Predicting annual budgets has proven to be exceedingly complex with the past three years of shutdowns, pivots, inflation and overall market volatility. Using this (hopefully aberrant) data to forecast could be a risky strategy. Nonetheless, every CFO has to set a practical yet sufficiently funded budget for the 2024 fiscal year. This article will outline the key trends and performance indicators that should be considered when planning for growth and expenses for 2024. It’s worth noting that my projections do not operate under the assumption of a 10 percent budget increase.

The Cost of Capital

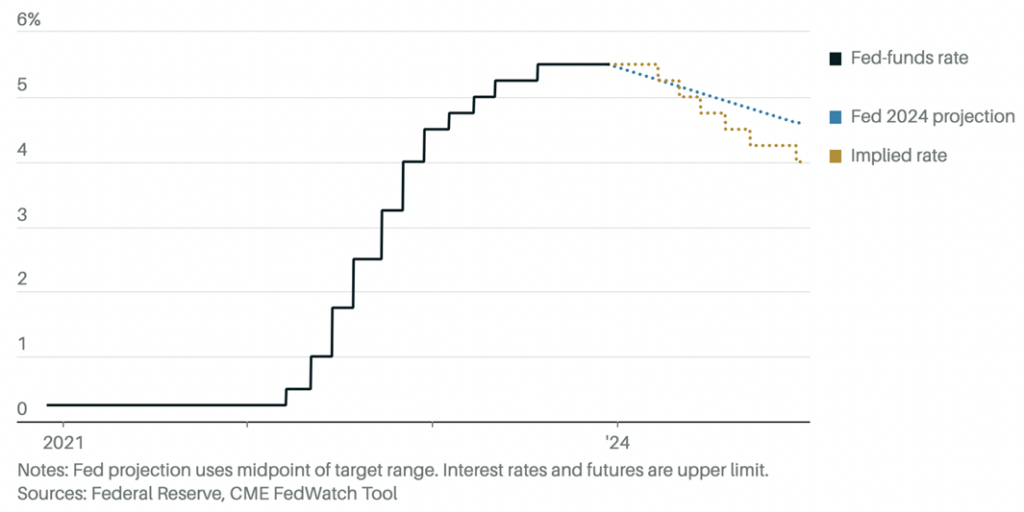

The U.S. economy’s resilience remains very uncertain in 2024, largely driven by the Federal Reserve’s efforts to control inflation. In the December 14 Federal Open Market Committee meeting, the Federal Reserve kept interest rates unchanged at 5.25-5.50 percent. And their projected three quarter-point rate cuts in 2024 were more conservative than the markets forecasted.

The cost of capital has skyrocketed since 2021 and, with these small rate cuts, access to it will remain tight in 2024. It’s more important than ever to scrutinize where money is going. Every expense, idea and department must be evaluated for its likely (not hopeful) ROI.

If you don’t have this granular data around spend and expenses, it’s time to get it. Fortunately, this doesn’t have to mean burdening your team with manual month-long analyses in Excel. Those analyses are plagued by version-control errors and then immediately obsolete. Instead, invest in real-time dashboards that can track spend against forecasts, flag anomalies, filter data and alleviate the reporting burden on the finance team.

Replacing New Headcount with Creative Tech Stacks

Almost every company is looking to accomplish more with fewer resources in 2024. In the past we could “throw people at problems,” but when new headcount is limited we have to be more creative and find efficiencies with software.

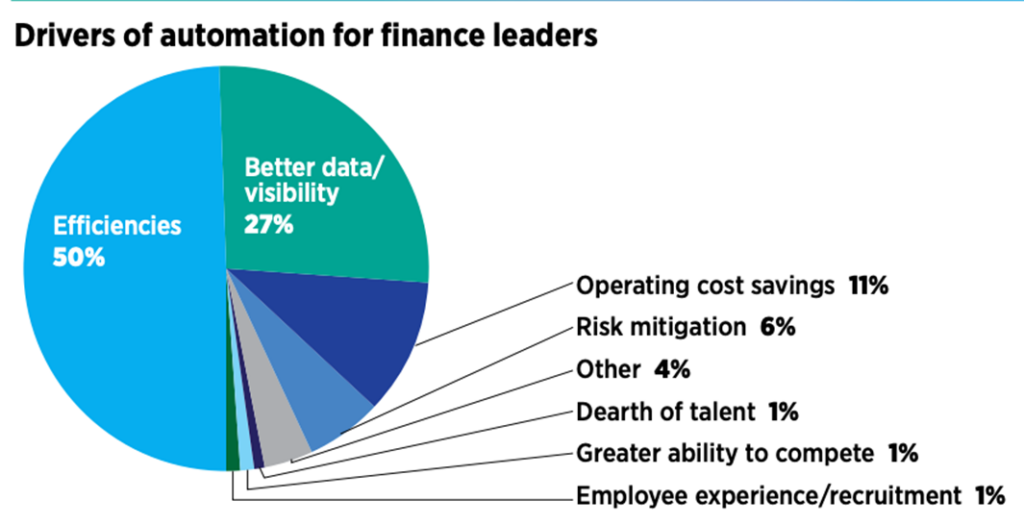

In a recent survey, 42 percent of finance executives said their highest priorities for 2023 were adoptingnew fintech or replacing legacy finance systems. Half were motivated by finding efficiency, versus 27 percent by better data visibility, and 11 percent by operational cost savings. It’s likely this sentiment will continue into 2024.

Even a small change could save hours each week. Instant virtual cards are such an example. Instead of having employees front expenses using personal cards, companies can issue virtual credit cards with a specific value for general expenses, for a fixed amount to be spent on a particular trip, or for a specific purchase or merchant. They’re more secure, give finance visibility into every card transaction in real-time, and automatically match receipts to expenses. Everyone saves time.

Start Budgeting from Scratch

If you simply pad your 2023 budgets by 10 percent, you’re also padding your waste and failed projects by 10 percent.

Instead, start from scratch using a zero-based budgeting approach. Regardless of what you spent last year, start over and freshly estimate what each department needs to hit their revenue and operational goals. It will take time, but it’s time well invested. If your finance team can’t find time for this strategic guidance, invest in automation to alleviate their busy work.

Accenture predicted that “automation can eliminate up to 40 percent of the transactional accounting work the finance department does today, [opening] your team up to creating business value through decision support, predictive analytics and performance management.” In short, what could your finance team do if they weren’t wasting days cleaning up data entry errors, investigating spending anomalies, reimbursing expenses or tracking down managers for approvals?