Healthcare represents one of a company’s largest, most unpredictable and growing expenses. The average premium for employer-sponsored family coverage has increased by 20 percent over the last five years and 43 percent over the last 10 years. In 2022, the average annual premium for employer-sponsored health insurance was $22,463 for family coverage, according to the Kaiser Family Foundation 2022 Employer Health Benefits Survey.

The numbers tell the story as healthcare costs continue to rise for companies and their employees. Employers are faced with difficult decisions around absorbing higher costs that negatively impact their margins or passing along those increases to their employees. Employees, in turn, are left struggling to afford the higher deductibles and having to make tough compromises around their family’s finances to pay for healthcare.

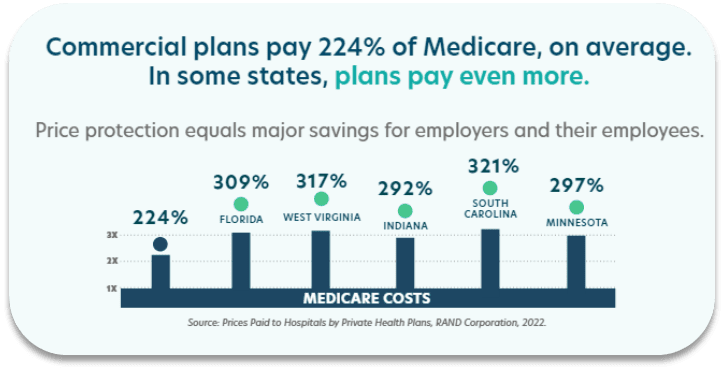

One of the most debated topics is whether costs are fair, reasonable and sustainable for businesses, employees, families and the economy. A 2022 RAND Corporation Health Study shows that employers have been paying unreasonably, in part because of the inability to compare costs between facilities or negotiate directly with hospitals. The study found that, on average, employers pay 224 percent over what Medicare would pay for the same service at the same facility. In some states, employers are paying well over 300 percent.

As financial executives, you understand all your organization’s expenses. You research and know in advance what it will cost to lease an office space or implement a new data processing system. You comparison shop, negotiate and make informed decisions to ensure the best deal. With healthcare, this is not an option. It all boils down to limited transparency and substantial fluctuations in hospital pricing which make that approach practically impossible.

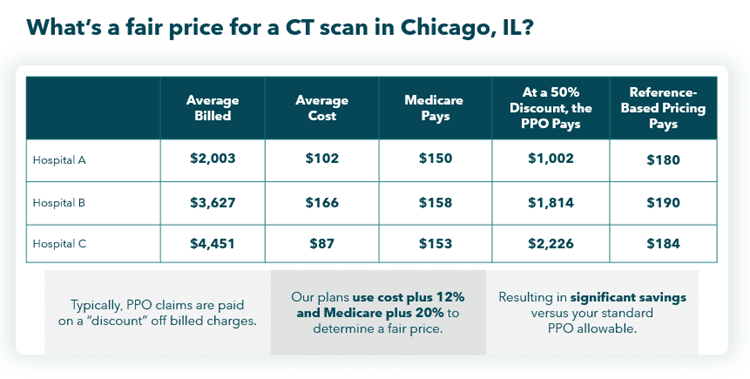

The Preferred Provider Organization (PPO) model promised to be the answer employers were looking for to provide healthcare to their workforce. PPOs give discounts to subscribers for healthcare services that fall into approved hospital and provider networks. But while a discount may seem helpful in controlling costs, the amount of the billed charge is almost always inflated. A hospital’s charge and an insurance company’s negotiated discount are arbitrary figures that can fluctuate widely within the same hospital system, let alone the same geographic area. In some instances, the provider’s chargemaster contains billed charges marked up by as much as 2,000 percent. This raises the question, is a 40 percent discount on inflated charges the best value for employers?

Employers have the right to know what they are paying for healthcare. With proper knowledge, smart healthcare decisions and awareness of cost-saving solutions, employers can reign in these expenses while still providing quality benefits to employees. The key is to treat healthcare like you would any other business expense.

A solution that can produce significant savings

Like many employers searching for ways to reduce costs, businesses are switching to a reference-based pricing (RBP) self-funded healthcare solution. RBP is an increasingly popular healthcare model for companies who choose to fund their own healthcare. While self-funding is already a cost-saving route for many mid- to large-sized businesses, reference-based pricing can elevate the savings even further.

With RBP, an employer pays for a healthcare service based on a specific reference point—often Medicare or the actual cost it takes to deliver the service—plus a fair margin rather than an inflated and variable chargemaster rate, on which traditional PPO models are based.

The positive ripple effects of reference-based pricing can be transformative for any employer. Businesses that have made the switch to being self-insured and adopted an RBP model have experienced deep savings on their healthcare costs year over year. These savings have allowed executives to invest back into their businesses, provide enhanced employee benefits and perks, and improve employee recruitment and retention. Consider the case of a Florida-based technology company that saved $1.5 million in their first year utilizing RBP and was able to offer their employees improved dental and vision benefits at no additional cost. Or a large senior living company that was able to completely revamp its benefits package with enhanced perks such as tuition forgiveness and subsidized childcare with the savings realized with RBP.

When approached astutely and similarly to other business operating expenses, reasonable costs and long-term solutions are available. Healthcare for your workforce should not be any different. For more information on reference-based pricing, download this white paper.