CFOs are now an integral part of the business decision-making process, partnering with their CEOs to lead expansion and drive value creation, says Nicholas Malone, CFO of E78 Partners, a consulting firm for the C-Suite.

However, the evolution of the CFO job has been slow to transform the perception of the career paths available to those in lower-level finance roles. That’s particularly true in corporate accounting, where many businesses face a talent shortage due to young people’s lack of interest in the profession.

The solution, in part, is about changing the perception that an accounting job means performing routine tasks in a spreadsheet day after day for years, like a line worker in a manufacturing plant pre-automation. Attracting the best professionals also requires communicating that people from various backgrounds and talents can find success in accounting and finance, says Malone, who earlier in his career served as CFO of Wayfair, Zagster and Examity.

In a recent interview with Malone, we discussed the accounting talent problem and how adopting innovative tech tools can be part of the solution.

What are the most common challenges that CFO clients and their companies face currently?

One of the biggest is staffing. Every year, private equity, the Big 4, Wall Street and hedge funds attract the lion’s share of the top finance and accounting graduates. That’s due to a combination of higher salaries and a general impression that investment analysis is more exciting and desirable than corporate accounting.

To secure young talent, many CFOs have had to adjust compensation, be more thoughtful in how they position the accounting career path to potential hires and use nontraditional resources to support and augment the office of the CFO (including outsourcing).

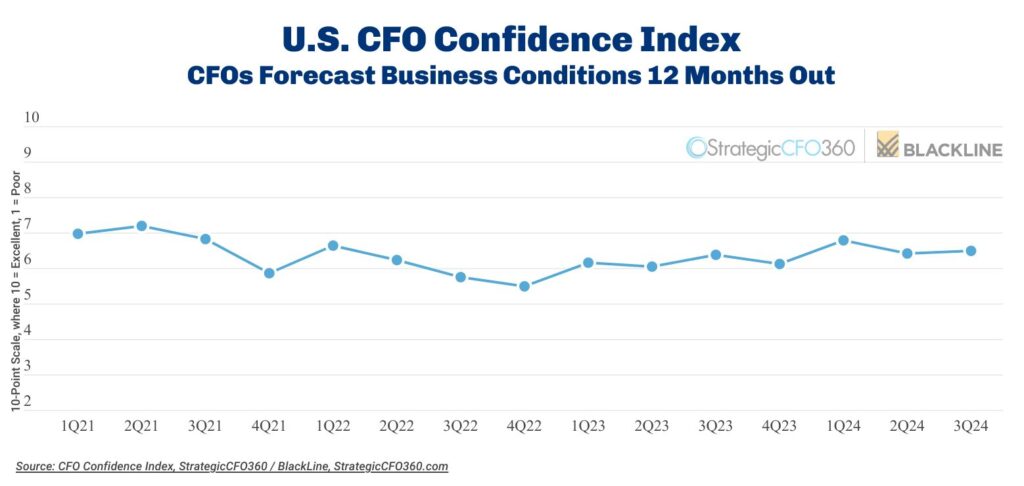

Another major issue for finance chiefs is that small and midsize companies have traditionally underfunded and ignored the CFO office. Corporate leaders often focus on growing the business and view finance and accounting as cost centers to manage instead of value-creation centers to prioritize.

That shortsighted thinking hinders the very growth they are trying to support. A lack of strong financial processes or infrastructure can cause major headaches when a company ventures into the market to raise funds. This is doubly true for companies on the cusp of an IPO, as publicly traded companies need a robust financial infrastructure.

How can CFOs attract more talent to their departments?

First, CFOs must accurately communicate what it means to work in accounting and corporate finance. It’s far from being in a “dead-end” job or deserving of the moniker “glorified bean counter.” The role of CFO, as has happened frequently recently, can be a stepping stone to other senior roles. Financial prudence and a strong understanding of the financial levers for value creation make a well-rounded chief executive.

Second, finance leaders must communicate that the [human capital] needs of finance and treasury departments have changed—people from various backgrounds can succeed in these fields. For example, forecasting continues to be one of the more important functions for CFOs and can be an exciting way to attract young talent to the field. Those with technical acumen are also increasingly valuable and may not know about the opportunities in finance to leverage their skills for career success.

How do you see new technology changing the finance department and the office of the CFO?

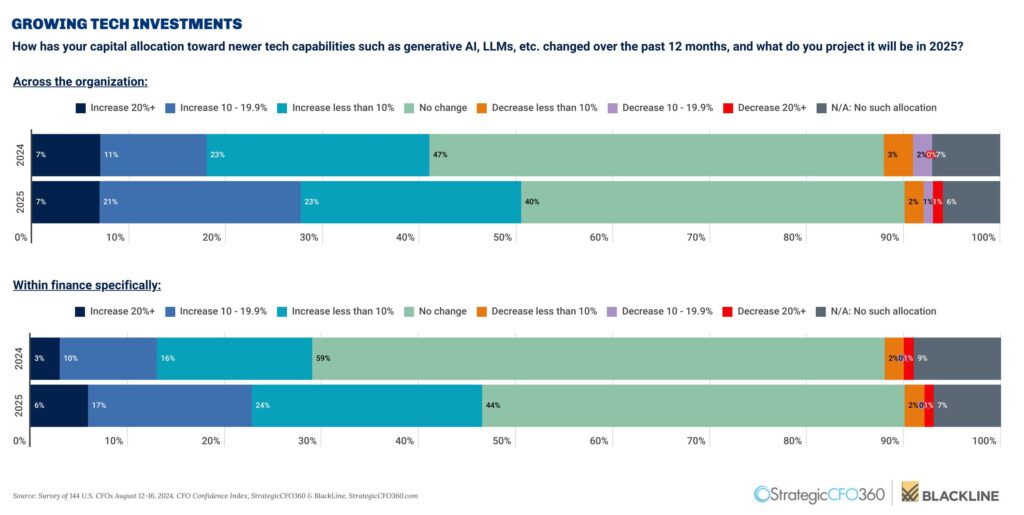

Companies are looking to data as a critical source of intelligence and value creation, but the data needs to be properly captured, analyzed and understood. New platforms and data approaches can equip finance with better situational awareness and a grasp of the business’s value-creation drivers.

Finance teams have traditionally relied on essential tools such as Excel. But today, CFOs should be looking to adopt more innovative tools for tasks like account reconciliation, forecasting and business intelligence. The latest software can eliminate much of the manual work that has traditionally bogged down finance teams.

What AI can do best is take on tedious, high-volume, routine tasks such as data entry, reconciliation and reporting, freeing up finance teams for more high-value work like strategic planning and oversight.

As financial forecasting and modeling become a larger part of CFOs’ responsibilities, they will benefit from AI-powered analytics tools that rapidly process and analyze vast amounts of structured and unstructured data. That will uncover hidden relationships, trends and opportunities that may not be apparent in traditional analysis. These insights will improve financial decision-making, company performance and offer a competitive edge.