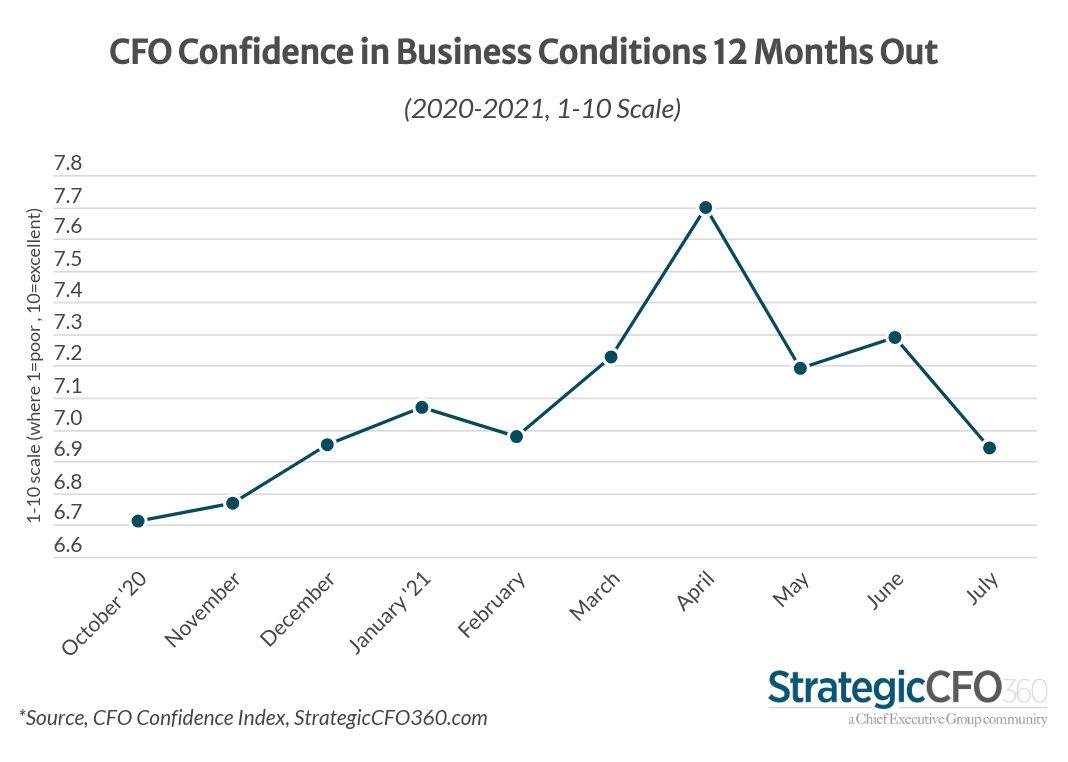

CFOs’ outlook for business over the next year fell nearly 5 percent in July, back to February levels when inflationary fears moved the leading indicator down to pre-vaccine levels. This month, America’s finance chiefs say they remain very concerned about inflation and the rising cost of materials, as well as the many shortages affecting supply chains across industries.

Those are the key findings from StrategicCFO360’s July reading of CFO confidence, conducted among 162 senior finance executives between July 19-22. America’s finance chiefs rated their confidence in the business environment 12 months from now a 6.9 out of 10, according to our 10-point scale—down from 7.3 in June and 5 percent lower than the 7.3 out of 10 rating CEOs gave, when polled earlier this month.

CFOs also report feeling less confident in the current business environment than they were just a month ago, rating current conditions a 6.7 out of 10—down 4 percent from 7/10 in June. For many, this assessment is based on the world’s struggle with Covid-19 and its most recent variants, which they say is having a domino effect on unemployment levels, demand, supply chains and business activity in general.

“Many businesses we do business with remain unable to maximize their revenues either due to lack of inventory or lack of employees,” said the CFO of a media company, who says she nevertheless remains cautiously optimistic that inventory will catch up to demand and that employment will level out in the near term, but not before Covid is fully controlled and stimulus packages cease.

The CFO of a midsized staffing company rates both the current and future environment a 4 out of 10—or “weak” according to our 10-point scale. He says he’s concerned the “pandemic is resurging and that the economy will once again contract.” He’s expecting profits and revenues to decline in the months ahead, each by double digits.

Kevin Lavan, CFO of Autoclear, a provider of security x-ray machines to America’s parks and attractions, says he’s optimistic because demand is picking up but adds, “My ranking would be better if it wasn’t for continuing supply chain issues (COVID and Suez Canal overhang).” He rates the current business environment a 6/10.

Scott Wheeker, CFO of NY-based wellness company Thorne HealthTech, says he believes “the Delta variant is going to take hold and send us retreating. We just don’t have herd immunity.” His rating of 5 out of 10—which he expects will have only ticked up to a 6/10 by this time next year—is partly caused by inflation that he says “is here for at least two more years.”

For Janine Morabito, controller at for-profit youth sports organization SMP Holdings LLC, it’s one thing for businesses to get back up post-Covid, but consumers also need to return. “As Covid restrictions lift, business is getting back to more normal; however, customers have been significantly impacted financially, and new customers may not walk in the door,” she says, forecasting status quo in profits and revenues for the year ahead.

Of course, not everyone agrees. Numerous CFOs participating in our flash poll say they’re expecting the recovery to continue.

“Most of our clients have a positive outlook on the year ahead, and I believe that the fundamentals of the economy are strong,” said Marc Rowland, president and treasurer of TMPartners, PLLC, a provider of architecture, interior design and planning services based out of Brentwood, Tennessee. He rates both current and future conditions a 9 out of 10.

The chief financial and operating officer of a non-profit also in the Volunteer State says the fears are overblown: “Supply chain disruptions will be replenished in the coming year; labor will begin to return more confidently to the workforce; inflation concerns are real, but manageable,” he says, expecting business conditions to move from a 5 out of 10 currently to a 9 out of 10 by this time next year. “Caveat to my optimistic forecast is increasing China geopolitical disruption,” he adds.

Overall, 40 percent of CFOs expect conditions to improve over the coming year, compared to 31 percent who expect them to worsen and 29 percent who don’t forecast any change. That is fairly in line with CEOs, who are split 36 percent, 36 percent and 27 percent respectively.

Yet the proportion of CFOs forecasting an improving landscape over the next year is down 13 percent since June—and 35 percent since the start of the year. The largest variation comes from CEOs now expecting conditions to remain unchanged, up 90 percent since January.

Forecasting for the Year Ahead

The proportion of CFOs forecasting increases in revenues and profits climbed in July, up 4 and 9 percent respectively to 84 and 75 percent. Those are the highest levels since we began tracking CFO sentiment in October 2020.

The proportion of CFOs forecasting increases in capital expenditures also rose this month, to 61 percent from 53 percent in June. That is also the highest level on record—and now on par with CEOs (60 percent).

The main decline recorded this month is in the proportion of CFOs forecasting adding to their ranks in the coming year: 59 percent, down 14 percent MoM and the lowest it’s been since the beginning of the year.

Sector, Size & State

CFO confidence in future business conditions is up across most sectors in July, vs. June, with the exception of financial services (-11 percent), construction (-10 percent) and technology (-7 percent). The consensus among those sectors’ finance chiefs comes down to inflation concerns, with some also reporting labor issues—shortage and wages—as an obstacle to growth.

Everywhere else, sentiment is fairly stable when looking at the month-over-month variations, with the biggest increase in optimism recorded among healthcare CFOs who cite growth as the primary reason for their rating, primarily due to recent investments in technology.

When looking at forecasts by company size (by annual revenues), sentiment is negative across all groups in July, with smaller company CFOs (less than $10 million) reporting the lowest rating of business conditions, at 6.6 out of 10.

Many say there is pent-up demand that they are struggling to fulfill due to labor shortages and increasing costs and regulations that are impeding smaller companies’ recovery.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index