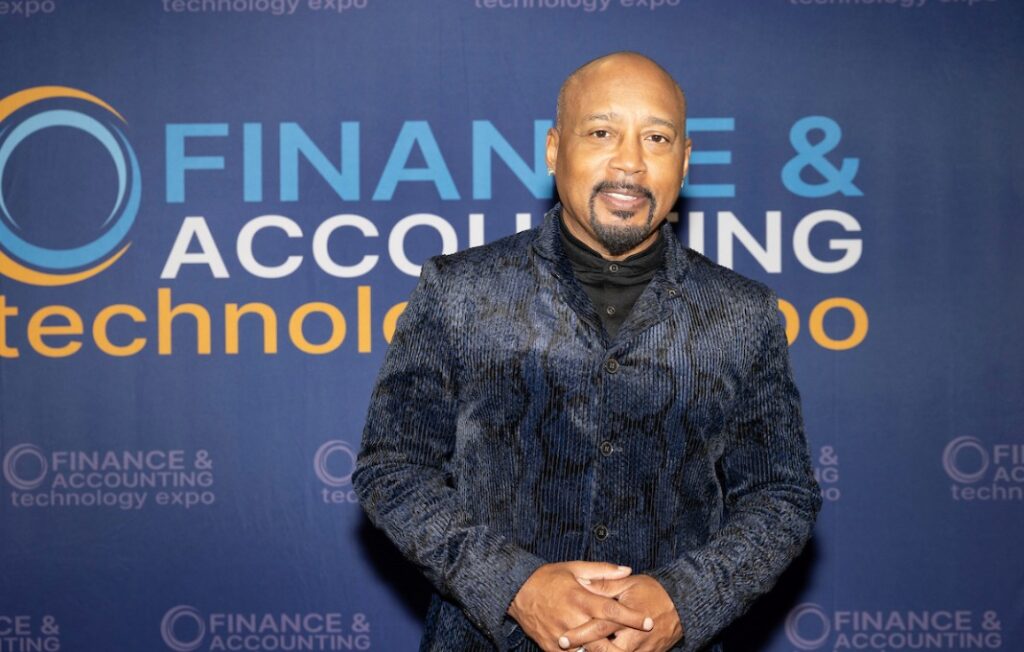

Intekhab Nazeer is a veteran of steering finance at young tech startups and helping them through impressive M&A exits. He’s now at a company in the latest hot market—supplying infrastructure to companies running massive AI workloads. Put simply, WEKA’s cloud-native data platform helps organizations manage GPUs so they run more efficiently.

The 10-year-old company has waited a long time for its day to arrive. WEKA raised $135 million in November 2022 and $140 million in an oversubscribed Series E round just last May; the post-money valuation for the Series E was $1.6 billion.

Nazeer, joining in 2020, was attracted by two things: the company had zero customer churn, and it was “landing and expanding” accounts quickly—winning a new account and expanding the customer’s use cases for WEKA in the same quarter.

What kind of foundation has Nazeer given the finance team since his arrival? What technology tools is WEKA using internally to stay on top of this rapid-growth market? Nazeer answers those and other questions below.

Can you break down the Series E round for us? It had a relatively unique feature.

The round consisted of $100 million in primary funding from existing investors, which was incremental capital to the company, and $40 million in secondary funding. The $40 million was to provide a liquidity event for our long-tenured employees, and it was at zero discount [employees could sell their common stock at the same price as the preferred shares]. This is the second time we have done a secondary for our employees. The company is 10 years old, and many of them have been with it for five, six and seven years. This was a way for them to share in our success and for us to thank them.

What is the incremental capital for?

We still had money left from a Series D funding in November 2022, but this market has just exploded. We needed immediate scale, including more investment in customer support and R&D, to be at the leading edge of innovation. We need a scalable IT infrastructure so we can mimic the test environment or clusters of our large customers. While we wanted to fortify our existing cash reserves, this [round] will also give us the option to scale the business and the product in accordance with the exploding needs of customers.

Was the global drop in venture capital funding a concern at all during the process of raising the round?

We had proactive investor interest. Companies that are impacted by trends like that aim for a large valuation. You can either go for a large valuation or a realistic valuation. WEKA wanted to go for a realistic valuation for a couple of reasons. If you go for a large valuation, the company has to grow [into] that valuation, which creates a lot of risk. Second, when we looked around, we saw a lot of corpses of newly minted unicorns, so we wanted to be responsible and ensure we had a realistic valuation. It was not a difficult round for us to close. It was a very good balance between not diluting [investors] too much and fortifying the company’s cash reserves.

What strategy have you employed to assemble the finance team and give it the right tools?

We have a global, lean and mean team across Tel Aviv, India, the UK, Asia Pacific and the United States. The team is basically comprised of accounting, FP&A and the local accountants in those territories.

My focus has been on process, system and people, in that order. In four years, we’ve come a long way. We moved from QuickBooks to NetSuite, and after process improvements, we now close the books in five days. We’re going live with a new budgeting tool, Adaptive Planning, this year, and we plan to hire more finance people in 2025 and beyond based on our growth.

Was budgeting software just the next logical tool to adopt, or was it a big pain point for the organization?

The annual operating plan is one of the most important parts of any Series E company. You can’t improve what you can’t measure. We must have a tool for departments to see, on the fly, how they perform against their operating budget or plan. This tool will enable them to do that in real-time.

In your LinkedIn profile’s “experience” section, you list “strategically priming sales.” What have you done in the sales area at WEKA?

When I started at WEKA, I collaborated closely with sales to help prime the company’s systems and processes for scalability. That included generating ideas to improve our CRM system, implementing SaaS analytics tools like Sightfull, working with our CRO to improve the forecasting methodology and helping sales optimize deal structures.

We are leveraging the capabilities of our CRM system at least 70 percent more than we did just four years ago. To monitor growth, for example, we now track TCV (total contract value), ACV (annual contract value), CARR (committed annualized run rate) and ARR (annualized run rate) for each opportunity.

We also use an AI sales forecast tool called Clari. Together with Salesforce, it allows us to simplify and standardize how we generate sales quotes. All of this has given us the ability to evaluate sales performance in detail and track the ROI of lead-generation activities.

What are your thoughts about the future uses of AI in finance?

I’m intrigued by what can happen in the future; anything is possible. It will be helpful in financial audits and sales forecasting. The third use would be [adding] AI to business intelligence tools. Once that happens, you’ll have an AI forecast of your budgeting model for the next three to five years, and it will encompass your company’s performance and what’s going on in the industry.