Change is upon us. Business leaders are being asked what their AI plan will look like in the next year and how to get a handle on it as soon as possible. Chief financial officers, accounting, FP&A and internal audit teams are at the cusp of a digital transformation, and the disruption is expected to be unlike anything seen before.

So, how do you empower your teams to drive change, mitigate risks, and ensure compliance across complex organization structures while satisfying boards and other stakeholders?

Here are five key strategic considerations for CFOs to maximize AI readiness.

Cut Through the Noise

CFOs need to develop a sound understanding of which AI technologies today are sufficiently mature and productized for deployment in finance. “AI” is a broad term found in technologies that usually have very specific capabilities. While large language models such as ChatGPT are built for language applications, they do not serve well for numerical (i.e., financial) data.

Some software vendors are touting AI in their sales and marketing pitches. Developing a sufficient understanding to separate promise from actual capability is essential.

Based on a solid understanding of the technical playing field, you must identify clear use cases where AI can deliver measurable benefits. Focus on AI that will impact finance and accounting productivity improvements and will scale for large financial ledgers and operational data sets.

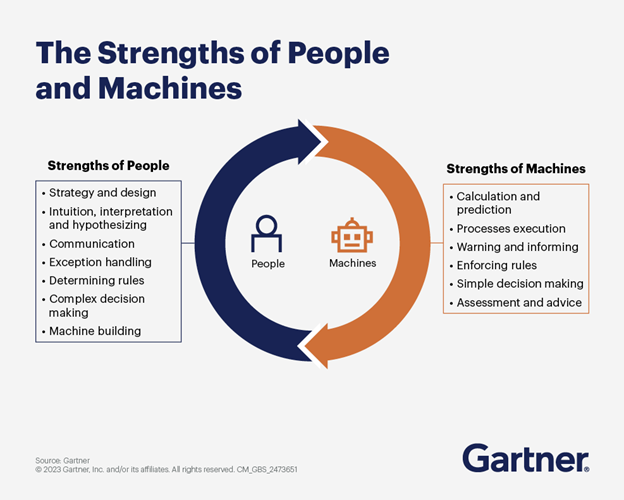

One way to think about AI use cases is in the following dimensions:

Align with your Organization’s Strategic Objectives

Before diving into AI implementation, CFOs must align AI use cases with the organization’s strategic objectives. When developing a first draft of a strategic “AI roadmap,” it is helpful to prioritize tools and use cases based on their potential implementation speed, estimated cost and impact.

- 92 percent of AI deployments are taking 12 months or less

- Organizations are realizing a return on their AI investments within 14 months

- For every $1 a company invests in AI, it is realizing an average return of $3.5X

The business opportunity of AI, IDC November 2023

Leadership will need to engage key stakeholders across departments to ensure that AI initiatives are aligned with broader organizational goals and to foster collaboration. Additionally, conducting preliminary tests and evaluating initial results can provide valuable insights to refine the AI roadmap before full-scale implementation.

Form an AI Advisory Committee to Determine the Priorities

The committee can conduct a proper cost-benefit analysis to assess the financial implications of AI adoption over the long term. By evaluating both the upfront costs and the expected ROI of AI priorities and tools, CFOs can make informed decisions about the financial feasibility and sustainability of AI investments.

This can ensure new investment strategies are aligned with business objectives. By leveraging these analyses, CFOs can enhance transparency and accountability in decision-making processes, fostering trust among sponsors.

Ensure Data Quality, Privacy and Governance

The success of AI in finance depends heavily on the quality, accuracy, and governance of data. CFOs must prioritize data quality initiatives to ensure that AI algorithms are trustworthy and can access clean, reliable data for analysis and decision-making. While this is universally true, keep in mind that finance departments already “own” one of the cleanest data sets available: Financial (ledger) data that can be leveraged for high ROI AI initiatives.

Privacy is another important consideration. How do specific AI tools store and use the data they ingest? The current situation remains dynamic. Vendors are adapting. For example, OpenAI, ChatGPT’s maker, recently announced a change to not retain prompt (i.e., customer) data. Equally, privacy teams are still learning and adapting to the new technology and products.

Foster a Culture of Innovation and Collaboration to Drive AI Adoption

It is imperative to promote cross-functional collaboration between finance, IT and other business units. This helps expedite and identify opportunities for AI innovation and experimentation.

CFOs should start within the finance department to encourage open communication, knowledge sharing and continuous learning to embrace AI technologies and explore new possibilities. By creating an environment that values innovation and encourages experimentation, CFOs can unleash the full potential of AI in finance, lead by example, and drive sustainable growth and competitive advantage.

How Will You Start Your AI Journey?

AI offers immense potential to transform the finance function and drive organizational value. By considering these five key steps, CFOs can maximize the benefits of AI in finance while ensuring that it’s worth the costs. By cutting through the noise, aligning with strategic objectives, forming an advisory committee, ensuring data governance, and fostering a culture of innovation and collaboration, CFOs can harness the power of AI to drive efficiency, enhance decision-making and unlock new opportunities in finance and accounting. Re-emerge as the “AI-powered CFO” and position yourself as the strategic navigator for your organization’s data-driven transformation.

Seize the opportunity to accelerate your AI readiness with a complimentary MindBridge AI for Finance and Accounting Strategy Session. Let MindBridge guide you through unlocking the power of AI to enhance your role and drive organizational change. Learn more.