CFOs are quickly gaining confidence in the recovery, as their rating of future business conditions jumped nearly 7 percent this month, according to our monthly CFO Confidence Index poll. Survey respondents say they are encouraged by vaccination rates, GDP growth, increasing demand and low interest rates. They say that the pent-up demand and widespread cash availability will fuel a new era of growth, as the nation emerges from more than a year of strict pandemic regulation.

Those are the key findings from StrategicCFO360’s April reading of CFO confidence, conducted among 69 finance executives between April 20 and 26. A continuously growing number of America’s finance chiefs are enthusiastic that business conditions will be very good 12 months from now, rating their forecast a 7.7 out of 10 on our 10-point scale—up 6.5 percent since March. Their rating of current conditions jumped 10 percent this month to 7.1, signaling that the economy is already in the midst of recovery.

Both ratings are the highest we have seen since StrategicCFO360 began fielding the poll last October.

CFO confidence in current business conditions is aligned with that of their CEOs, both hovering at or around 7 out of 10. However, CFO confidence in future business conditions dwarfs that of their CEOs, whose confidence in future business conditions grew only 3 percent this month when polled by our sister publication, Chief Executive, two weeks prior, to a 7.3/10.

Bill Schlitter, CFO of Dolese Bros., a construction company based out of Oklahoma, rates future conditions a 9 out of 10: “Current rate of vaccinations and the large amount of fiscal stimulus entering the economy” are the top reasons for his rating, he says.

Some CFOs, however, remain concerned that the current growth is only a façade, and that the Biden Administration’s tax policy will destroy it.

“The recent legislation and the current legislative agenda will negatively impact the economic environment,” says the CFO of a large wholesale/distribution company based out of Utah, who believes current conditions are very good, scoring them an 8 out of 10, but expects future conditions to take a massive hit, scoring them 4/10.

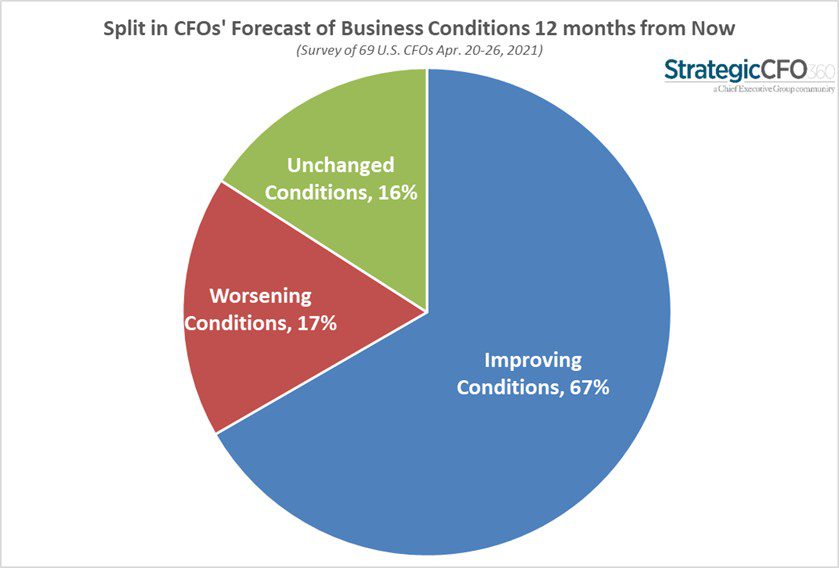

While he isn’t alone in that view, 67 percent of CFOs expect business conditions to improve by this time next year, according to this month’s data, compared to 33 percent who forecast conditions to either worsen or stagnate over that period.

Forecasting for the Year Ahead

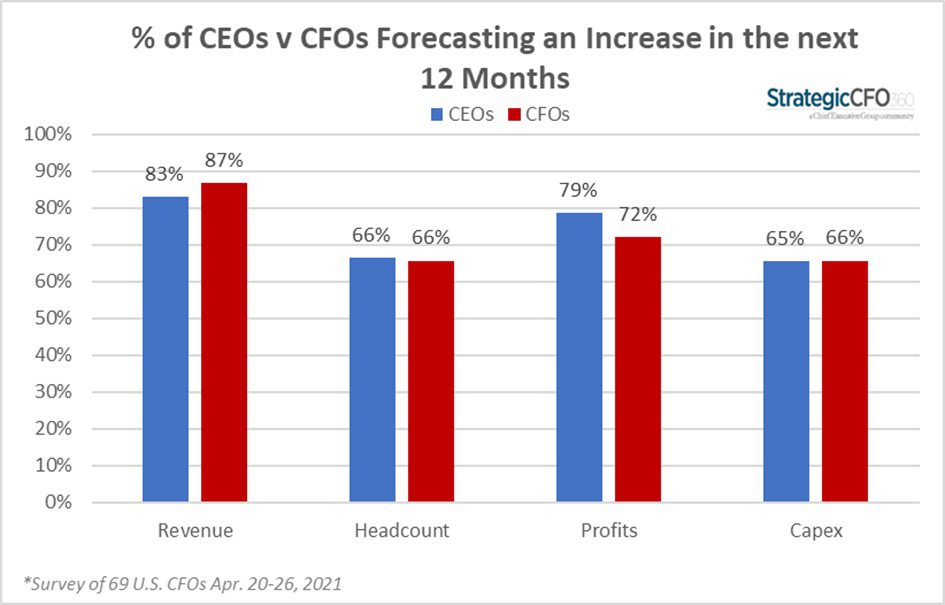

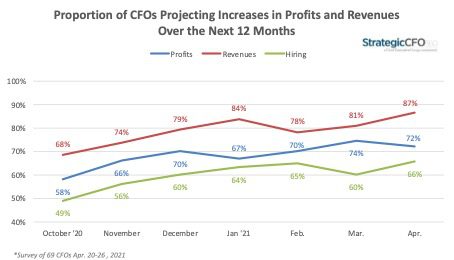

CFOs and CEOs remain in agreement on how their companies’ profits, revenues, hiring and capital expenditures will change in the coming months. CEOs’ forecasts increased across the board in April, and so did CFOs’, with the exception of profits—3 percent fewer CFOs believe that profits will increase in the next 12 months since last month, down from 74 percent to 72 percent this month.

In March, 81 percent of CFOs believed that revenues will increase over the next 12 months; that proportion jumped 7 percent, this month, now at 87 percent. Their CEOs are similarly optimistic about both revenue and hiring. This month, 66 percent of CFOs polled believe that hiring will increase over the next 12 months compared to the 60 percent, last month, and is the highest we have seen since the poll began fielding in October, before a dramatic series of political events and a widespread vaccine rollout.

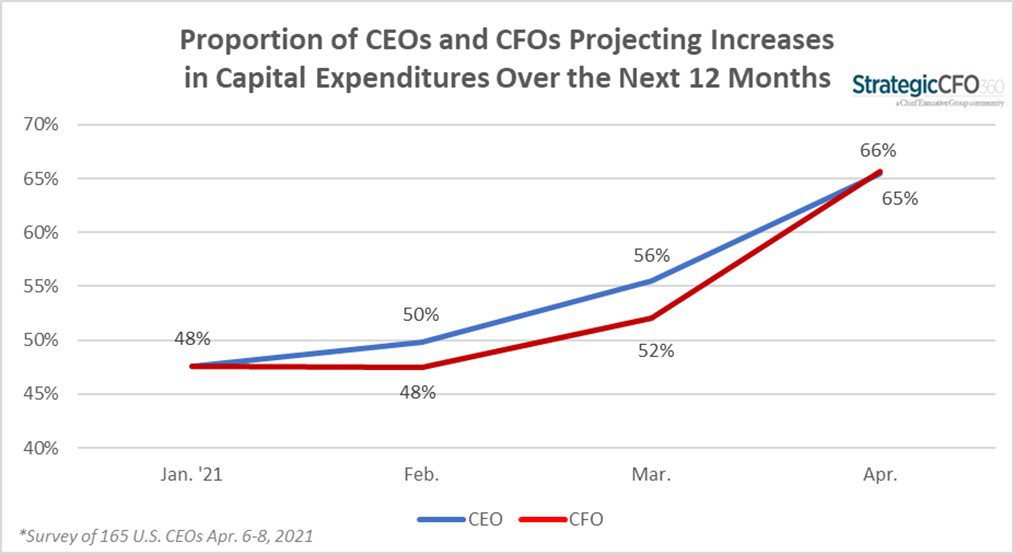

In line with a steady trend over recent months, both the percentage of CEOs and CFOs who forecast an increase in capital expenditures escalated this month, up 18 and 25 percent, respectively, now above 65 percent.

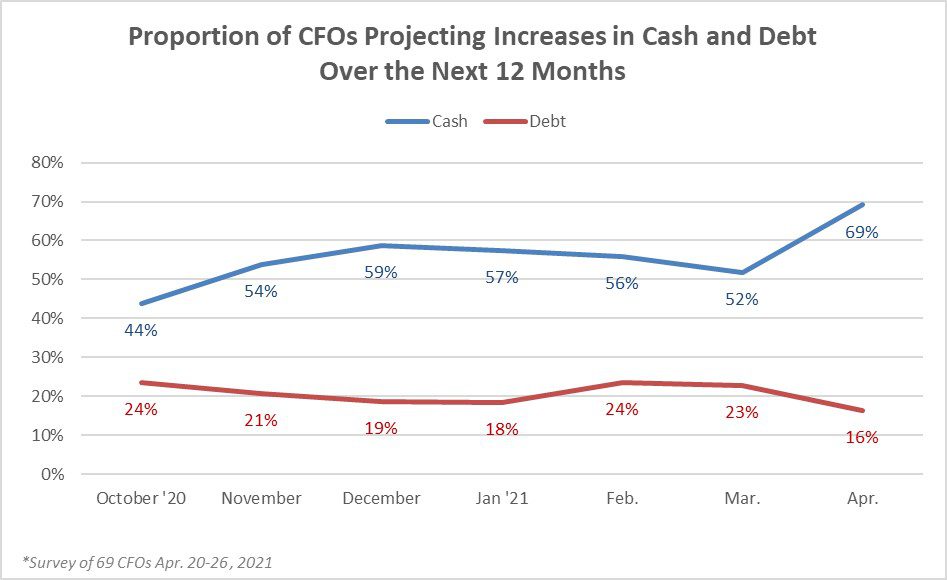

Unsurprisingly, the proportion of CFOs expecting to increase debt dropped by 28 percent this month, now at 16 percent, while those expecting to increase cash climbed by 34 percent, to 69 percent.

Sector View

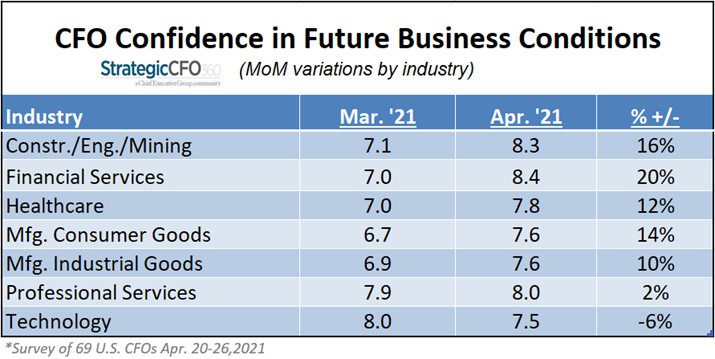

Positive forecasts about future business conditions are up across most sectors, except for CFOs in technology. Last month, the nation’s tech CFOs rated future business conditions an 8/10, the highest out of all industries. This month, that rating is down 6 percent, to 7.5, and now the lowest rating compared to other industries.

“I would view things as great 12 months from now, except I am concerned with too much money in the banking system combined with banks taking more risks. Further, we are seeing pressure on staffing costs,” says the CFO of a mid-size technology company based out of Florida. His rating of current vs. future business conditions is unchanged, both at a 7/10.

CFOs in construction and financial services gained the most optimism this month, up 16 and 20 percent, respectively. CFOs in financial services are now the most confident of the bunch, rating future business conditions at an 8.4 out of 10.

“The custom residential home market will remain strong,” says the CFO of a mid-size construction company based in Washington state, echoing the sentiment of other CFOs that low interest rates will help to drive growth. “The Fed has proven that it has the ability to keep interest rates in check. People can now build outside of the city and retain their income.” For those reasons, he rates future conditions an 8 out of 10.

Those in the financial services sector say vaccination rates paving the way to business reopening, travel and consumer spending are fueling their high hopes for the future.

Size View

When looking at the data by size (by annual revenues), CFOs at small companies are now the most optimistic among their peers, rating future business conditions an 8.1 out of 10, up 16 percent since March. They attribute this to the “successful inoculation of the population against Covid, opening previously restricted areas of economy,” as one CFO of a small advertising company put it.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index