Technology—specifically AI and GenAI—seems to be behind most headlines these days. Every facet of life now has a tech angle, and business leaders hope to gain from the lofty promises of new and emerging capabilities.

But first, CFOs have to budget the funds to those technologies. No problem, according to one CFO. “There is one sub-sector in technology getting budget approval, and that is AI,” Dave Jolley, former CFO of Domo, told us in July.

Many CFOs told us of plans for higher capital allocations to new technologies when polled the week of August 12 as part of StrategicCFO360’s CFO Confidence Index survey, conducted in partnership with BlackLine.

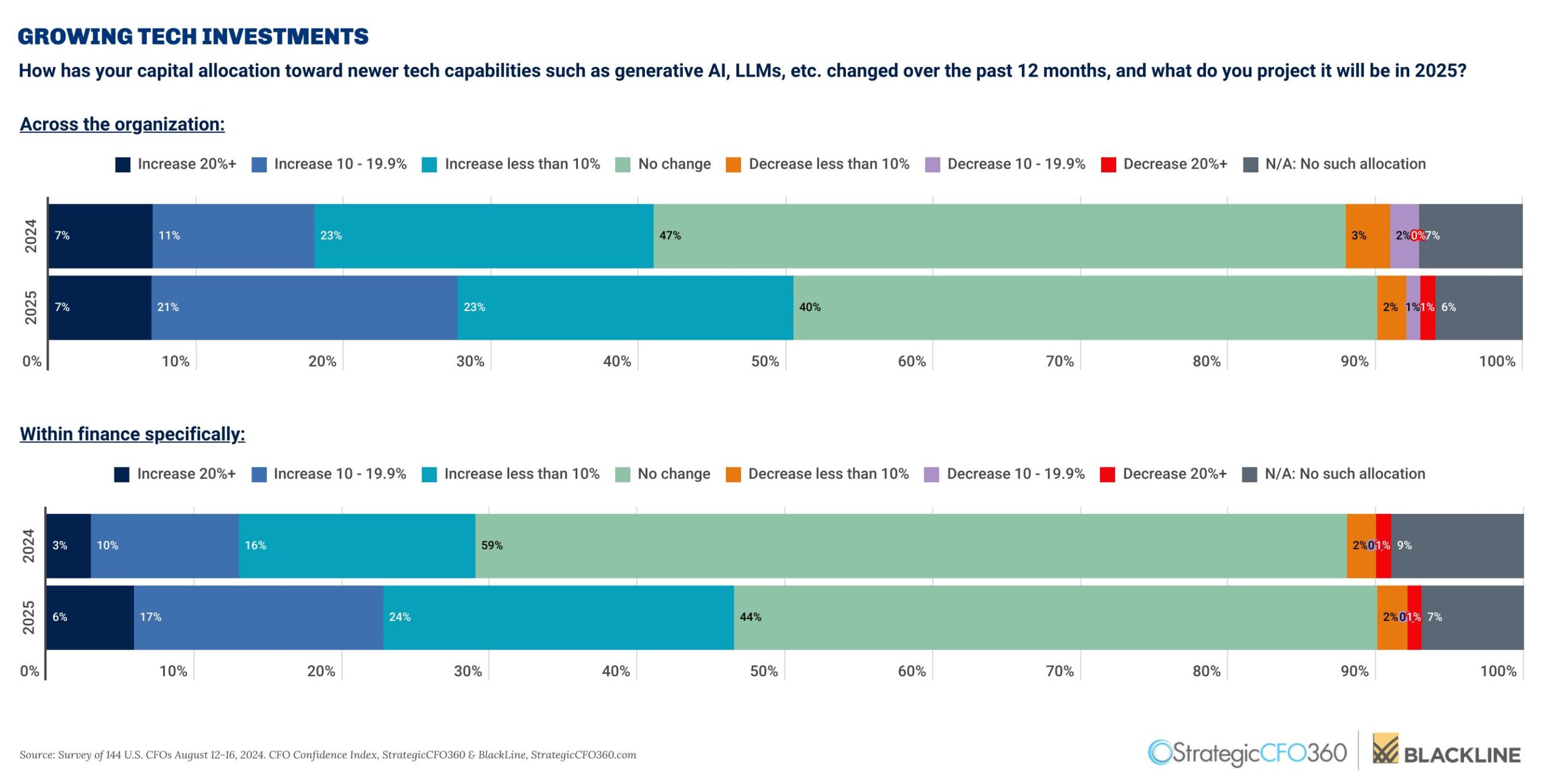

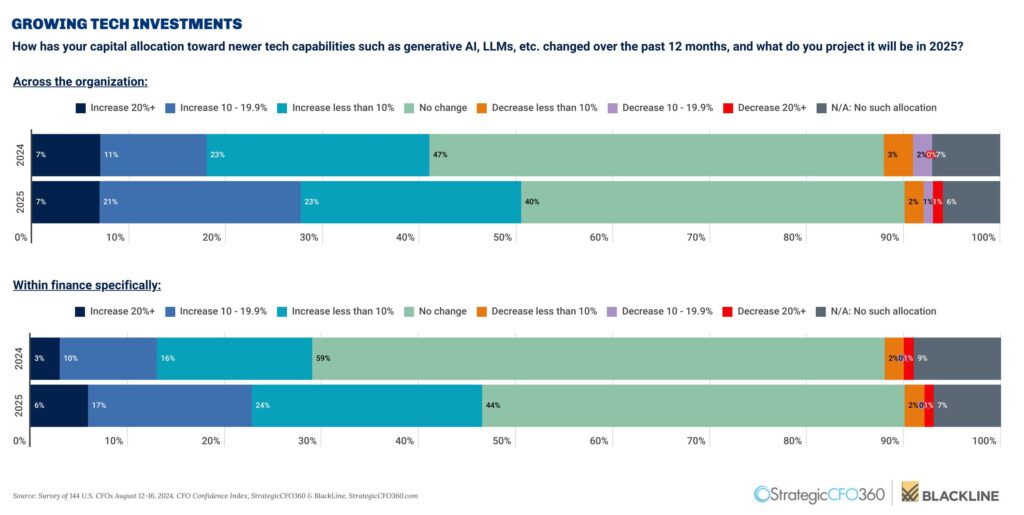

Going into 2024, 41 percent of the 144 CFOs surveyed said they had increased their allocation to new technologies such as GenAI and LLMs across their organizations, and less than one-third said they had upped their allocation for the finance function specifically.

Heading into 2025, companies are doubling down. More than half (51 percent) of the CFOs polled planned on increasing their investments into new technologies across the organization—and 47 percent indicated they would do the same for finance.

The uptrend in organizations allocating more capital to emerging technologies echoes what CEOs told our sister publication Chief Executive when polled earlier in August: 59 percent of CEOs said their organization’s capital allocation to new technologies rose in 2024, but 68 percent planned an increase for 2025.

CFOs indicated the size of the additional budget allocations is healthy. The proportion of CFOs who plan to boost spending on new technologies by more than 10 percent within finance, for example, was up 10 percentage points for 2025, to 23 percent from the previous year’s 13%. Organization-wide, 28% of CFOs plan an allocation increase of 10% or more next year, up from 18% in 2024.

Despite the flood of dollars allocated to new technologies like GenAI, CFOs will keep a trained eye on whether the higher expenditure is ultimately justifiable. According to our survey, 60 percent of CFOs expect to see a positive return on their investments within the next 3 years; a quarter of them (26%) said they want to see positive ROI even sooner—within the next 12 months.