cycle for portfolio company holdings: Crisis, Recovery, Digestion.

• Portfolio companies acquired just prior to Covid are entering the Recovery phase, resulting in the recent uptick in holding periods.

• Recovery from major economic downturns requires 4–6 years for the PE industry collectively but varies greatly across individual portfolio companies.

Historical Cycles

The Dot-Com Bust (2001 – 2002) had a sudden impact on PE portfolio holding periods, which ramped up steeply in 2003, leveled off for four years of recovery, then trended back down in a digestion phase.

The Great Recession (2008 – 2010) had a more significant and longer-term impact. The holding period peaked during the recovery phase to 5.5 years in 2014, representing the acquisitions made in mid-2008 just before the recession, likely at peak valuations. These ill-timed acquisitions required longer holding periods to realize a return. The holding period then trended back down in a digestion phase through 2018.

The economic impact from the Covid shutdowns is first seen in the 2023 holding period data, the beginning of the recovery phase. Once again, the holding periods have taken a sharp upturn.

All three macro-economic shocks forced PE firms that acquired portfolio companies at high valuations just before a crash to hold longer than originally expected.

Cause & Effect

PE holding periods are the result of an external cause. That is, changes in the median holding period are a lagging indicator and not a predictor of future causes, with two interesting caveats:

Valuation Fragility

A decline in holding periods during better economic times is positively correlated with increased valuations. Consequently, there’s potential fragility in the required future holding duration for acquisitions made during seasons of low holding periods. Acquisitions at higher valuations are less stable to subsequent economic shocks. So, while holding periods are a lagging indicator, a shorter median holding duration might indicate valuations are peaking. Seasons with short median holding periods might be a clue to exercise caution with large platform acquisitions.

Future Expectations

Although the holding period is a lagging indicator, we now know the likely impact of future economic shocks. Generally, we should expect:

Recovery time for the PE industry to be 4-6 years, during which there will be a slower-than-normal pace of exits. This impacts the entire M&A ecosystem.

Median portfolio age will likely increase 1.0-1.5 years. This is the “median” impact. The implications for specific portfolio companies varies widely, depending on the industry and the acquisition date relative to economic shocks:

For portfolio companies acquired at peak valuations, just before an economic shock, the holding period for that specific portfolio company might increase an additional 3-5 years, stretching the holding period on that investment to 8-10 years, a significant shift in expectations for the fund.

For portfolio companies acquired years before an economic shock at more conservative valuations, the holding period might stretch a more manageable 12-18 months.

Going Forward

We expect the median holding period to increase a bit more, mimicking the 2003–2004 pattern, before leveling off as the private equity market digests some ill-timed investments just prior to Covid restrictions. Given the structure of many private equity firms, with an end date to their funds, bulges in the pipeline will ultimately result in an increased number of exits, eventually.

About Private Equity Info

Private Equity Info’s M&A Research Database features more than 118,000 private equity portfolio companies, updated continuously by our in-house research team. M&A professionals that rely on PEI’s database can sort by keyword and industry, set up automated transaction alerts, map the landscape of a particular industry, and easily find portfolio company and private equity firm executives.