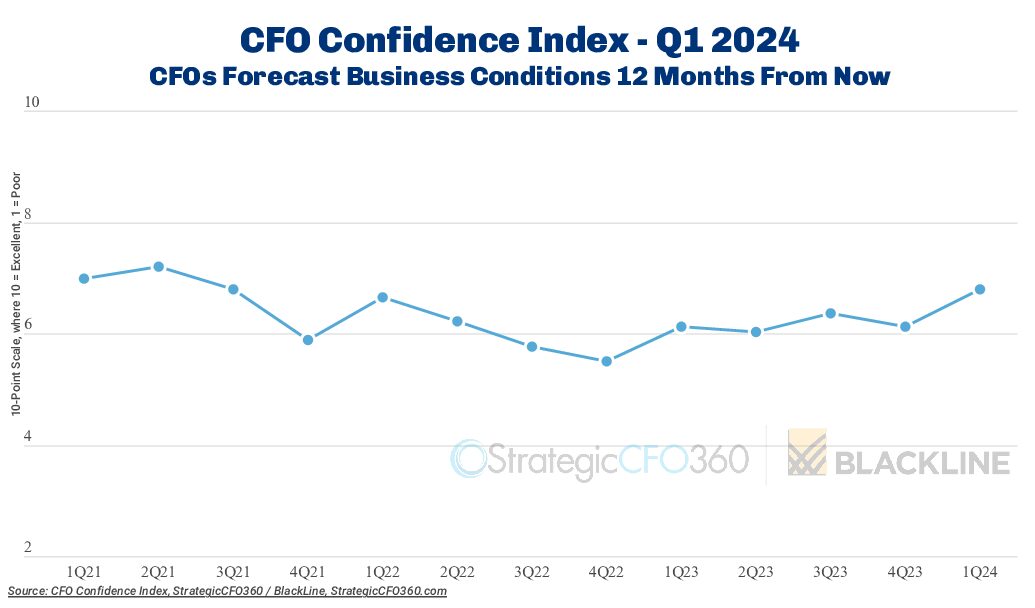

CFOs—who according to our historical data tend to be the least optimistic of the C-Suite when it comes to forecasting the future of business conditions—showed a surge in confidence in the business environment in 2024 when we polled them at the end of February as part of our CFO Confidence Index, conducted in partnership with BlackLine.

The proportion of CFOs who expect business conditions to improve over the next 12 months jumped from 38 percent in Q4 to 46 percent in Q1—the highest level recorded since mid-2021.

The Q1 data, collected among 169 U.S. CFOs February 26 to March 4, finds CFOs’ outlook for business conditions one year from now at 6.8 out of 10, from 6.1 in Q4. CFOs say the reason for that is they expect inflationary pressures to continue to decrease over the course of this year, albeit gradually, which they believe will, in turn, drive interest rates down and lead to increased investments and business spending.

While many noted a high degree of uncertainty leading up to the presidential election in the fall, CFOs said they believe that one year from now, the outcome will be decided and there will be more stability, which could further drive growth.

“We believe business will be good [one year from now], but it will definitely depend on the election outcome and decisions made as a result for 2025,” said Michael Jackson, CFO of Radius Global Market Research. Still, he said, “We expect 2024 will be strong.”

C-Suite Comparison

CFOs aren’t the only optimistic members of the C-Suite so far this year. Every other group surveyed as part of our Confidence Index series—CEO, CHRO, Board Members—has reported a heightened outlook for the next 12 months.

Sister publication Chief Executive’s February polling of CEOs, for instance, found America’s business chiefs confident over the expected rate cuts, with 44 percent expecting improvement in the economy as a result over the next 12 months.

Then only 28 percent of public company board members polled by Corporate Board Member in February said they expect conditions to worsen in the next 12 months—the lowest proportion in over one year. Instead, 72 percent said they now expect conditions to improve or remain the same.

CHROs gained confidence too, giving a 6.8 out of 10 rating for future conditions, matching that of CFOs in Q1. Perhaps a slight difference: We have found a higher proportion CHROs expecting conditions to remain the same over the coming months, rather than improving, compared to other members of leadership, at 48 percent—a finding that can be attributed to the labor market challenges that remain.

Part of our Confidence Index polling also asks members of the C-Suite about their rating of the current environment, on the same 10-point scale. According to our Q1 data, all agree on a 6.4 rating, with CEOs bucking the trend slightly with 6.3.

The Year Ahead

When asked to share their forecasts for their respective companies, 74 percent of CFOs project profit increases in the next 12 months, up from only 61 percent who said the same in Q4 of 2023. This proportion is now at its highest level since 2021.

Looking at the numbers on a more granular level, 42 percent expect profitability increases of less than 10 percent, while 32 percent expect a more bullish increase of least 10 percent.

The proportion of CFOs projecting increases in revenues is also up this quarter, by 4 percent, to 80 percent from 77 percent in Q4 of last year.

The proportion of CFOs who plan on adding to their company’s headcount in the months ahead rose to its highest rate since May 2023, to 58 percent.

Also at its highest rate since then is the proportion of CFOs who plan on increasing capex: 45 percent, according to our March data, an impressive 13 percentage point increase since last quarter. One of the CFOs we polled said he does see investments in business continuing to build as the economy regains speed, but he expects CFOs to keep a close eye on cost control and ROI for some time still.

Michael Polaha, senior solutions leader at financial automation provider BlackLine, a partner in our CFO Confidence Index, agrees. “The best evidence of companies returning to a growth mindsight we see is an accelerated engagement and decision-making cycle,” Polaha said. But even as CFOs become “more secure” in their operating environments, Polaha doesn’t expect CFOs will take their foot off the spending break too fast—or loosely. “CFOs may be redeploying capex, but they will continue to demand high ROI of their investments and seek out capabilities that can position their businesses to scale for growth and renewed volatility ahead.”

When asked about their debt and cash positions, 26 percent said they expect to increase debt (vs. 27 percent in Q4), and 56 percent plan to increase their cash position (up from 47 percent in Q4).

About the CFO Confidence Index

The CFO Confidence Index is a recurring flash poll of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index