Last time we polled CFOs on their forecast for business in the U.S. was in the aftermath of the SVB-led bank run. And even then, nearly half of them had said they were optimistic the business landscape would rebound in the near term and that the threat of a recession was waning.

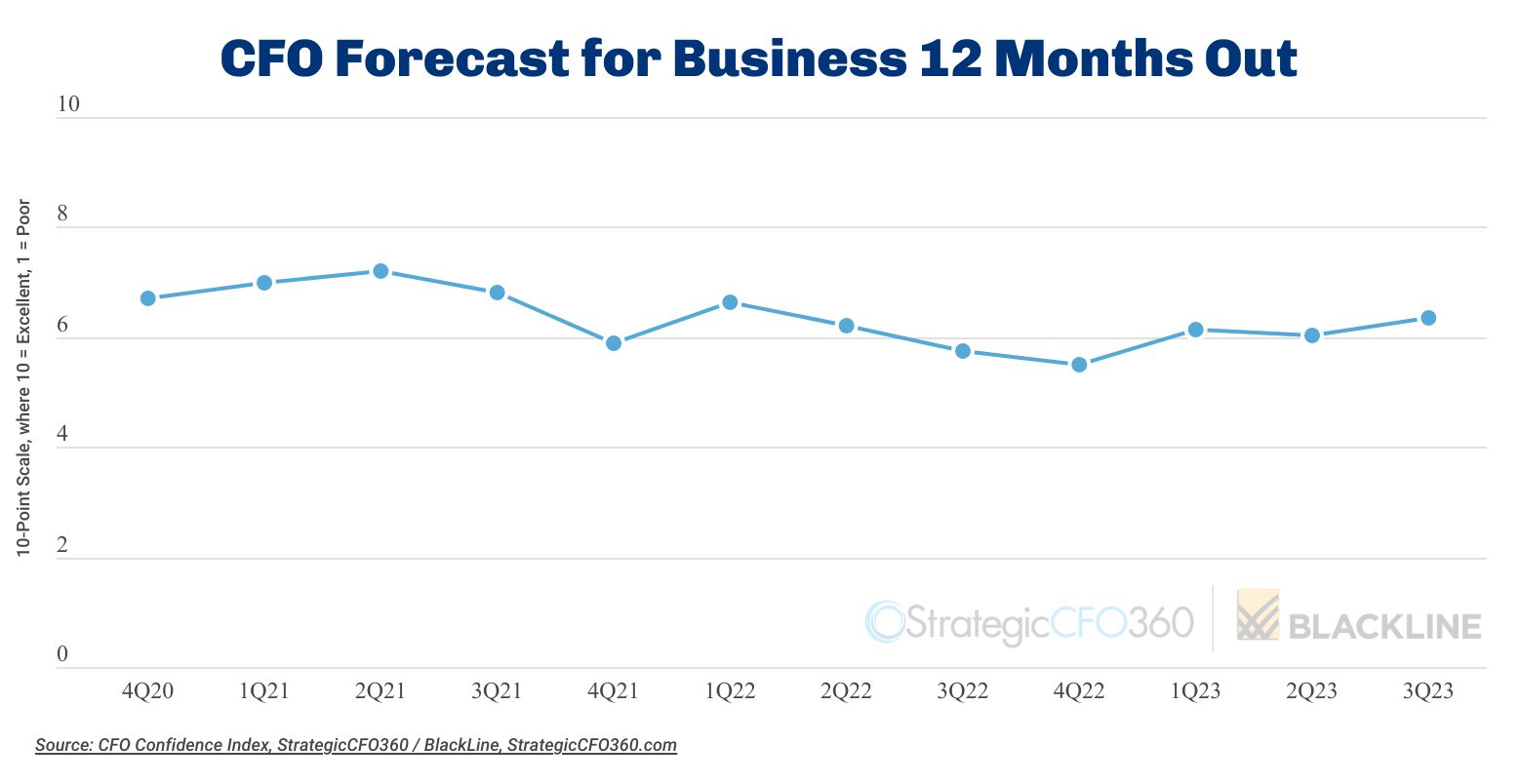

This month, as part of StrategicCFO360’s Q3 CFO Confidence Index, conducted in partnership with BlackLine, the 170 CFOs polled are upping their forecast for the year ahead, expecting the U.S. economy to rank 6.4 out of 10 (as measured on our 10-point scale where 10 is Excellent and 1 is Poor)—an increase of 6 percent since Q2 and the highest rating given in over a year.

At that level, our leading indicator, which measures CFOs’ projection of business conditions 12 months out, has now rebounded 16 percent since its low of 5.5 last fall and is halfway to a full recovery to the high of 7.7/10 recorded in April 2021.

CFOs’ rating of current business conditions also ticked up this quarter, though by a smaller margin, from 5.9 in Q2 to 6.0 in Q3. While that takes the Index out of “Weak” territory, according to the scale labels, it is also far from being firmly anchored in “Good” territory.

It’s perhaps for that reason that some CFOs say they’re not taking any chances, shifting strategies to prepare for the eventuality of a downturn. “We’ve downsized a bit to fit to current market conditions and will have improved inventory and some key processes as we roll into 2024,” said Michael Childers, president and CFO at Weisser Distributing, Inc.

“We have refocused our business and were able to reduce headcount to align with technology changes that positively affect our revenues and cash flow,” echoed Eileen Doody, CFO at Durham, North Carolina-based software company Percona.

Terry Curtis, CFO at Comtrade Group BV, says the uncertainty and volatility found in his sector—and many others—have motivated companies to adopt a more conservative approach going forward. And while he, like so many of his peers, expects conditions to improve in the year ahead, he nonetheless expects conditions to impact the bottom line.

Several other CFOs indicated they had taken action to improve their company’s agility and preparedness to weather a potential downturn. “We’re making changes in the business by adding additional business development resources,” said Nate Cohen, CFO, Cohen Woodworking.

“Taking a laser–beam approach to how we work has indeed become paramount for organizations,” said Michael Polaha, SVP finance transformation and strategy at BlackLine, our partner in this research. “Not only does it help buffer economic conditions, it’s also an accelerant to profitable growth as macro-economic conditions pivot.”

But beyond internal factors, the CFOs polled said they also see positive external signs of a near-term recovery, from slowing inflation to persistent demand, to the belief that by this time next year, the Fed will have begun cutting rates again.

“Interest rates should be on their way back down,” said Michael New, VP finance and operations at learning solutions provider Tracom. “Talk of recession should have faded by then.”

“We have not seen a significant decrease or a slowdown in projects and strategic initiatives from our client base,” said Pelageya A. Kostenko, VP of Finance at PathGuide Technologies, Inc. “Growth projections for 2023 are on target, and we expect the same in 2024.”

Meanwhile, others say there is still too much uncertainty in the U.S. and global economy to be certain a recovery is imminent. They cite the continuation of the war in Ukraine, a still challenging labor market and a Fed that has not given any signs of easing anytime soon as reasons for their caution.

“Labor costs continue to rise, inflation is still on the horizon, and supply chain issues are the norm now,” said Patricia Brewster, CFO at All Medical Research. “Interest rates are still rising, and the economy is slowing down. Next year will be a contraction year.”

The good news is that only 22 percent of CFOs said they expect things to deteriorate over the next 12 months, down from 26 percent in Q2 and from 36 percent in Q1—a clear indicator that despite the caution among some, concerns are waning.

But that doesn’t mean CFOs expect clear skies ahead either. The proportion of CFOs who expect things to improve slid in Q3, albeit slightly, from 44 percent to 42 percent. Instead, 36 percent said they anticipate more of the status quo (vs. 26 percent the previous quarter).

Those numbers are in line with those of CEOs, whom our sister publication Chief Executive polled July 10-13. Among the CEO community, we found 44 percent who said they expect an improvement in the business environment 12 months from now, vs. 27 who expect things to worsen and 29 percent who anticipate the status quo.

In fact, CFOs and CEOs have been in lockstep for months now, faltering only once in Q4 of 2021, when labor shortages, supply chain disruptions and rising inflation had carved a significant roadblock to meeting growing demand, sending CFOs’ assessment of the year ahead sharply down.

The Year Ahead

When asked how all of this is likely to affect their own companies, here too CFOs remain, for the most part, optimistic.

The proportion of CFOs forecasting increased profitability a year from now rose to 61 percent in Q3, from 56 percent in Q2 (and up 31 percent since hitting a low of 46 percent last fall). And the proportion of CFOs expecting revenues to grow over that same period jumped to 74 percent, from 66 percent in Q2.

Interestingly, while a growing proportion of CFOs said they plan to increase capital expenditures in the year ahead—35 percent vs. 30 percent in Q2—the proportion planning to increase hiring fell to 49 percent from 53 percent in Q2. Many said the cost of labor is just too expensive right now, and new technology has helped them streamline operations—at least for the time being.

BlackLine’s Polaha said he’s encouraged by this finding. “It’s imperative for companies to continue to optimize their processes, technology and operating model to drive efficiency and scale to maximize investment in those solutions that deliver substantive value to their customer base,” he said.

About the CFO Confidence Index

The CFO Confidence Index is a recurring flash poll of CFOs and finance chiefs on their perspective of the economy and how policies and current events are affecting their companies and strategies. Throughout the year, StrategicCFO360 surveys hundreds of CFOs across America, at organizations of all types and sizes, to compile our CFO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at StrategicCFO360.com/CFO-Confidence-Index