Investing In Minority-Owned Companies Strengthens the Economy

To address disparity in capital access and win over investors, CFOs of women- and minority-owned businesses need more than just a good idea, says Fred Royall of JPMorgan Chase.

To address disparity in capital access and win over investors, CFOs of women- and minority-owned businesses need more than just a good idea, says Fred Royall of JPMorgan Chase.

“Banking is a small community, so be mindful of how your reputation can impact your banking relationships,” says Bridget Meyer of Redbridge Debt & Treasury.

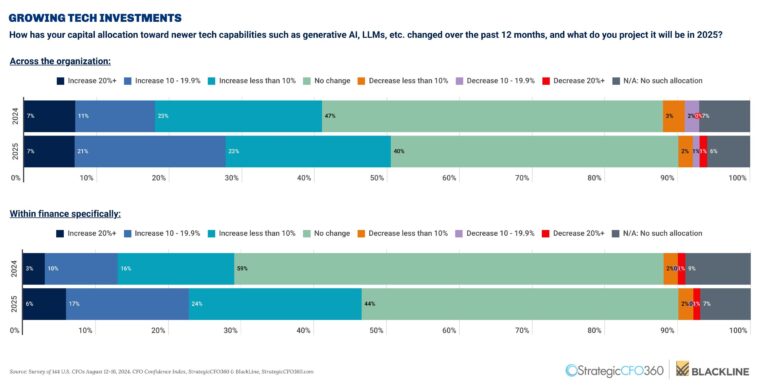

America’s finance chiefs are loosening the purse strings for new technologies, with 25% planning to increase their investment by 10% or more next year—and expecting positive ROI within three years.

Traditional investment approaches will cost you. Instead, consider a more nuanced, granular—and often surprising—approach that will position you well for profitable growth.

As Helicoid Industries entered the commercialization phase, it sought non-dilutive capital to boost liquidity, says CFO Bill Spathelf.

Government incentives and certain M&A strategies could be catalysts for growth in the coming months, says TD Bank’s William Fink.

"*" indicates required fields

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.