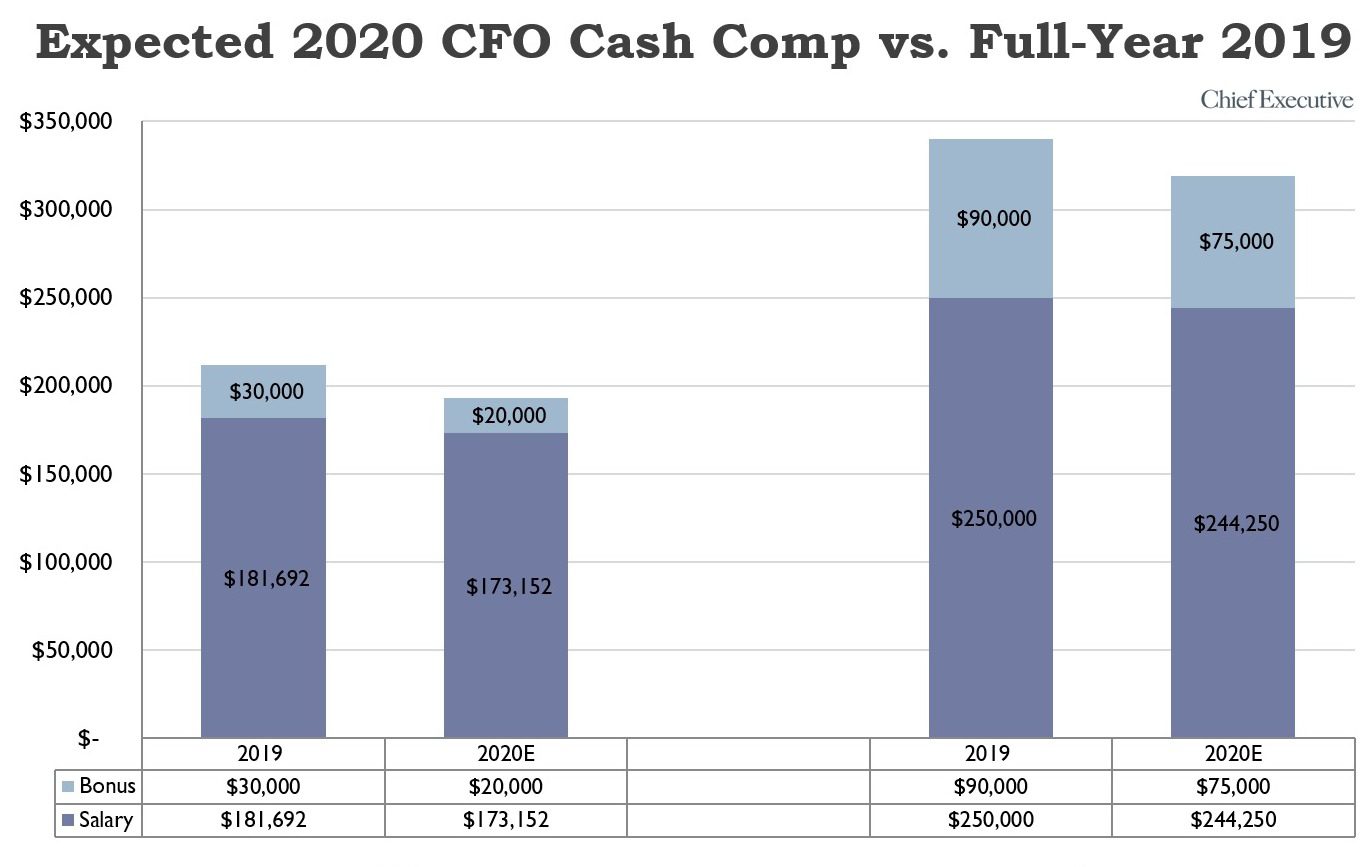

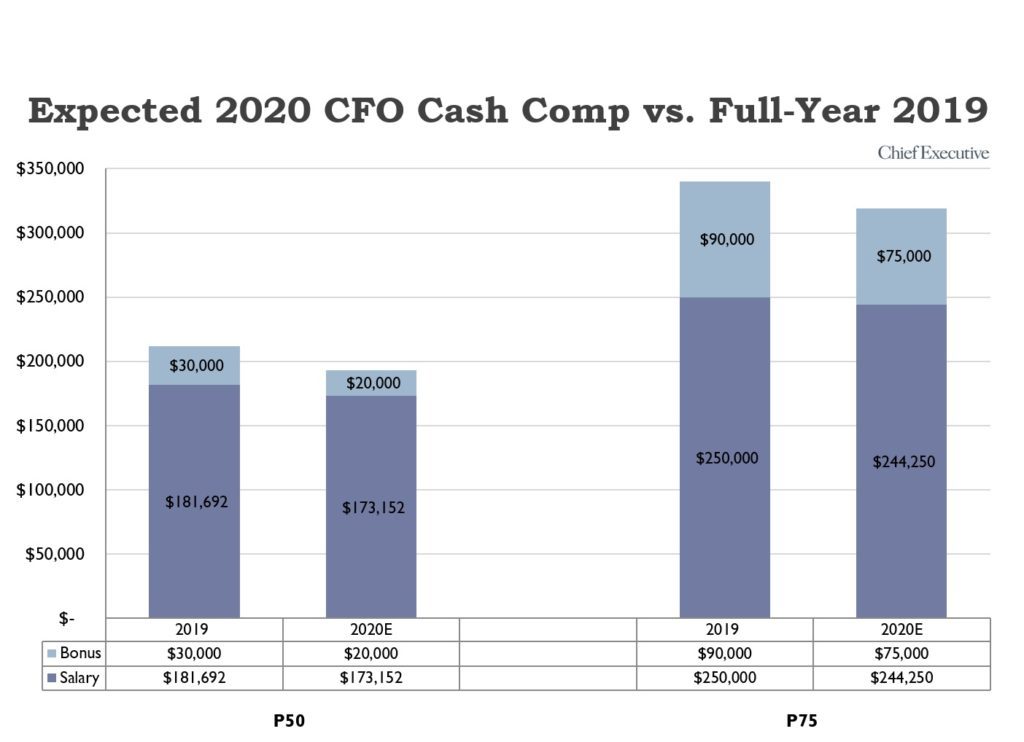

The Covid-19 pandemic has had considerable impact on senior executives’ expected compensation for 2020, but CFOs were among the members of the C-Suite most affected by the crisis. Besides the CEO and president, finance chiefs experienced the largest cut to their median base salary in 2020, down 4.7% on an annualized basis.

Those are among the key findings from Chief Executive Group’s 2020-21 CEO and Senior Executive Compensation Report for Private Companies. Based on survey data from more than 1,700 companies, the report—published by the parent company of StrategicCFO360.com—is the largest annual survey of its kind in the United States (learn more about the report).

Overall, a third (34%) of private companies in the U.S. reported reducing their CFO’s salary in 2020 in response to the Covid crisis. Of those companies that did, the majority implemented cuts of 10 to 29.9%, with a weighted average salary reduction of 23.5%. When taking into consideration that the average duration of those cuts was 6.9 months, the survey shows that median CFO base salaries declined by 4.7% on an annualized basis.

In addition to cuts to their base salaries, median CFO bonus awards are also expected to decrease in 2020, by a full third, according to the survey findings, bringing CFOs’ median total cash compensation for 2020 down 8.8% vs. prior year.

Ownership type and industry were two of the prevailing factors in the extent of the cuts to CFO salary. For instance, median base salary for CFOs at Sole Proprietorships and Partnerships experienced the deepest cuts, down 10% and 7% for the year, respectively. And like many of their C-Suite counterparts, CFOs in Advertising, Entertainment, Restaurant and Retail, as well as those in Media/Publishing, were most impacted.

Ownership type and industry were two of the prevailing factors in the extent of the cuts to CFO salary. For instance, median base salary for CFOs at Sole Proprietorships and Partnerships experienced the deepest cuts, down 10% and 7% for the year, respectively. And like many of their C-Suite counterparts, CFOs in Advertising, Entertainment, Restaurant and Retail, as well as those in Media/Publishing, were most impacted.

Nevertheless, the majority (60%) of companies that instituted salary reductions reported having mechanisms in place to make their executives “whole” and recover at least a portion of their foregone salaries:

• 17% say the salary reduction is in fact a deferral and will be repaid

• 2% say the salary reduction will be paid back with interest

• 32% say the salary reduction will be repaid but only if the company achieves specific financial targets

• 9% say the reduction will be exchanged for additional equity or bonus opportunities

This is an important consideration for finance chiefs, who typically enjoy the fourth largest compensation packages of the C-Suite, behind CEOs, presidents and COOs. In 2019 alone, median CFO cash compensation exceeded $210,000—an increase of more than 10% vs. prior year.

In the past, company size (particularly by the number of employees) and level of profitability have been the major drivers of CFO compensation. For example, the median CFO in companies with 100-249 employees earned 28% of the compensation of the median CFO in companies with 5,000+ employees.

But material differences also exist by industry, ownership type and geographic market size. Pharma/Bio CFOs enjoyed the highest median total compensation packages in 2019, coming in 3% higher than the second-highest compensation package (Restaurant CFOs), and CFOs at PE-backed firms earned the highest median compensation, more than 1.5 times that of other investor-backed CFOs and 78% more than CFOs at sole proprietorships.

The survey data shows the correlation of several variables on CFO compensation at private companies with peer group comparisons across company sizes, geographies, market sizes, growth rates, sectors, ownership types and profitability. As one would expect, the greater the profitability of a company, the higher the total median compensation package of the CFO, although unprofitable companies tend to pay higher salaries and bonuses—and higher-valued benefits and perquisites—than many of their peers to attract top talent.

For more information, visit CompReport.ChiefExecutive.net or contact [email protected].