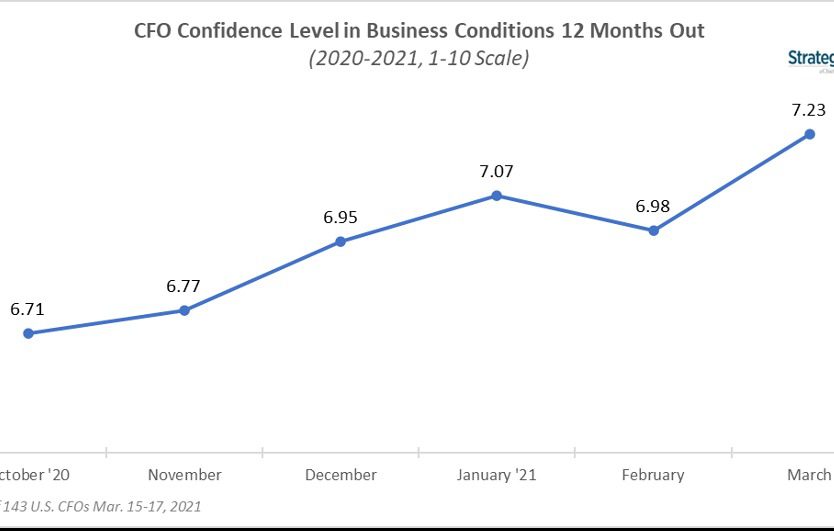

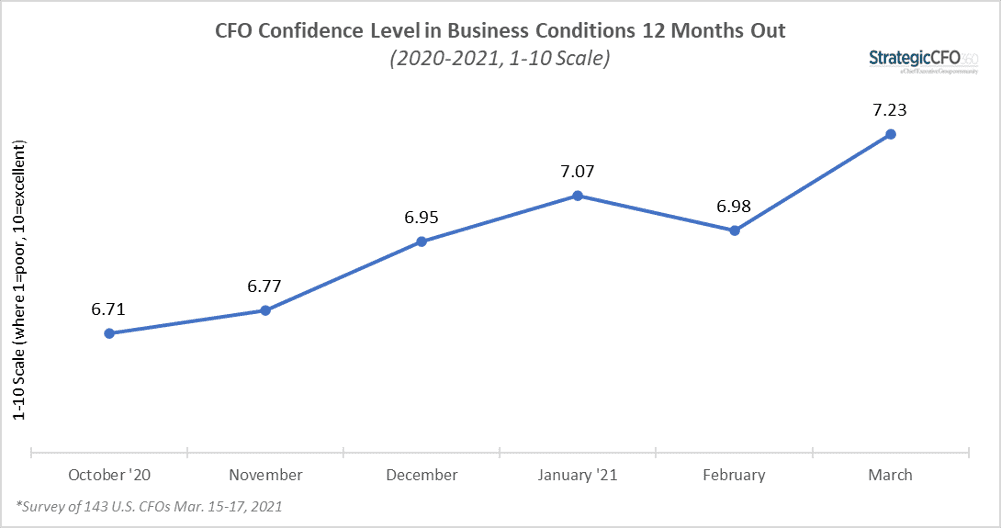

CFO confidence jumped nearly 4 percent in March on hopes of a recovery by the third quarter of this year. Many say they are encouraged by the ongoing vaccine rollout and the fact that many states are beginning to loosen their Covid restrictions—although some remain cautious due to inflationary fears and a tax policy they say could shrink consumers’ disposable income.

Those are the key findings from StrategicCFO360’s March reading of CFO confidence, conducted among 143 finance executives between March 15 and 17. The data shows a growing number of America’s finance chiefs are gaining optimism about the prospect of business conditions 12 months from now, rating their forecast a 7.2 out of 10 on our 10-point scale—up 3.6 percent since February. That’s 12 percent higher than their rating of current conditions, which they rate at 6.5 out of 10.

CFO confidence has now surpassed that of their CEOs, whose confidence in future business conditions stalled this month when polled by our sister publication, Chief Executive, two weeks prior. Looking at historical data, both groups nevertheless remain bullish on the business conditions they expect will be in place by this time next year.

CFOs have been concerned over the risk of inflation for some time now, citing it as a primary reason for their 1.3 percent drop in confidence last month, but many of the CFOs surveyed in March say they believe this risk will be offset by increasing consumer confidence resulting from widespread vaccinations and a release of pent-up demand, especially in the hardest-hit industries like entertainment and travel.

Sandra Molnar, CFO of WCIRB California, a mid-size financial services company, rates future conditions a 9 out of 10, up from her 6/10 rating of current conditions. She sums up many respondents’ sentiment when she says, “I am predicting that the loss of freedom and choices from the pandemic will result in a surge of spending once the vaccinations take hold, in terms of travel, socializing and personal gatherings.”

The recapture of freedoms in a post-Covid world is, indeed, a factor that is positively affecting the confidence of many members of the C-Suite, according to our CEO, CHRO and Director Confidence Index series.

Of the issues that could impact this forecast, CFOs say they are concerned over the new administration’s fiscal policy. “Government spending is out of control and the tax increases to follow will cripple should-be significant growth coming out of the pandemic,” says Thomas Harrison, CFO of Pioneer Services International, who doesn’t forecast any improvement in business conditions over the next 12 months, rating them a mere 5 out of 10. “We’re already seeing significant increases in fuel costs and this will cause inflationary problems that will suck all of the energy out of recovery,” he says, echoing some of his peers’ concerns.

Forecasting for the Year Ahead

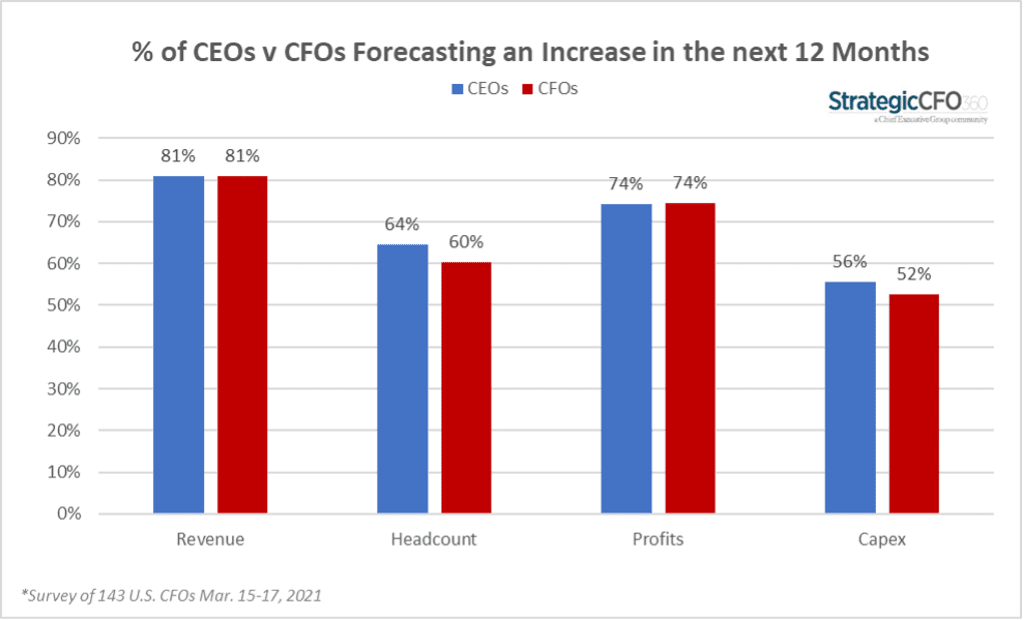

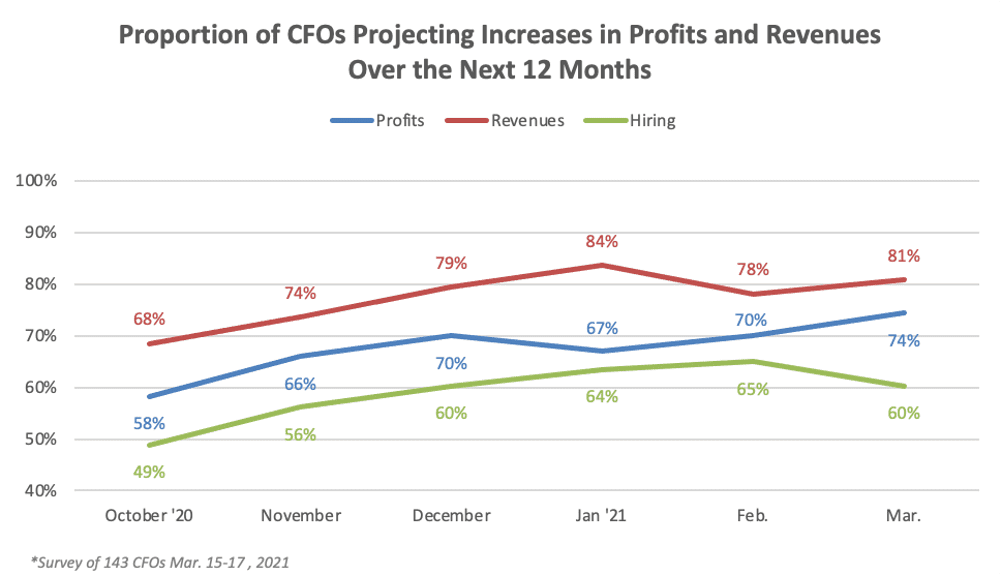

When asked to forecast their company’s profitability, revenue, capital expenditures and hiring plans over the next 12 months, CFOs and CEOs are aligned, with a growing proportion predicting increases in profits, revenues and capex over the coming year.

The proportion of CFOs projecting an increase in profits is at its highest this month since we began fielding the index in October of 2020, at 74 percent, which is 6 percent higher than last month. Although the percentage of CFOs predicting increases in revenues is not the highest we’ve seen, at 81 percent it is still 4 percent higher this month. CFOs’ projections for hiring are a bit bleaker, with 7 percent less CFOs predicting an increase in headcount since last month, now at 60 percent.

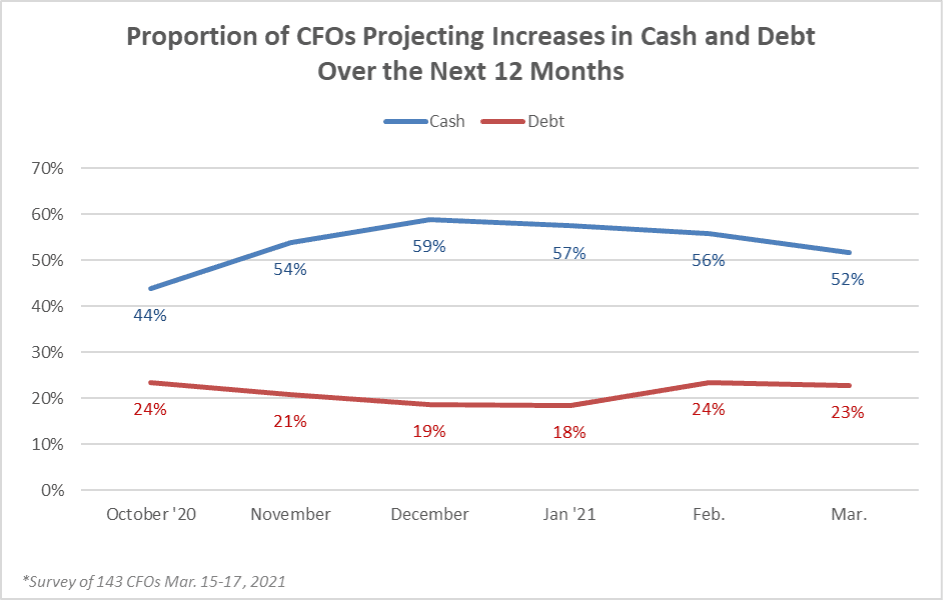

The proportion of CFOs expecting to increase debt remained steady this month, at 24 percent in February vs. 23 percent in March, and the poll shows a 7 percent decrease in the number of CFOs forecasting an increase in cash.

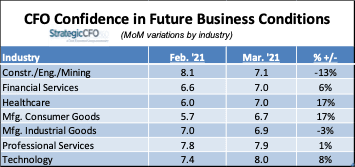

Sector View

CFO sentiment about future business conditions has leveled out across all industries this month, with forecasts hovering around a 7 out of 10, or “very good” according to our scale points. CFOs from the construction and industrial manufacturing sectors were the only ones reporting a decline in confidence, down 13 percent and 3 percent, respectively.

“All our predictive indicators are either down or flat. We’re hearing from both vendors and competitors that business is down. Until people go back to work and to some sort of normal again, the economy will be down,” says Chris Adams, CFO of New York-based Canfield & Tack, to explain his view of business in the industrial manufacturing sector. He rates current conditions a 4/10 and expects them to improve to only a 6 by this time next year.

On the positive front, CFOs in the healthcare and consumer manufacturing sectors reported the highest increases in confidence, 17 percent since February. One CFO in healthcare says that “patients being able to access healthcare to the extent they desire” will boost business conditions in his sector in the next year. For that reason, he rates future conditions an 8 out of 10.

The highest overall rating recorded in March is in the technology sector, where CFO confidence increased 8 percent month-over-month and reached its highest rating since we began fielding this survey in October 2020—at 8 out of 10. CFOs in this sector say they expect an explosion in consumer spending in the third quarter of this year and project a continuation of the technological revolution.

The CFO of a small technology company who is very optimistic about the future, rating it a perfect 10 out of 10, says, “We will come out of the pandemic by June 2021, latest by September. Different sectors of the economy will open up over the next few months and get to full speed over the next 12 months. Pent-up demand will give an extra boost to the economy. Growth rates will be high, as the comparisons will be to a low base,” he says, referring to current conditions, which he rates a 5 out of 10.

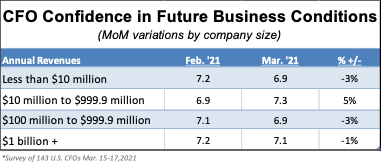

Size View

When looking at the data by size (by annual revenues), CFOs of middle-market companies remain the most optimistic about the future, rating it a 7.3 out of 10, up another 5 percent since the month prior. In contrast, both smaller and larger company CFOs (less than $100 million or $100 million+) report declining confidence, down 3 percent each since February.

Regional View

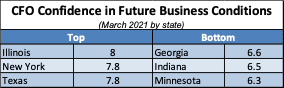

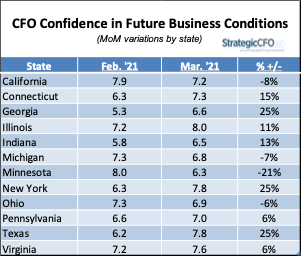

When looking across different states, the data shows great variations in confidence depending on where the CFO is located—from 6.3 out of 10 in Minnesota, to 8 out of 10 in Illinois.

When looking across different states, the data shows great variations in confidence depending on where the CFO is located—from 6.3 out of 10 in Minnesota, to 8 out of 10 in Illinois.

Among those with the lowest confidence levels, Minnesota, Indiana and Georgia CFOs say energy prices and lower-than-expected consumer demand are having a negative impact on their outlook. It is, however, worth noting that CFOs in Georgia, despite their relatively low 6.6/10 rating, have been showing increased confidence in the future month-over-month, up 25 percent since February, on the basis that they are seeing “continued recovery from Covid related issues and delays,” as the CFO of a construction company in the state explained.

CFOs in Illinois are the most optimistic, ranking future conditions an 8 out of 10, followed by CFOs in New York and Texas, who both rate future conditions a 7.8/10—both are also up 25 percent since February. Their reasons for this degree of optimism include visions of normalcy in spending and living habits, reaching herd immunity, increased investments in infrastructure, improved supply chain reliability and the release of pent-up demand by this time next year.

About the CFO Confidence Index

The CFO Confidence Index is a new monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CEOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index.