As we enter the new year and try to leave 2020 behind, America’s CFOs are increasingly optimistic that business conditions will improve in 2021, with a growing number forecasting increases in revenues and capital expenditures at their firms over the coming months.

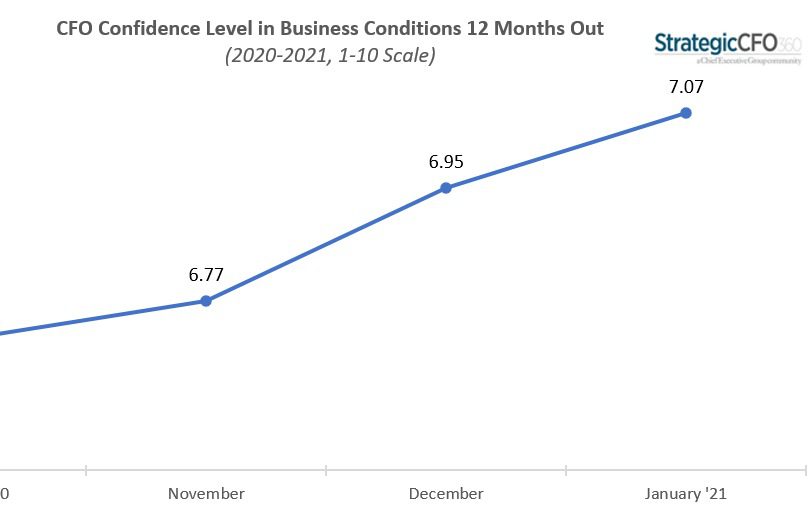

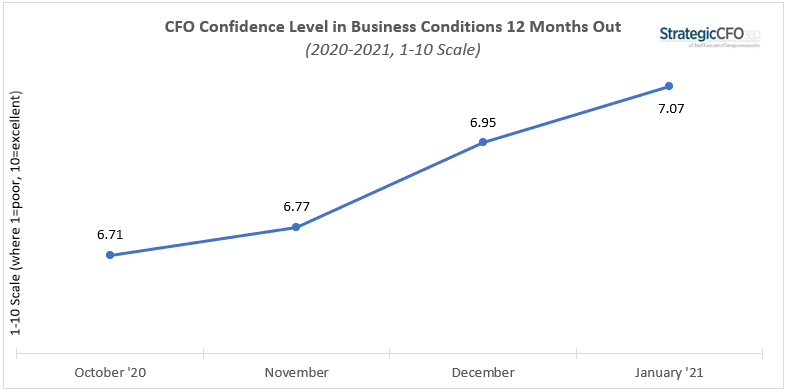

StrategicCFO360’s January reading of CFO confidence shows America’s finance chiefs rating the economy 12 months from now a 7.1 out of 10 on our 1-10 scale—2 percent higher than what it was in December and 20 percent higher than their view of current conditions. Those numbers are in line with the outlook of CEOs—6.9/10, when polled by our sister publication, Chief Executive, the week prior.

The continuation of the vaccine rollout and pent-up demand continue to fuel optimism among many of the 149 CFOs we polled January 11-13, 2021. In contrast to CEOs, however, fewer CFOs note the political environment as a factor affecting their outlook, instead citing tax increases as their main concern.

“Vaccine rollout will provide a path for increased mobility,” says the CFO of a healthcare company, rating his outlook for business 12 months from now an 8 out of 10 on our scale. “There is pent up demand, and household savings levels are at an all-time high.”

“A year from now with the vaccine, the economy [will be] back to somewhat normalcy,” says Wayne Romanczuk, CFO of Double H Plastics, a consumer goods manufacturing company. “Plus, in the short term, there will be two more relief packages: $900B in process and a couple trillion more from the Biden Dems.”

Yet, when asked to rank agenda items by priority, taxes/regulation falls to the bottom of the list of issues on CFO’s minds these days, with growth taking the top spot for 58 percent of respondents.

Forecasting for the Year Ahead

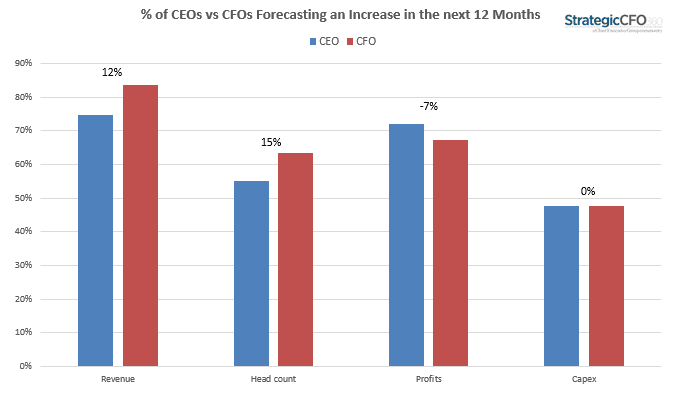

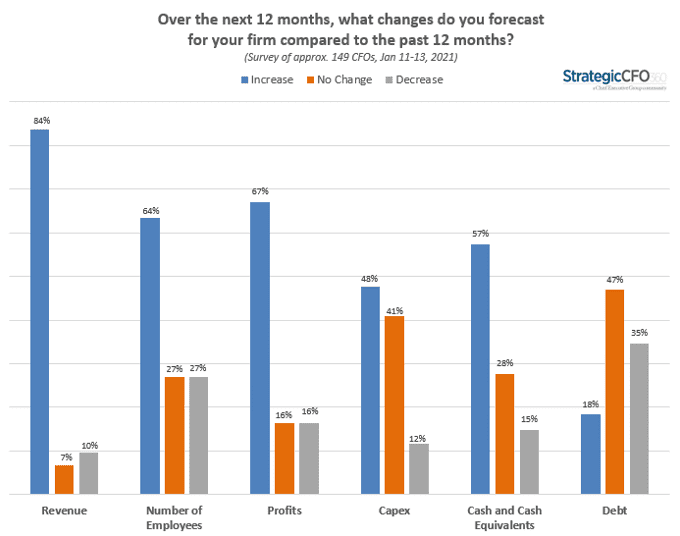

Some 48 percent of CFOs we polled now forecast an increase in capital expenditures in the year ahead—that’s up 18 percent since last month and our highest reading since we began this poll in October 2020. It puts them in line with CEOs, where 48 percent also forecast new investments over the coming months.

With the possibility of rising interest rates in the short term, our survey found a greater proportion of CFOs now planning to reduce debt—up 9 percent since last month—while forecasts for an increase in cash and equivalents fell slightly, down 3 percent from December, further corroborating the intent to increase capital expenditures.

CFOs are also increasingly optimistic about their company’s revenue growth, with forecasts revealing a promising trend: 84 percent of senior finance executives say they anticipate revenues to be up by this time next year (+5 percent MoM). To account for that growth, 64 percent say they plan to add to their headcount (+5 percent MoM).

In contrast to capex forecasts, the proportion of CFOs expecting increases in revenue and headcount is 12 percent higher than that of CEOs.

This month, the survey shows fewer CFOs forecasting increases in profits over the next 12 months—4 percent lower than last month, at 67 percent. This is 7 percent lower than the proportion of CEOs forecasting an increase in profitability. Respondents say they expect that an increase in taxes will reduce their companies’ profitability.

Sector View

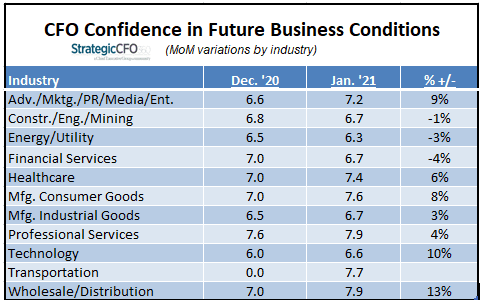

CFO sentiment about future business conditions evened out across industries, with only 3 out of 10 sectors forecasting declines since last month. However, of the CFOs in industries whose outlook decreased, they are down less this month than the month prior, all under 5 percent, compared to an average drop of 9 percent last month. Across industries, CFOs are encouraged that the reopening of the economy will boost revenue and lead to more opportunity.

This month, the greatest increases in CFO optimism are within the Advertising/PR/Media, Tech and Wholesale/Distribution industries, a stark contrast from last month where CFOs in both the Tech and Wholesale/Distribution industries forecasted a decline in future business conditions.

“Covid is pushing people to outdoor activities and some retail activity,” says Jeff Jones, CFO of Twisted X, a Wholesale/Distribution company, who rated future business conditions at 7/10. “The new administration rules may curtail some of that from growing, but I believe it will still be a positive business environment.”

About the CFO Confidence Index

The CFO Confidence Index is a new monthly pulse survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index.