CFO confidence contracted this month amid concerns about the potential impact of government stimulus on the economy, with an increasing number of those surveyed saying they are worried it could spark inflation and damage business prospects in the year ahead. But most agree that an accelerating rollout of the Covid-19 vaccine to so-called herd immunity would eclipse any inflation risks.

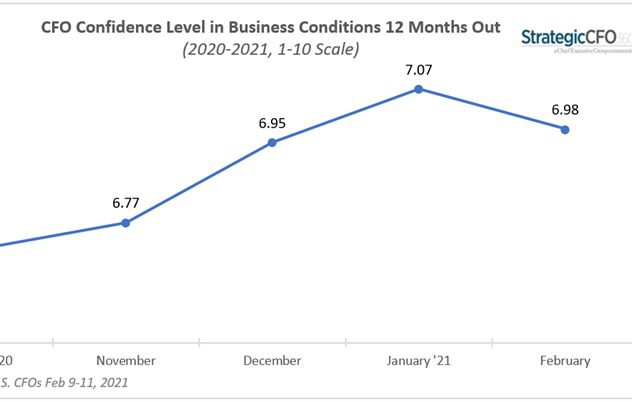

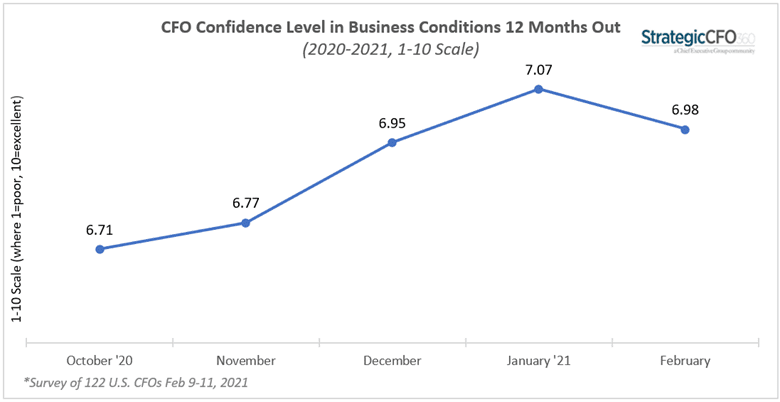

StrategicCFO360’s February reading of CFO confidence shows America’s finance chiefs remain optimistic about future business conditions, forecasting the environment a year from now will be “very good,” at 7.0 out of 10 on our 1-10 scale—16 percent higher than their rating of current conditions. Yet their perceptions of future growth were down 1.3 percent this month compared to January.

CFOs are only slightly less optimistic in their outlook than CEOs, whose confidence in future business conditions reached multi-year highs when polled by our sister publication, Chief Executive in early February.

Similar to CEOs, the majority of the 122 CFOs we polled between February 9 and 11 say they expect a strong recovery in the third quarter, although they worry that a large stimulus bill will lead to higher inflation and put the economy at risk.

Robert Alessandrini, CFO of international consultancy firm The Judge Group, rates future business conditions 7/10, which is 75 percent higher than the 4/10 he gives to current conditions in the U.S. “Once consumers are truly back purchasing and travelling, the economy will see a surge,” he says. “I believe there will be higher than normal inflation for a couple years when that starts.”

The chief financial and operating officer of a California-based technology company rates both current and future business conditions at a 6 out of 10, “good” on our scale, saying “the outlook for broad vaccinations will be offset by the possibility of inflation.”

Forecasting for the Year Ahead

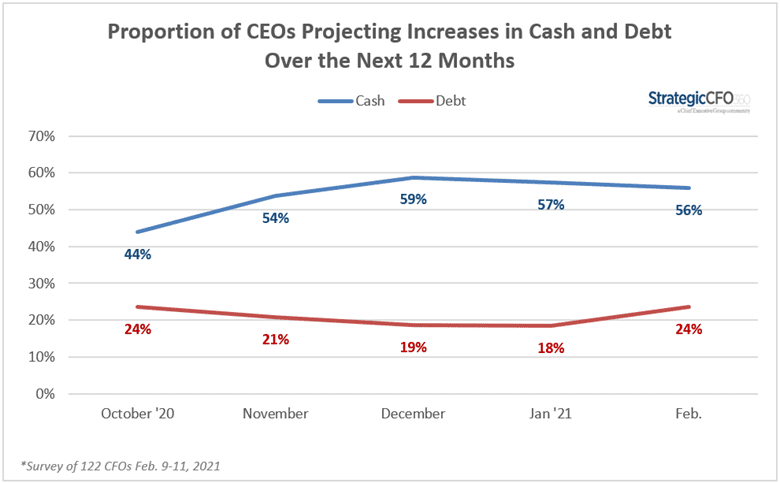

Overall, CFOs and CEOs are aligned in their forecast for 2021, with nearly half forecasting increases in capital expenditures, when compared to the year prior, 70 percent expecting greater profitability, and 78 percent forecasting revenues to climb.

The only area where the data shows a significant gap is hiring: 65 percent of CFOs expect to increase hiring over the next 12 months, versus just 59 percent of CEOs.

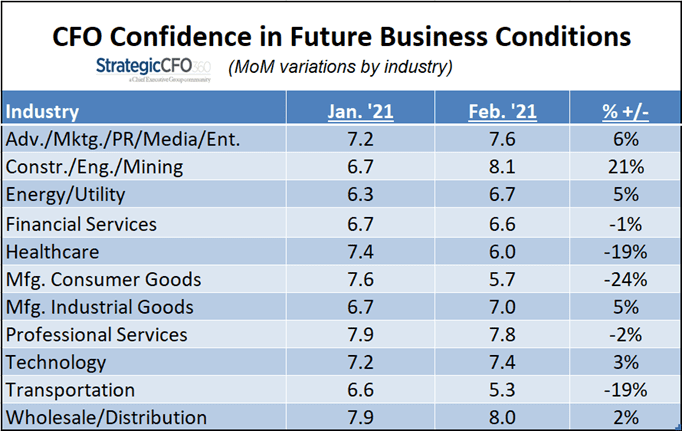

Sector View

CFO sentiment about future business conditions is volatile across industries, with half saying they are less optimistic than they were last month. The greatest loss in confidence was reported in the consumer goods, manufacturing, transportation and healthcare sectors. The main reasons CFOs cite for their diminishing outlook include a fear that inflation will outstrip growth and a lack of confidence in the new administration to support business.

“The administration is driving labor costs which will in turn drive inflation and disincentive hiring, resulting in challenging labor market for next few years,” says the CFO of a mid-size manufacturing company, explaining his 2 out of 10 rating for future business conditions, down from his 4 out of 10 rating in current conditions.

“The stimulus is creating a bubble, and the new administration’s policies are eliminating high-paying jobs before the green jobs they promise have materialized,” says Chris Horner, CFO of a transportation company. “I expect these policies to weigh heavily on the economy,” he says, giving the current environment a rating of 7 out of 10 and expecting future conditions to drop to 4 out of 10.

“We rely heavily on the tire and rubber industry. The shutdown of the pipeline is going to affect purchase of new vehicles, which in turn affects our industry,” says Joy Hanson-Hickerson, CFO of Texas-based manufacturer TSD Logistics, explaining the reasons for her weak forecast of the future.

The highest rating recorded this month is in the construction sector. The confidence of CFOs in that industry increased 21 percent this month and reached its highest rating since we began fielding this survey in October 2020—at 8.1 out of 10. CFOs in the sector say they anticipate increased public and private infrastructure investments and an explosion in consumer spending when the pandemic fades.

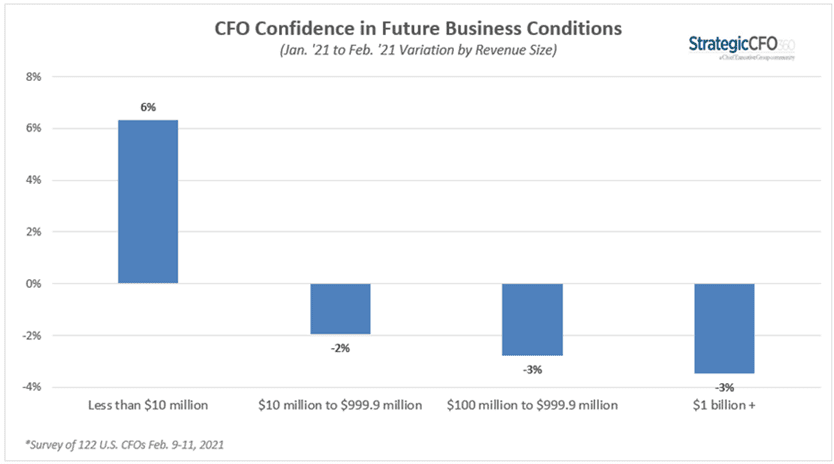

Size View

When looking at the data by size (by annual revenues), small company CFOs were the only ones showing more confidence in the future in February, up 6 percent from January. They attribute their increased confidence to post-election political stability and the unleashing of pent-up demand that has so far stunted their growth but that they expect will be released when the nation can return to work later this year. CFOs of larger companies, for their part, say they are concerned that rising labor costs and the risk of inflation will further contract the labor market and eat into their profitability and ability to compete.

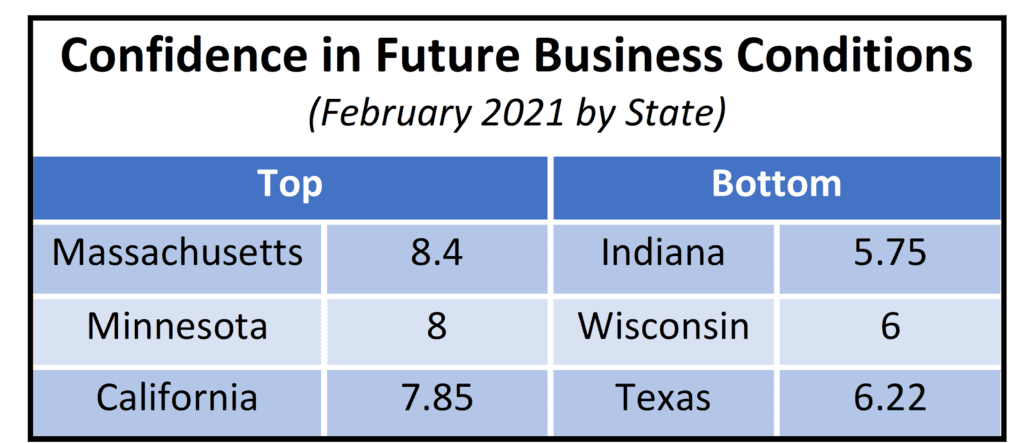

Regional View

The impact and management of the Covid pandemic has differed greatly from state to state, and when looking at confidence by state where the company is headquartered, CFOs reporting the highest level of optimism were found in Massachusetts, Minnesota and California—where they cite expectations of renewed stability, an effective vaccine rollout and pent-up demand as their primary reasons for this outlook.

CFOs with the least confidence in the future were found in Texas, Wisconsin and Indiana, where they list continued business shutdowns and unfriendly monetary policies as their main concerns for the year ahead. Tax burdens on producers that will affect supply pipelines is also noted as a worry.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index