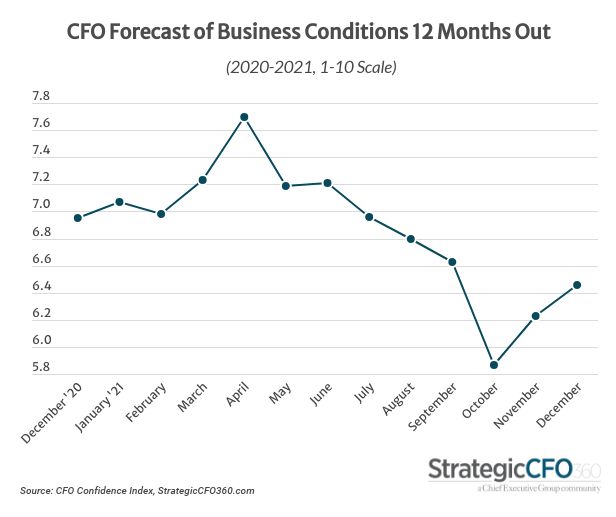

In December, America’s CFOs continued their optimistic streak from last month, boosting their rating even further from its October lows. They are encouraged by the resilient stock market, resilient consumer spending and the even more resilient businesses across the nation that have drastically improved their strategies for success amid continued supply chain issues and novel Covid-19 variants. Although the indicator has gained momentum in recent months, inflation, material shortages and the Great Resignation continue to weigh heavy on CFOs’ minds—and are manifested in their rating, which is 16 percent below its April high.

Those are the key findings from StrategicCFO360’s December reading of CFO confidence, conducted among 127 senior finance executives between December 13 and 17. Their rating of future business conditions now matches that of CEOs, who, when polled earlier in the month, rated business conditions a 6.5 out of 10—a 4 percent jump for CFOs and up 2 percent for CEOs.

CFOs’ rating of current conditions also ramped up this month, now at a 6.6 out of 10, up 5 percent since November and 14 percent higher than their rating of the current business environment a year ago in December, when heading into 2021.

This month, CFOs are split in almost even thirds, with 31 percent expecting conditions to improve, 35 percent expecting them to deteriorate and 34 percent expecting them to remain the same, a 26 percent increase month over month. Other members of the C-Suite have also grown to believe that conditions now are as good as it gets, with both a plurality of CIOs and CHROs expecting conditions to remain the same.

Robert Alder, finance director at Fire and Rescue NSW, an upper middle government/nonprofit company in New York, believes that business conditions now and in the future will remain at a 6 out of 10. “There are low interest rates and Covid conditions are improving,” he says, explaining his ratings.

Others who believe conditions will stagnate cite inflation, labor shortages and unfriendly business policies as reasons why there won’t be improvement, yet they remain hopeful that conditions won’t deteriorate.

Those who believe conditions will deteriorate have similar explanations, yet add that supply chain issues won’t subside and forecast that price increases, coupled with tax increases, inflation and widespread labor shortages will create a hostile business environment one year from now.

“We are receiving unprecedented price increases from many of our suppliers. Some as much as 100 to 400 percent. If this continues to happen across the board, this will be unsustainable,” says Greg Sansom, CFO at Origen Biomedical, a mid-size pharma company out of Texas. He believes conditions will drop from a 4/10 to a 3/10 in the future.

Charles P. McGovern, CFO at Mid-Atlantic Emergency Medical Associates, agrees with Sansom over the costs of doing business and says, “Compensation cost increases are exceeding revenue growth and I expect that trend into next year. Inflation will likely continue, especially if the government passes additional spending bills, and salaries will have to match competitors in a market with competition for each employee.” He rates current conditions as a 5/10 and expects them to drop one point over the next year.

Bob Toews, CFO and general counsel at Kaivac, an industrial manufacturing company, rates current conditions as an 8/10 but expects them to decline to a 6. “We are young, have innovative products that customers need and have tremendous unmet opportunities in front of us. However, government decision making is very poor right now, and it may cause economic difficulties overall.”

Despite citing the many issues they face, the most optimistic emphasize that like themselves, American businesses will find ways to adapt. Nate Cohen, CFO at Cohen Architectural Woodworking, based in Missouri, says, “I am very optimistic about our future. We are making strategic changes to proactively respond to labor and material shortages. I believe 2022 will be an incredible year, not because the industry is so strong but because of how we’re solving problems.” He expects conditions to improve from a 6/10 to a 10/10 by December 2022.

Michael Gasick, CFO at Rawhide, a healthcare company in Wisconsin, says, “Although there will be more global shocks, such as another variant, there will be overall recovery from pandemic conditions and pent up demand will drive business activities and efficiencies over the next year.” He believes conditions will improve from a 7/10 to an 8/10 over the next year.

Forecasting for the Year Ahead

The proportion of CFOs expecting both profits and revenues to increase expanded this month, up 5 and 7 percent, respectively. The 80 percent of CFOs who expect revenues to increase by December 2022 is the highest proportion recorded since July of this year—and is the only reading where the fraction of CFOs forecasting increases surpasses that of CEOs.

CFOs expecting to increase their capital expenditures dropped this month, down 3 percent to 50 percent of them, compared to the 57 percent of CEOs who expect the same. Two percent more CFOs, 63 percent, anticipate a hiring increase over the next year.

The proportion of CFOs expecting to grow their cash on hand is now 47 percent, up 17 percent since last month, while the proportion expecting to grow their debt dropped by 5 percent, now at 20 percent.

Sector & Size View

Industry over industry, most CFOs are hopeful. Only three industries’ ratings took a dip this month: technology, wholesale/distribution and construction. The rating construction CFOs gave future business conditions dropped 14 percent this month, citing supply chain issues such as wait times and price increases, labor supply issues and inflation.

CFOs in the wholesale/distribution industry gained the most ground this month, up 27 percent since November. They are encouraged by unending consumer and industrial demand.

CFO ratings of future business conditions were up across most size categories, except in the largest companies with revenues over $1 billion, whose rating remained unchanged.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index