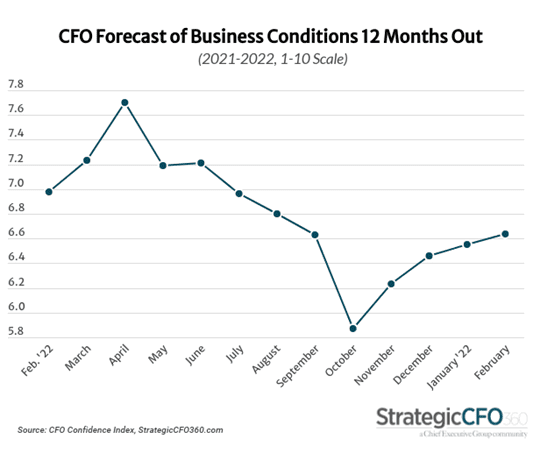

CFOs again gained confidence in February, boosting their rating of future business conditions by 1.4 percent. With the height of Omicron seemingly behind us and states repealing Covid-19 mandates, CFOs are looking to a brighter future where Covid-19 is endemic. Labor shortages, supply chain issues, inflation and subsequent price increases are casting their rating of present business conditions down, but many expect resolutions to the labor and supply issues soon.

Those are the key findings from StrategicCFO360’s February reading of CFO confidence, conducted among 62 senior finance executives between February 14 and 23. They rate future business conditions a 6.6 out of 10 on our 10-point scale, where 10 is excellent and 1 is poor. Their rating matches that of CEOs, whose rating fell by less than 5 percent, when polled by our sister publication, Chief Executive, earlier in the month.

CFOs’ rating of current conditions dropped by 4 percent this month, down to 6.4 out of 10, on continued inflation and a growing war on talent, coupled with geopolitical conflict.

The proportion of CFOs who expect business conditions to improve increased by 29 percent this month, from 35 percent in January to 45 percent now. The proportions of CFOs predicting worsening or unchanged conditions both declined this month and now measure, 30 and 25 percent, respectively.

Ali Firoozi, CFO of the PAC Group, a professional services firm, rates current conditions a 7 out of 10 and expects them to grow to an 8 in the future. He joins many CFOs when he says, “My rating would be higher if finding people was easier. There is business we cannot take on due to lack of staff.”

Danny Jordan, CFO at K and B Industries, an industrial manufacturing company, agrees with Firoozi that conditions will improve, rating them an 8 and expecting them to improve to a 9 over the course of the year. He says, “We expect demand to remain robust and a year from now some supply chain constraints will diminish to improve business conditions.”

Many CFOs agree that issues around the pandemic will resolve by 2023 and the business environment will prosper. However, others think that headwinds will tamper what growth is left after issues subside.

“Although we’re coming out of Covid, we are facing labor shortages, supply chain shortages, inflation and rising interest rates which are likely to cool off the economy and economic growth,” says KC Breen, CFO at Exchange Networks, a company in the advertising/media sector. He believes conditions will be stable and remain unchanged at a 7 out of 10.

Similarly, Robert J. Gold, CFO at AM General, a government contracting firm, believes that conditions will remain stable, at a 6 out of 10. “Although I think the shortages in the supply chain and labor will even out by early 2023, there is still significant risk of inflation that may drive a slower economy,” he says.

CFOs who believe conditions will deteriorate point to a long list of concerns including inflation, higher government spending, higher taxes, political instability, geopolitical conflict overseas and increasing uncertainty. They have been concerned already with the lack of skilled talent and myriad supply chain issues which they believe will help to cause worse business conditions one year from now.

Forecasting for the Year Ahead

After dropping at the start of 2022, the proportion of CFOs predicting increases in revenues clawed back most of January’s losses, up 7 percent to 79 percent. The proportion predicting increases in profits also climbed, up 2 percent since January, now at 60 percent. Both metrics are still at smaller percentages than CEOs, 81 percent of whom expect increases in revenue and 69 percent of whom expect the same for profits.

The proportion of CFOs planning to increase their capital expenditures over the next 12 months jumped 14 percent to 57 percent on an expectation that interest rates and inflation will stabilize by this time next year. This is the highest proportion since July—but still squarely below the 62 percent of CEOs.

The proportion of CFOs expecting to boost their hiring fell this month, down 6 percent to 57 percent and over 20 percent below the proportion of CEOs who expect the same, at 72 percent.

A higher proportion of CFOs are now expecting to add to both their cash and debt, up 23 and 8 percent, respectively. Now, 60 percent of CFOs plan to increase their cash and 28 percent plan the same for their debt.

Additionally, 80 percent of CFOs say that they will be increasing prices due to inflation. Twenty percent say they will be keeping prices the same and none will be decreasing prices.

Of those CFOs increasing prices due to inflation, 34 percent will increase prices between 2.5 and 4.9 percent. Almost a quarter of CFOs will be increasing prices by 5 to 7.49 percent and 19 percent will increase prices less than 2.5 percent. Only 2 percent of CFOs are increasing prices more than 20 percent this year due to inflation.

Wage increases are not to be counted out. CFOs report that, on average, the employees at their company will be seeing a 4.45 percent boost in their salary in 2022 and a 3.48 percent gain in their bonus/commission.

When it comes to their salary, CFOs say that in 2021 they saw an average increase of 3.49 percent compared to 2020. Their bonus increased by 2.75 percent, on average, along that same time. For this year, CFOs expect an average salary increase of 5.1 percent in 2022 compared to 2021 but are reporting a slight average drop in their bonuses, down almost 1 percent, compared to the record-breaking bonuses given out in 2021.

About the CFO Confidence Index

The CFO Confidence Index is a monthly survey of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every month, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index