Whichever side of the political aisle they stand on, America’s finance chiefs echoed their CEO peers in our latest CFO Confidence Index in expressing relief that the U.S. had moved beyond the uncertainty that accompanied a contentious election cycle.

When we asked nearly 500 business leaders on Nov 6-9 to share their outlook on the heels of a hot election cycle, the resounding sentiment across the C-Suite—and boardrooms—was that regardless of who won the elections, just moving beyond them would provide a level of certainty that would benefit businesses and markets.

Fifty-eight percent of the 119 CFOs participating in the survey say they expect business conditions to improve over the coming year, up 9 percentage points from 49 percent when we asked the same question in Q3. That is the largest proportion of CFOs who feel this optimistic since March 2021, when the new COVID-19 vaccine bred hope that life would soon return to normal.

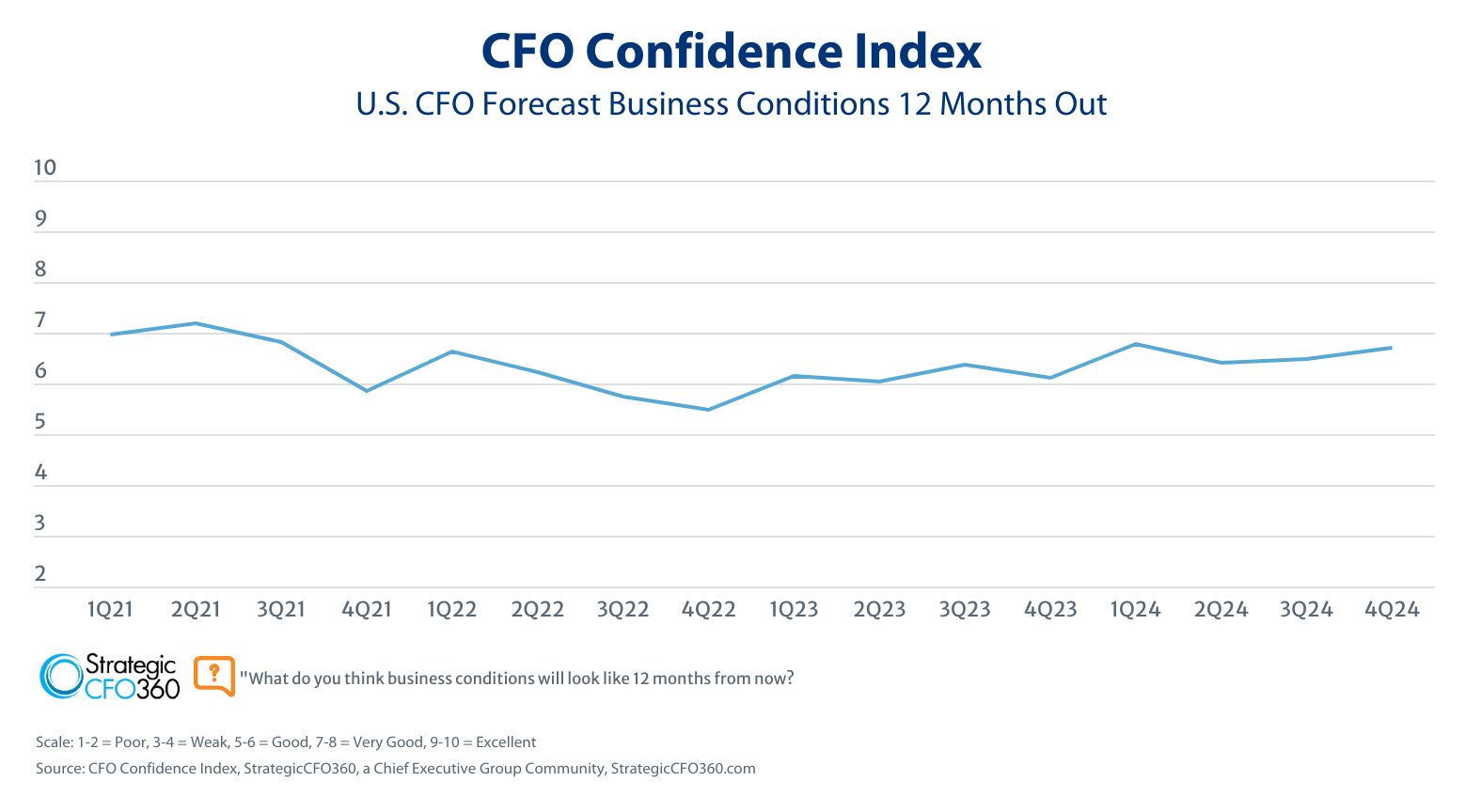

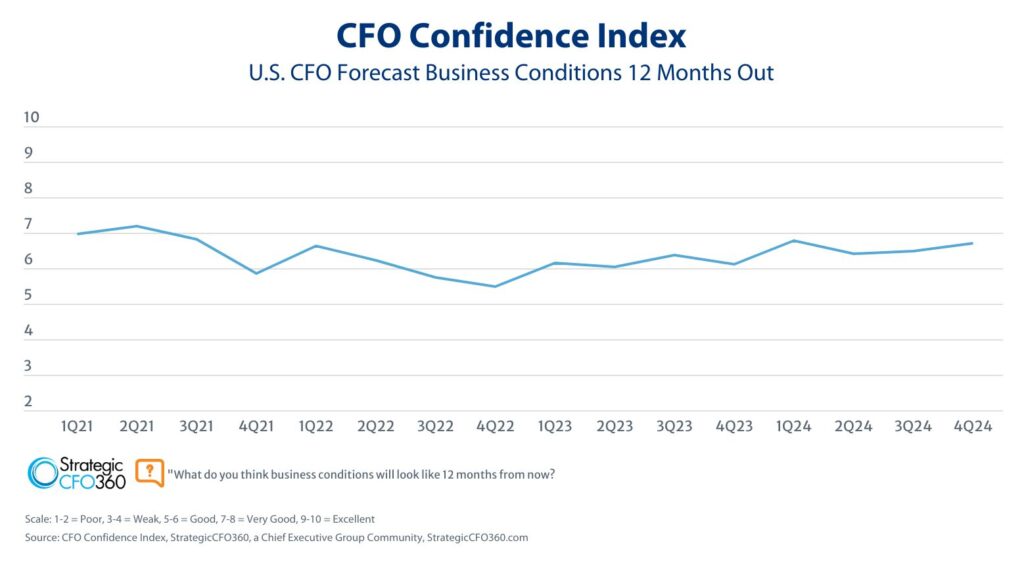

CFOs expect the business environment in the next 12 months to be a 6.7 out of 10, on a scale where 1 is Poor and 10 is Excellent—up from 6.5 in Q3, but still slightly behind where it started the year (6.8/10). In contrast, CEOs polled by sister publication Chief Executive rated the prospective business environment in the next year a 6.8 out of 10, up from 6.4 in Q3.

Ninety-three percent of CFOs polled say the outcome of the U.S. presidential election affected their forecast this quarter, though to varying degrees.

“If Harris had won, we anticipated a 4-to-6 percent topline decline,” comments the CFO of a large retail company for whom the election outcome played a significant role. Only 7 percent of CFOs say the election plays no role in their projections.

While some say they are approaching the election results with caution—and others with flat-out fear and concern—most say they intend to make the best of the opportunities the incoming administration is proposing regardless of whether they agree with them.

“Optimistic for decreased regulation and continuation of TCJA. Expecting lower interest rates as we use some debt to expand,” says the CFO of a PE-backed company.

“Solid economy prior to election and should be positioned to be stronger with less regulation, potentially lower corporate tax rates [and] energy independence with a holistic view,” notes the CFO of a midsized financial services firm.

“New pro-business president and Senate will help increase business confidence—and spending,” says the CFO of a marketing/advertising company.

CFOs from every sector say they can capitalize on some of the government policy changes to grow their business. Among those policy domains they expect to have the biggest impact on their business, CFOs rank “corporate taxes” first, followed by “labor,” “industry regulation” and “trade.”

Interestingly, though, despite the potential lift from lower business taxes, CFOs say they prefer the incoming administration to prioritize growing the economy (70 percent). Taxes (and fiscal policy) come in third place among desired policy priorities, 9 percentage points behind immigration.

The Year Ahead

When asked about their respective company forecasts for 2025, 78 percent of CFOs project their revenues to be up by this time next year (vs. 71 percent in Q3), and 68 percent predict an increase in profits (vs. 58 percent in Q3).

The data also points to an increase in spending: 48 percent of CFO respondents expect to increase capital expenditures in the next 12 months (vs. 40 percent in Q3), the highest level since Q1 2022. Three-quarters of the CFOs (73 percent) project operating expenses to rise again next year, up from 70 percent in Q3.

CFOs are earmarking part of that operating spend increase for wages, as 50 percent of CFOs plan to add to their headcount in 2025, up from 39 percent in Q3.

Finally, when asked about their balance sheets, 27 percent of CFOs say they expect to take on more debt in the months ahead (vs. 24 percent in Q3), and half (50 percent) foresee increasing their levels of cash (vs. 49 percent in Q3).

About the CFO Confidence Index

The CFO Confidence Index is a quarterly poll of CFOs and finance chiefs on their outlook for business and how policies and current events affect their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index