Thirty years ago, if you told a CFO that being the caretaker of the organization’s data would be a strategic responsibility, they may have found it hard to imagine. Not so today. A single source of truth—enabled by robust data controls and governance—is a destination most organizations are still journeying toward. But getting there is essential to building a foundation for shaping and guiding smart business strategies.

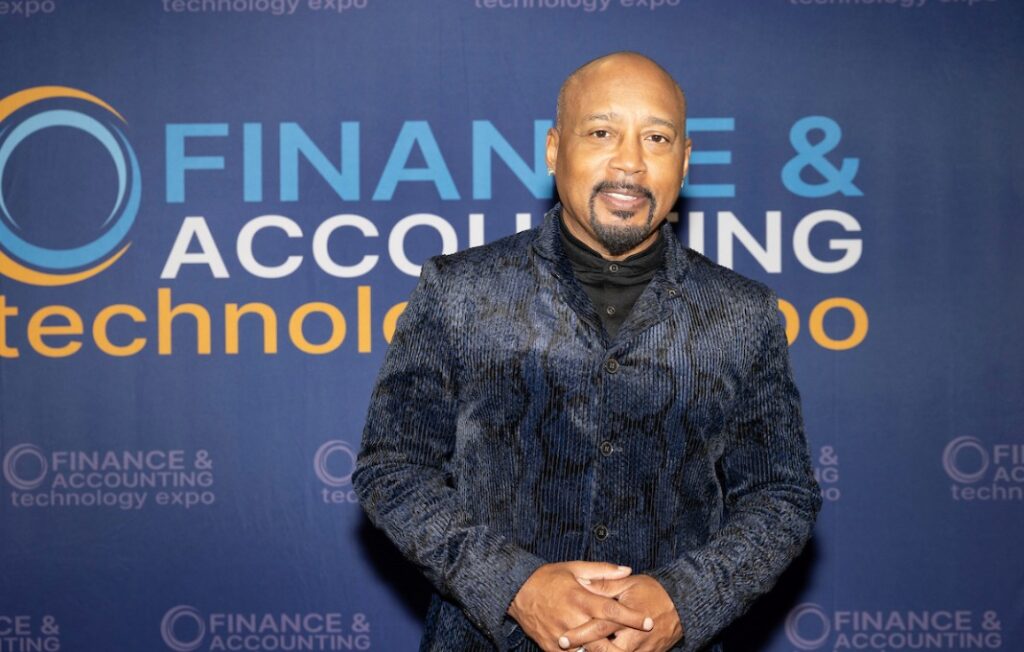

To discuss how CFOs have progressed beyond financial gatekeepers to data stewards, our Katie Kuehner-Hebert spoke with Aaron Levine, CFO of Toronto-based FP&A platform company Prophix. As the finance chief of high-tech companies for a decade, Levine has witnessed firsthand how vital data accuracy and integrity are to the modern enterprise.

You’ve held several CFO positions. How has your experience influenced your approach to addressing the needs of today’s finance teams?

Early in my career, I encountered the common pain points that many finance professionals face: an overwhelming volume of data, manual processes prone to error and constant pressure to deliver accurate financial reports under tight deadlines. One of the critical lessons I learned was the importance of leveraging technology to streamline financial processes wherever possible. Early in my career, I witnessed firsthand how manual data entry and disjointed systems lead to inefficiencies and errors.

Why is it essential for CFOs to be data stewards?

As data stewards, CFOs play a critical role in shaping and guiding their organizations’ business strategies. We are responsible for ensuring the integrity, accuracy and accessibility of financial data. That is why I advocate for robust data governance practices, so CFOs can help establish a single source of truth within their organizations. That enables better decision-making and strategic planning and elevates a CFO’s financial insights as a trusted source for others in the C-Suite. I’ve seen the ability to manage and interpret data effectively become a key differentiator for many successful CFOs.

The CFO-CEO relationship is built on trust. How does a new CFO start to build trust with their CEO, and what role does data play in that?

It starts with fostering a culture of honesty and openness, where clear and candid communication is prioritized from both sides. The CFO must be proactive in sharing positive news and potential challenges to provide a candid view of the organization’s financial landscape. Regular updates on financial performance, risks and strategic opportunities help keep the CEO informed and engaged, demonstrating the CFO’s reliability and forward-thinking approach.

Leveraging the unique perspective of the CFO’s bird’s-eye view of the organization’s data is also crucial. That vantage point allows the CFO to provide valuable insights that guide decision-making and drive successful business outcomes, showcasing the finance chief as a trusted adviser.

There’s a growing shortage of accounting and finance professionals. How do you recruit and retain talent for your company’s finance department?

We’re certainly aware of the challenges in recruiting and retaining finance professionals, a situation exacerbated by factors like an aging workforce and fewer students pursuing accounting degrees. To counter this, we focus on fostering a culture of continuous learning, offering flexible work arrangements and emphasizing professional development.

Some of my favorite employee benefits that I encourage every Phixer—as we are known—to take advantage of are our unlimited training reimbursements, our CPA Education Success Program, an optional week off for personal growth and our Circle of Success leadership development program. We provide that in recognition that the next generation of finance leaders is eager to develop into positions that go beyond day-to-day, routine tasks and deliver tangible value to the organization.