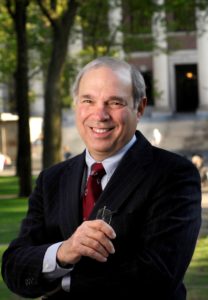

Jonathan Byrnes, co-author of the upcoming book, Choose Your Customer: How to Compete Against the Digital Giants and Thrive (McGraw-Hill Education, May 2021), has a message for CFOs: don’t give up.

A senior lecturer at the Massachusetts Institute of Technology, where he has taught logistics, supply chain management and integrated account management at the graduate level and in executive programs for more than 30 years, Byrnes also regularly advises CFOs and other key executives on strategic initiatives as president of Jonathan Byrnes & Co., a consulting firm he founded in 1976. By embracing change and finding your company’s niche, he argues, it’s possible to take on the Amazons of the world.

We talked with Byrnes about why traditional accounting categories are obsolete and how to target customers today.

How can companies best compete against the digital giants?

By providing services and experiences that can’t be replicated by the tech giants, no matter how much data they have, or how much automation they use.

Twenty years ago, we lived at the tail end of the Age of Mass Markets. In this prior era, the win strategy was to get big, so economies of scale would kick in, lower costs and boost profits. This started to break down with the spread of digital capabilities and internet availability, which allowed the emerging digital companies to segment their markets and target customers using captured customer data and algorithmic analysis. This accelerated the growing trend toward fragmented markets, which we call the Age of Diverse Markets. This means that managers have to choose which market segments to target, and which to avoid—the opposite of the win strategy in the fading Age of Mass Markets.

To best compete, companies need to target customers who the giants are carefully avoiding. This often means developing packages of physical products and related services that smaller, agile companies can do well, and that the digital giants carefully avoid. For many managers, this means shifting from pursuing all revenues with all-the-same products, to developing and providing semi-customized packages of products and related services to carefully targeted customers. This comes with higher costs, but then companies can potentially earn higher margins.

How can CFOs play a role in identifying and focusing on the customers who are the most profitable?

CFOs need to accomplish two things. First, they need need to match each element of revenue with the all-in cost of producing it. Traditional accounting categories cannot guide CFOs in repositioning their companies and growing their long-term profitability. In new transaction-based profit metrics and analytics, a SaaS product can create a full P&L on every invoice line. With this information, managers can determine the actual profitability of every nook and cranny of a complex company.

When we analyze companies using this process, we always find that about 20 percent of the customers—and products—produce over 150 percent of the profits, which we call “profit peaks.” On the flip side, 30 percent of the customers—and products—erode away over half of the profits, which we call “profit drains.” The rest of the company produces almost no profits but consumes about half of the company’s resources, and we call these “profit deserts.” This information is essential to choosing the right customers, and owning the winning market segments.

Second, CFOs can help their companies achieve sustainable profit growth by choosing the right customers. Managers who try to hold on to all of their revenues wind up with declining sales and plunging profits. Amazon and the other digital giants are expert at one thing: providing arm’s length service to small customers with incredible efficiency and huge network effects. This leaves a wide-open playing field that is defensible, profitable and fast-growing—but it requires that managers focus their resources, and say no to customers who don’t fit.

What other role should CFOs play in these endeavors to accelerate profitability and growth?

By helping to lead decentralized organizations that can better meet the chosen customers’ diverse and rapidly evolving needs. Today, different market segments have different needs. Being customer-centric means being specialized in meeting the chosen customers’ needs through all of the company’s processes and activities. If CFOs and other leaders haven’t aimed their companies at a specific market segment, they will wind up trying to be everything to everyone.

In the Age of Mass Markets, the win strategy was to get big by serving as many customers as possible in a largely all-the-same way in order to get the economies of scale that enabled them to beat their competitors. The classic centralized command-and-control organization was ideally suited for this need, and many top managers knew only this way to work. Today, fragmented markets require decentralized organizations, with teams of managers working closely together to meet the diverse and rapidly evolving needs of their diverse customers.

Like all people, managers tend to cling to the behaviors that led to success in the past, and this prevents them from being able to support their chosen customers’ diverse and rapidly evolving needs. CFOs are essential to getting this core company capability right.

For more from Byrnes, visit our sister publication Chief Executive here.