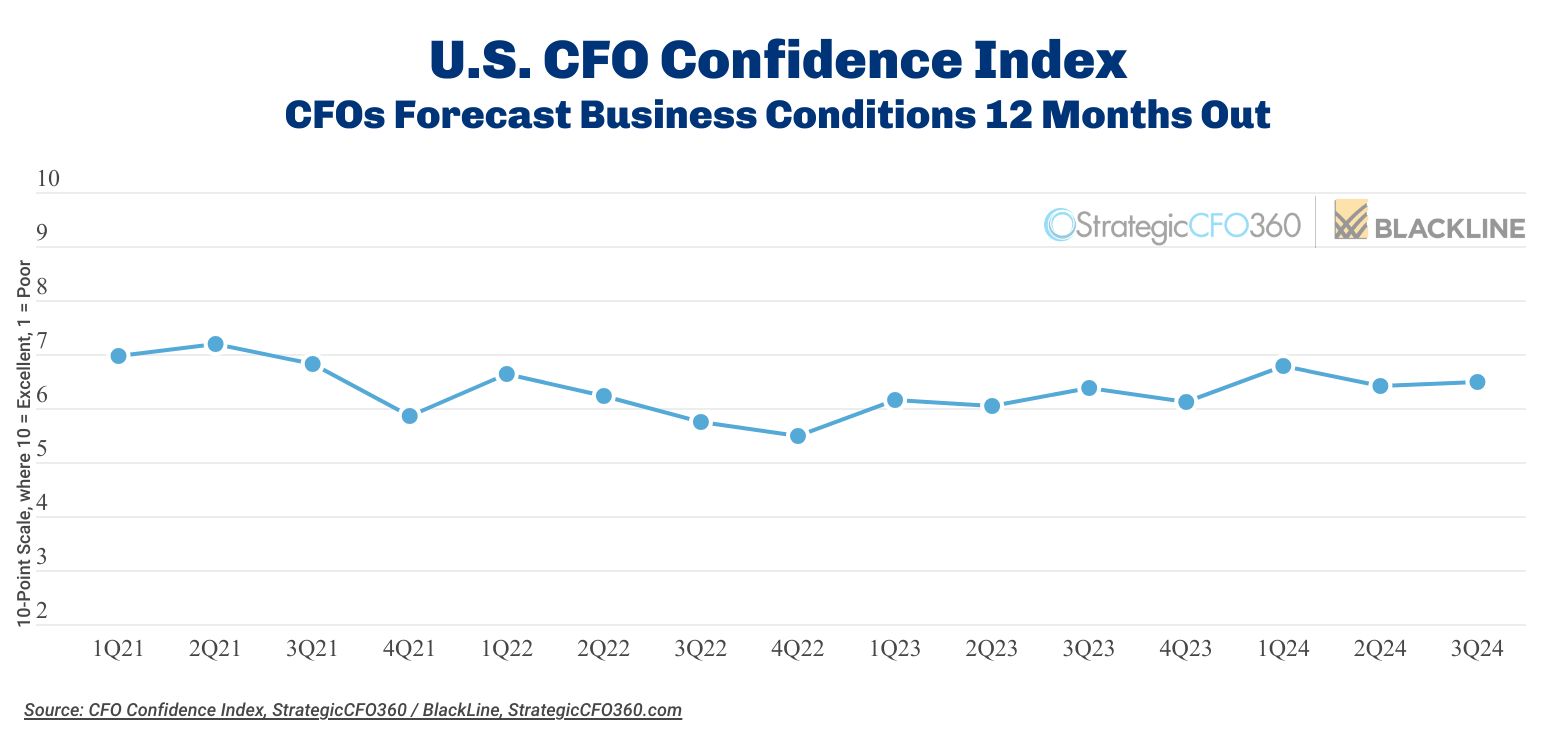

You wouldn’t guess it by the level of uncertainty and volatility across markets, the economy and the political environment. Still, a growing number of America’s CFOs are optimistic about the coming year when it comes to the U.S. economy. They are, in fact, the only member of the C-Suite we surveyed who, in August, raised their forecasts for business in the year ahead.

That is one of the key findings from our third-quarter polling of 144 CFOs conducted in partnership with BlackLine during the week of August 12. Data shows 49 percent of those CFOs polled expect business conditions to improve over the next 12 months—up from 44 percent who said the same in our second-quarter poll conducted last May.

Those surveyed in August say they now anticipate the business landscape to be at 6.5 out of 10 on our 10-point scale, where 10 is Excellent and 1 is Poor—up from their 6.4 out of 10 forecast last quarter.

In contrast, CEOs’ forecast decreased by 4 percent during that same period, when our sister publication Chief Executive polled them the first week of August. It is worth noting, though, that CEOs were polled amid a market dip, while CFOs were asked the same questions during the recovery. Still, board members at public companies also downgraded their outlook for the year ahead when Corporate Board Member polled them the same week as CFOs.

CFOs acknowledge the slew of challenges they continue to face—from price pressures and increasing cost of capital to regulatory volatility, political uncertainty and decreasing consumer spending—and have, as a result, dropped their rating of current market conditions to 6/10 in Q3 from 6.2/10 in Q2. However, many say they are confident the upcoming Fed rate cut will help remove some of those hurdles and provide better conditions for businesses and consumers by next year.

“Persistent consumer despite uncertain economy will get better with interest rate cuts,” said one of the surveyed CFOs who expects improvements in 2025.

“Interest rate drop will fuel demand,” echoed another.

Expecting a recession

Much of the rationale for the improved outlook this quarter is rooted in the idea that the upcoming interest rate cut—and, as many expect, others after that—will resolve some of the current issues businesses face. But several CFOs said there were two important variables that could upend all those forecasts: the outcome of the upcoming presidential election and the country falling into a recession.

“The main element is inflation. Next is the recent economic data pointing toward a recession,” said the CFO of a mid-sized private industrial company. “But the results of the 2024 elections may change my forecast.”

“The political environment poses challenges, and the election outcome is not certain to provide relief,” said the CFO of a public financial services company who said he expects the business climate one year from now to worsen—down to a 3 out of 10.

Overall, 55 percent said they expect the U.S. to fall into a recession in the near term, with 8 percent saying it would likely be severe. That is in line with CEOs’ forecast: 60 percent said they also expect a recession, 7 percent of which expect it to be severe.

“[We’re] going to miss the soft landing and hit a full-blown recession,” said Zach Taylor. CFO at Diversified Chemical Technologies. “Consumer debt will hit unprecedented levels and drive spending down. The lack of interest rate cuts has already seriously hurt the world’s economic outlook.”

Only 35 percent anticipate a soft landing.

“Interest rates are still relatively low, unemployment is relatively flat, hard landing vs. soft landing will vary by industry and will be difficult to predict, but the economy will still grow,” said one CFO in the consumer discretionary space.

Our data supports that statement, with significant fluctuations in sector recession forecasts. For instance, 20 percent of CFOs in the industrials, energy and communications services sectors forecast a severe recession in the months ahead, vs. 12 percent in healthcare, 9 percent in consumer discretionary and none across other sectors. In IT, one-third of the CFOs forecast a recession—but they expect it to be mild.

Interestingly, though, when we asked CFOs what actions they intend to take once the Fed cuts interest rates in September, nearly half (43 percent) said they’d do nothing. Among those who plan to act, scanning the market for M&A opportunities and reviewing existing supplier contract terms were most common.

While the Fed’s decision may not be a factor, our data shows that the proportion of CFOs planning to take on new debt increased in Q3 compared with Q2, to 24 percent from 18 percent. Those planning to reduce their cash position decreased to 19 percent from 23 percent; those adding to their cash fell to 49 percent from 53 percent in Q2.

Digging into the numbers

Despite expecting overall improved conditions one year from now, CFOs polled revised their individual companies’ outlook downward this third quarter:

- The survey found 71 percent of CFOs expect their company’s revenues to increase in the year ahead, down from 74 percent who forecasted increases when polled in Q2—the lowest percentage since Q2 of 2023, on the heels of the SVB-led bank run.

- But 58 percent of those surveyed in August said they expect profits to be higher one year from now, down from 64 percent who said the same in Q2. Looking at the data since the beginning of the year, the proportion of CFOs who forecast increased profitability over the next 12 months was 16 percentage points lower than in January (74 percent)—and the lowest on record since Q2 of 2023.

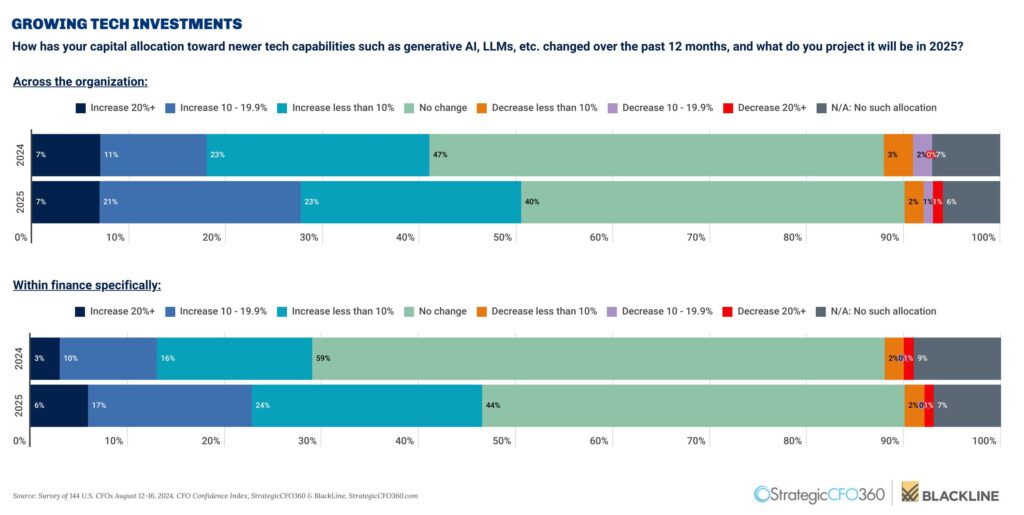

When asked about their plans for capital expenditures, 41 percent of surveyed CFOs said they would increase them over the next 12 months, vs. 37 percent who said the same in Q2.

Meanwhile, fewer CFOs project adding to headcount in the coming year, 39 percent, compared with 48 percent who had anticipated increasing hiring when asked in Q2. And of those who intend to hire over the next 12 months, almost all said the increase would be less than 10 percent. Hiring forecasts are now at their lowest point since we began fielding our CFO Confidence Index in the fall of 2020.

About the CFO Confidence Index

The CFO Confidence Index is a quarterly poll of CFOs and finance chiefs on their outlook for business and how policies and current events affect their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America at organizations of all types and sizes to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their companies’ revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index.